Passive income is the goal of every long-term real estate investor, and that goal begins with cash flow. Understanding how cash flow is generated can help you select the best rental properties, and also unlock hidden opportunities that other investors may miss.

In this article we’ll explain how to calculate cash flow, provide some tips on finding the best cash flowing properties, and explain why good cash flow for one investor may be less than desirable for another.

What is cash flow?

Rental property generates two types of cash flow:

- Gross cash flow

- Net cash flow

Gross cash flow is money collected from rent and extra services such as application fees, late fees, or renting appliances to a tenant. Net cash flow is the amount of money left over at the end of each month after the rent has been collected and all of the bills have been paid.

Ideally, net cash flow from a rental property is always positive. However, cash flow can also be negative if expenses are greater than the property’s income. Negative cash flow can occur for a number of reasons, including an extended period of vacancy, overpaying for a rental property, and using too much leverage when you finance.

How to calculate cash flow

You can calculate cash flow from rental property in three easy steps:

- Determine the gross cash flow by adding up all of the rents and other income received.

- Subtract all operating expenses, contributions to a CapEx (capital expense) account.

- Deduct the mortgage payment if you financed the property.

The balance remaining is your net cash flow.

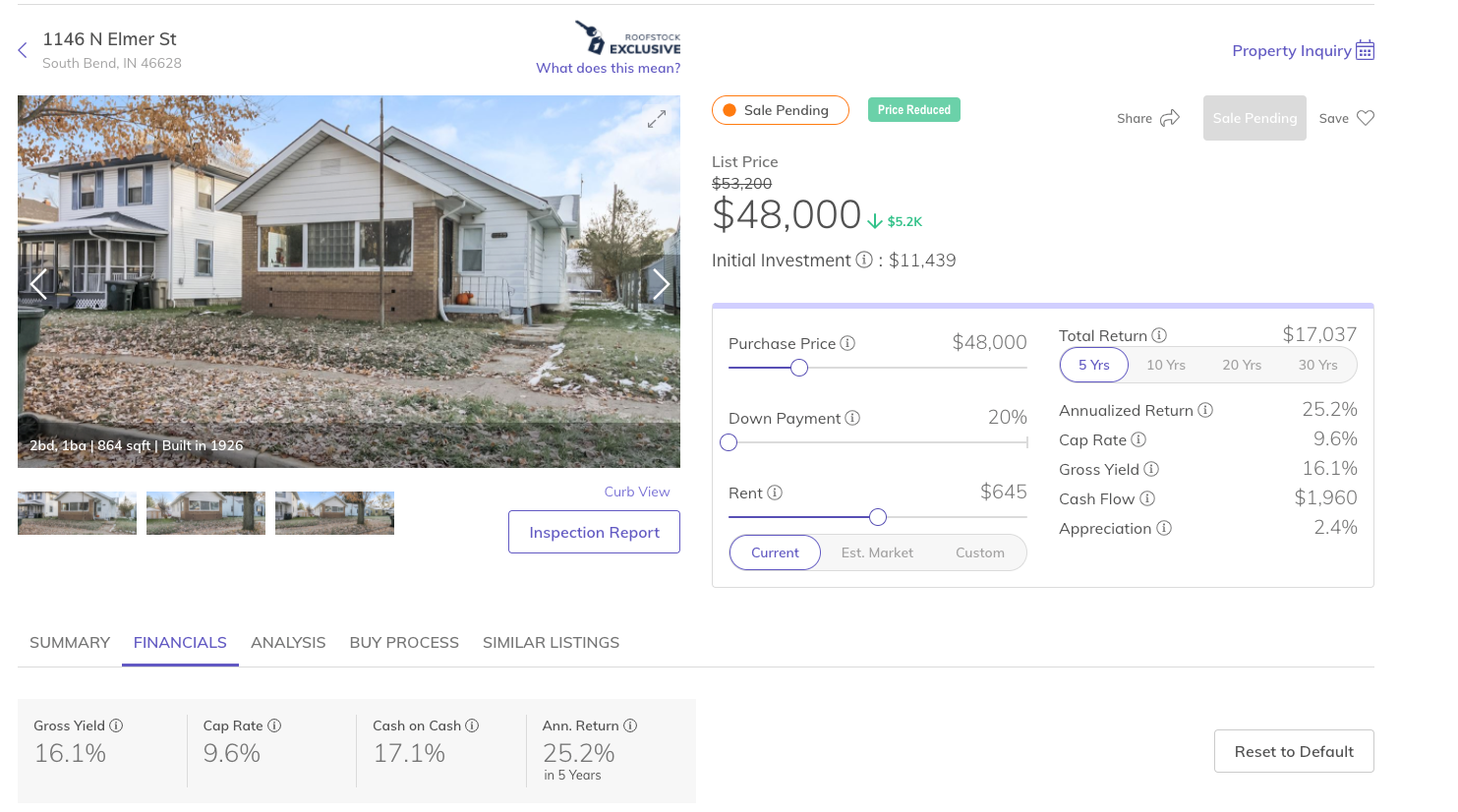

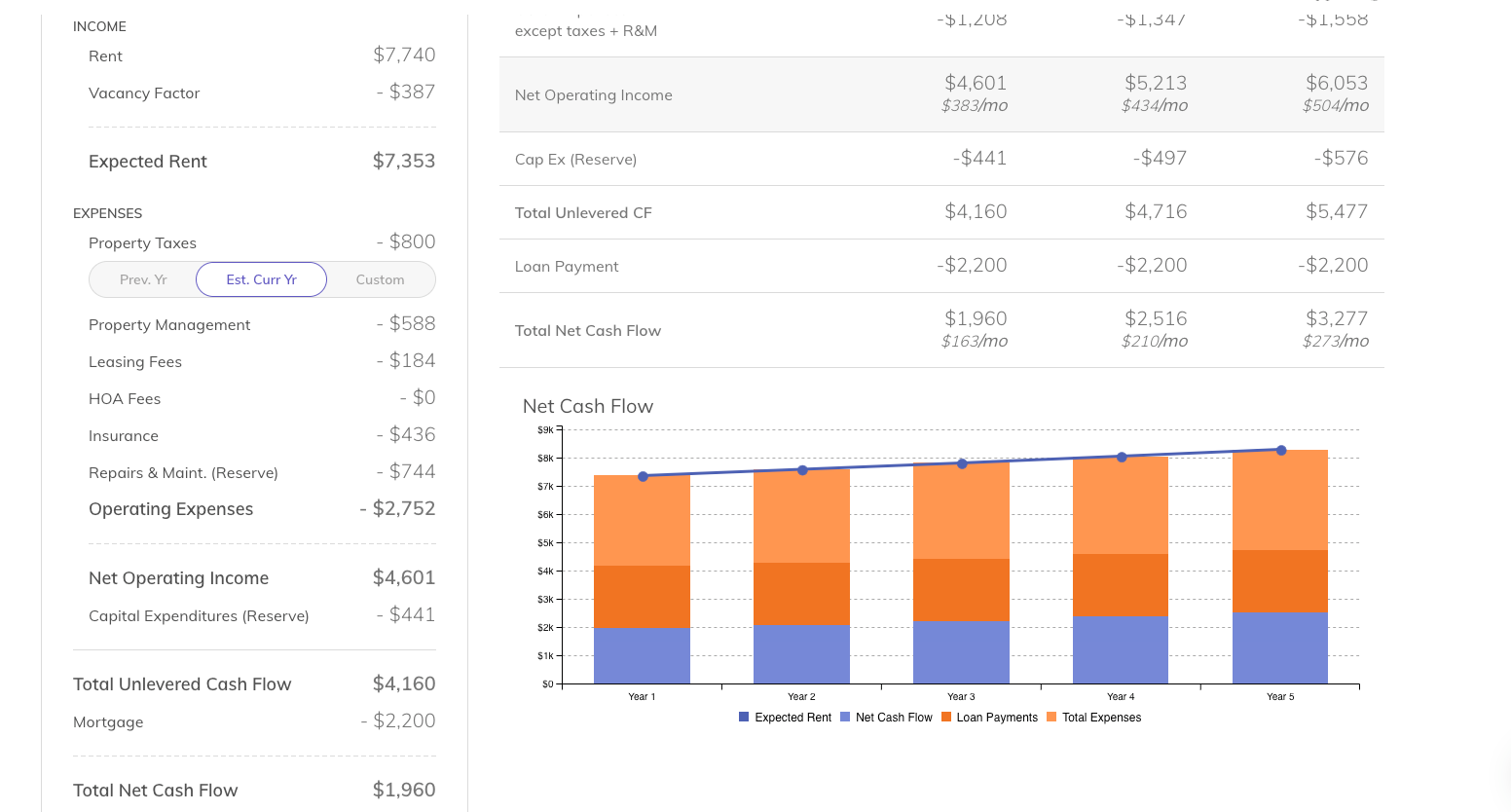

Now, let’s look at a recent listing on Roofstock to see how calculating the cash flow of a rental property works in the real world:

Income

- Rent $7,740

- Vacancy factor - $387

Expected Rent or Gross Cash Flow $7,353

Expenses

- Property taxes - $800

- Property management - $588

- Leasing fees - $184

- HOA fees - $0

- Insurance - $353

- Repairs & maintenance (reserve) - $744

Operating expenses - $2,669

- Mortgage payment - $0

Net operating income $4,684

- Capital expenditures (CapEx reserve) - $441

Total Net Cash Flow $4,243

It’s important to remember that cash flow isn’t always the same from month to month or year to year.

For example, leasing fees can be minimized by keeping tenant turnover low, while money spent for repairs and maintenance can be reduced by performing seasonal preventative maintenance such as servicing the HVAC or furnace to help prevent unexpected major expenses.

.jpg?width=2163&name=iStock-1176080337%20(1).jpg)

How much cash flow is good?

The short answer to this question is that any amount of positive cash flow is good, and the bigger the better. But in reality, what makes cash flow “good” is subjective, and varies from one investor to another.

Some rental property investors look for a minimum return on investment (ROI) while others look for property that generates a sufficient net cash flow to meet targeted cash-on-cash returns:

Return on investment (ROI)

