Analyzing the potential return from a rental property can be challenging, because cash flows typically vary from one year to the next. Rent prices can go up or down, operating expenses can be higher or lower than anticipated, and home prices in some markets may appreciate more rapidly than in others.

Real estate investors have a variety of tools at their disposal to analyze rental property returns, and IRR is one of the most useful. IRR in real estate can offer an investor a more complete picture of how profitable a rental property might be, by taking an investor’s desired rate of return and the time value of money.

Key takeaways

- IRR or internal rate of return is the annualized return a property is expected to generate over the entire holding period and is expressed as a percentage.

- IRR in real estate combines profit or loss, the time value of money, and the future sales price of a property into one calculation.

- A rental property may generate a positive IRR, even if annual cash flows are negative.

- Unlike ROI which measures total return over the entire holding period, IRR measures the annualized return over a multi-year holding period.

What is IRR?

IRR – or Internal Rate of Return – is a metric that real estate investors use to calculate the annualized net return on an equity investment and is expressed as a percentage of the initial amount of the investment. For example, if an investor has an IRR of 15% after holding a property for 1 year, that means an investor has 15% more of something than he or she did a year ago.

Because real estate investments are usually held for longer than 1 year, IRR is often expressed as an annualized return. Annualized return is the rate of return per year measured over the period of time an investor holds a property.

Knowing the IRR of a property is useful for a real estate investor because it takes into account profit (or loss) and time into one calculation:

- Profit (or loss) is the amount of cash an investment gains (or loses) over the holding period compared to the amount of equity invested.

- Time value of money (or TVM) is used to estimate the current value of money received at some point in the future.

- Future sale date of property and the sale price.

IRR also allows an investor to consider opportunity cost – which is the loss of potential gain from other alternatives when one alternative is chosen – by comparing the IRRs of various investment options.

Why TVM is an important part of IRR

By factoring in the time value of money an investor may use IRR to compare the potential risk and reward of various investments that produce cash flows over different points in time.

To illustrate, assume that 2 single-family rental homes generate the same amount of cash flow over a holding period of 5 years.

At first glance, both homes may appear to offer the same potential return. However, if the first home produced its entire return in year 5 while the second home produced cash flows over each year of the 5-year holding period, an investor may decide that the second home is the less risky investment, everything else being equal. That’s because $1 received today is worth more than the promise of $1 received at a future date, due to risks such as rising inflation or a change in the real estate cycle.

How to calculate IRR in real estate

A real estate investor calculates IRR to better understand the potential return from cash flows that may differ from one period to the next. The formula for IRR is used to identify the interest rate or discount rate required to make the net present value (NPV) of cash flows from a property equal to zero.

Here’s what the formula to calculate IRR looks like, courtesy of the Corporate Finance Institute:

To use the IRR formula, a real estate investor must estimate the amount of annual cash flows, when a property will be sold, and at what price a property will be sold. Also, note that the initial investment is a negative amount, because money is going into a property instead of flowing out when a property is sold.

While it’s possible to calculate IRR by hand, an investor may also wish to use an online IRR calculator or the IRR function in Excel.

