Recent turbulence in the stock market was an abrupt wake-up call for investors, especially after a booming 2019. If recent volatility in the equity market has you thinking about different ways to diversify your assets, new data released by Roofstock illustrates why single-family rentals are a strong alternative investment option compared to stocks and bonds.

Key takeaways from this article:

- Over the past 25 years, single-family rental returns were nearly identical to stock returns and outperformed bonds, but with far less volatility

- Single-family rentals have historically offered more attractive risk-adjusted returns than the S&P 500 and bonds

- Single-family rental prices and stock prices have proven to be almost perfectly uncorrelated since 1971

Volatility of stocks and bonds vs. single-family rentals

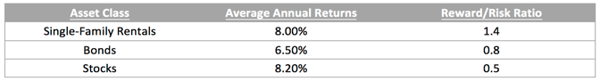

According to data from Roofstock, average annual returns in the $4 trillion single-family rental market are comparable to stock market returns and outperform bond returns, but with considerably less volatility.

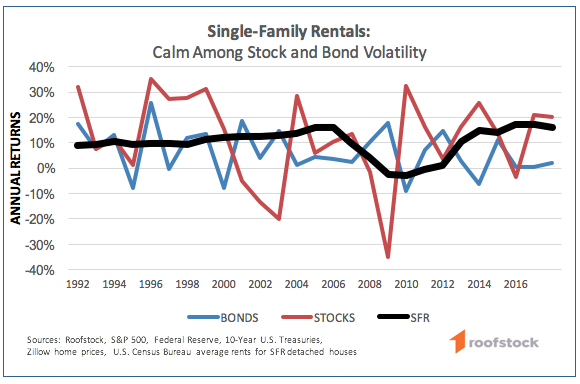

For this study, Roofstock compared single-family rental housing returns data from the U.S. Census Bureau, as well as S&P 500 returns data and 10-Year Treasury returns data from 1992 to 2017.

At its high point during this 25-year span, S&P 500 stocks posted average annual returns in excess of 35 percent, but returns also plummeted equally during their worst year. Alternatively, single-family rental investments posted 17.5 percent returns during their best year, and only declined 2.5 percent in their worst year. The stock market had a total of six down years in this period, while the single-family rental sector only had two down years. Bond market returns were also more volatile than single-family rental returns, but less risky than stock market returns on an annual basis.

The chart below illustrates the volatility of stocks and bonds vs. the single-family rental market over the past 25 years:

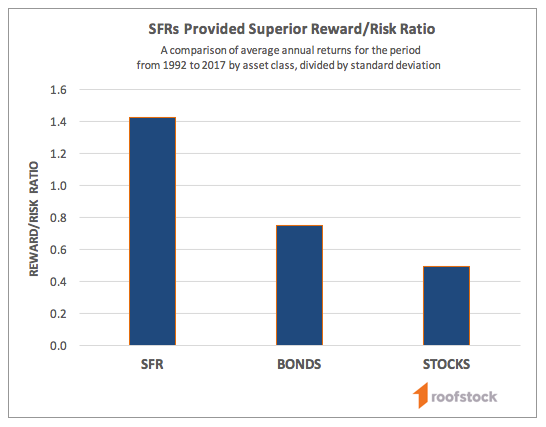

Measuring Reward/Risk Ratios

The Reward/Risk Ratio is a measure of the efficiency of an investment, or how much return is associated with a specified level of risk, as measured by volatility. The higher the ratio, the more efficient the investment is from a risk/return standpoint. Generally, higher-risk investments should produce better returns to reward investors for assuming these higher risk levels. Single-family rentals have historically offered more attractive risk-adjusted returns by this measure than the S&P 500 and bonds, as outlined in the chart below:

Single-Family Rental Returns Remain Uncorrelated to Stocks

Investors who add real estate to their investment portfolios further reduce their exposure to risk since SFR returns are highly uncorrelated to the stock market, according to Roofstock’s new data. In fact, SFR prices and stock prices have proven to be almost perfectly uncorrelated since 1971, with a correlation coefficient of only 0.07. To put that figure into perspective, a coefficient of zero equates to a complete lack of correlation.

>>Related: Studs over stocks: 5 reasons to invest in rental property

Conclusion

Investors can strengthen their portfolios by acquiring single-family rentals. This asset class has historically been less volatile than stocks and bonds and can generate consistent monthly income. As we ride the ups and down of the stock market roller coaster, it’s nice to know a portion of your portfolio consists of a tangible investment that’s largely uncorrelated to the equity market.

*****

Roofstock provides all of the resources to purchase turnkey single-family rental properties fully online, including data analytics, property management oversight and other tools. Start earning rental income as soon as you close.