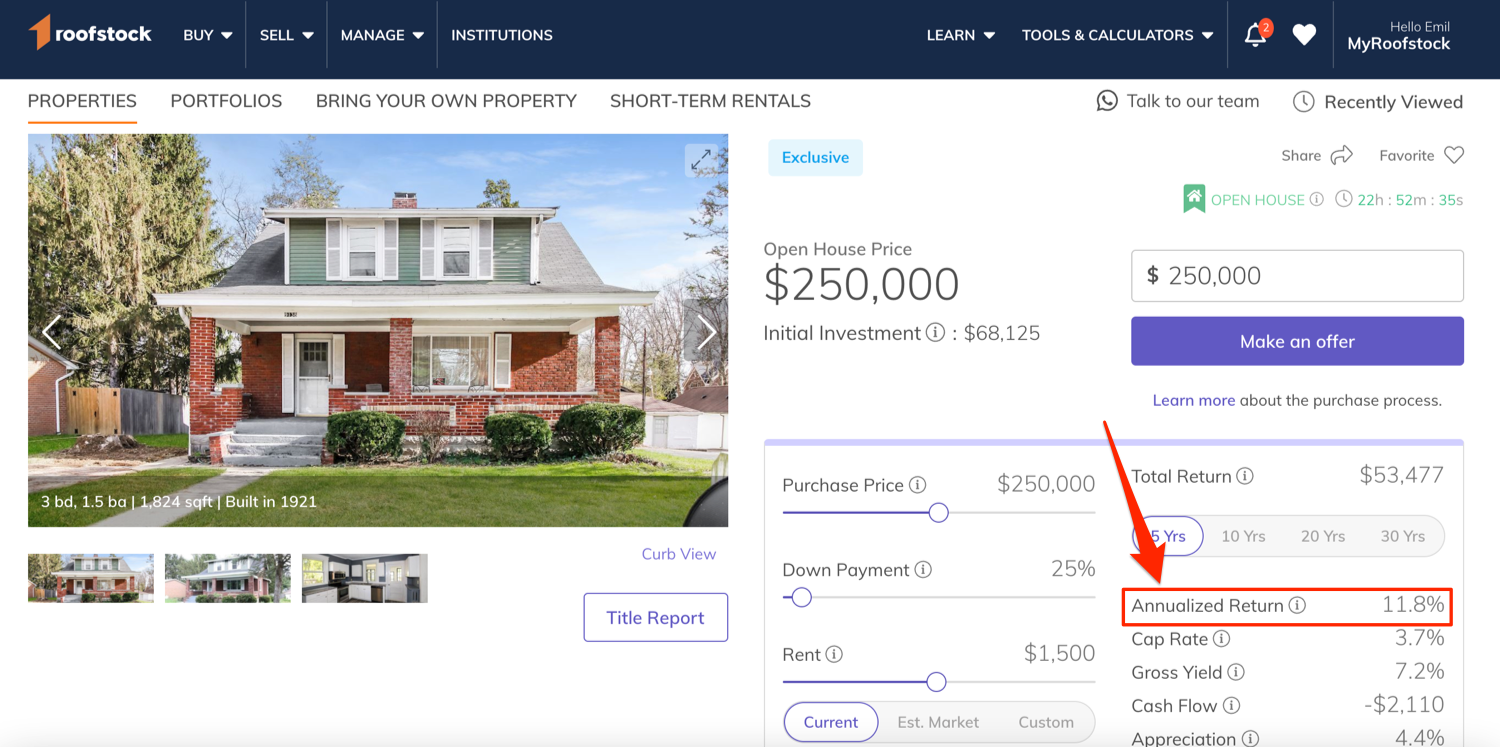

Quick note: If you’re searching for rental properties on Roofstock, some of the legwork has already done the legwork for you. On every listing, you'll see a projected “Annualized Return,” which is essentially the property’s Internal Rate of Return number. In that same module, you'll also see helpful metrics like estimated cap rate, gross yield, cash flow, and appreciation.

Now let’s look at three scenarios a real estate investor might face, and how to calculate the IRR of each investment over a 5-year holding period.

Scenario #1: Positive annual cash flows + gain on sale

In this example we’ll assume a single-family rental home is purchased for $100,000 and sold for $150,000 at the end of 5 years. The cash flow in the 1st year is $3,000 and increases by 5% for each of the following years.

- Initial investment = $100,000

- Annual cash flows: $3,000 + $3,150 + $3,308 + $3,473 + $3,647

- Sale price = $150,000

In this scenario the IRR is 11.27%, which means the rental property generated an annualized return of 11.27%.

Scenario #2: Negative annual cash flows + gain on sale

In this example, we’ll look at why an investor may purchase a rental property with a negative cash flow. We’ll use the same figures from the first scenario, except that the annual cash flows are negative and the sale price is $225,000 because the home is located in a real estate market where home prices are projected to continue rapidly appreciating.

- Initial investment = $100,000

- Annual cash flows: -$3,000 + -$3,150 + -$3,308 + -$3,473 + -$3,647

- Sale price = $225,000

In this scenario the IRR is 15.20%, which means the property generated an annualized return of 15.20%, even though cash flow was negative over the entire 5-year holding period.

Scenario #3: No annual cash flows + no gain on sale

In this example, we’ll assume that an investor breaks even. The property does not generate any cash flow over the holding period, and an investor ends up selling the home for the same price paid for the home.

- Initial investment = $100,000

- Annual cash flows: $0 + $0 + $0 + $0 + $0

- Sale price = $100,000

In this scenario the IRR is 0% because there are no annual cash flows, and the property was sold for the original purchase price.

What is a good IRR?

IRR provides an investor with a more complete picture of how profitable a rental property might be in relation to other alternative investments. Unlike the cap rate calculation or cash-on-cash return, IRR may offer a better idea of potential returns throughout the entire time a property is held.

As with any other financial metric, what’s good for one investor may be bad for another. An investor who is risk-averse may be satisfied with an IRR of 10% or less, while an investor seeking a balanced blend of risk and potential reward may only consider properties with a projected IRR of 20% or more.

For example, an older home in a market where home prices are forecast to rapidly appreciate may offer a higher IRR. However, there may also be the risk of higher than expected maintenance expenses that could reduce cash flow, and reduced demand from buyers causing home prices to increase less than expected, or even decline.

On the other hand, a brand new home in a highly rated neighborhood may generate a lower IRR. Cash flows are predicted to gradually increase each year, along with a smaller gain when the home is sold. An investor looking for less risk may be willing to accept a lower IRR in exchange for owning a new home requiring fewer repairs in a neighborhood where the school district is good and employment rates are high.

IRR depends on specific assumptions, such as the change in rent prices, vacancy rate, and property sales price. Because assumptions can be incorrect, an investor may wish to calculate IRR using different scenarios to better understand how annualized return could vary.

IRR vs other financial performance metrics

Using IRR with other financial metrics may provide an investor with a more holistic view of the potential returns from a rental property. Other calculations used to measure the financial performance of a rental property include:

- ROI or Return on Investment measures the total return over the entire holding period of an investment, rather than the annual rate of return. While ROI and IRR are usually the same for the first year, they will vary over multi-year holding periods.

- Cap rate is the percentage return in the 1st year calculated by dividing a property’s net operating income (NOI) by the property purchase price. However, NOI and cap rate do not take into account ownership costs such as financing and capital repairs.

- Gross yield is the annual rental income generated by a property divided by the property purchase price. Because gross yield excludes operating expenses, an investor may use the calculation as part of an initial screening process to identify properties for additional analysis.

- Cash flow is the net amount of profit (or loss) remaining at the end of each period, after all rents have been collected and all expenses have been paid, including a mortgage and capital expenses.

Closing thoughts

As a rule of thumb, a rental property that generates an IRR equal or greater to an investor’s desired rate of return may be worth further analysis. IRR is a useful calculation because it takes into account annualized returns for an investment that generates different cash flows from one year to the next, as well as the time value of money.

However, IRR also depends on an investor making accurate assumptions such as required capital repairs, changes in rent prices, and the sale price of a property. In addition to IRR, an investor may wish to use other financial metrics when evaluating the potential profitability of a rental property investment.