ROI indicates how profitably your investment capital is being used. The formula for return on investment compares your net profit to the cost of the property:

- ROI = Net cash flow / Property cost

- $12,000 Annual Net cash flow / $100,000 Property cost = .12 or 12% ROI

As a rule of thumb, most rental property investors look for an ROI of at least 8%. However, depending on the investment strategy being used, some are satisfied with a 6% return, while other investors focused on “cash cow” income property look for an ROI of 12% or more.

Cash-on-cash

Another way of determining how much cash flow is good is by calculating the cash-on-cash return of a rental property. Cash-on-cash compares the net profit to the amount of cash invested in the property (as opposed to the total property cost):

- Cash-on-cash = Net cash flow / Cash invested

For example, if you make a down payment of $25,000 on a property that generates a net cash flow of $3,600 per year (after paying all of the bills, including the mortgage), your cash-on-cash return would be:

- $3,600 Net cash flow / $25,000 Cash invested from down payment = .144 or 14.4%

Cash-on-cash return is also a good calculation to use if you’re investing in value-add rental property.

Let’s say you purchase a property that needs $10,000 in additional upgrades. After the improvements are completed your net cash flow - due to higher gross rents from your improvements - increases to $6,000. Your new cash-on-cash return would be:

- $6,000 Net cash flow / $35,000 Cash invested ($25,000 down payment + $10,000 repairs) = .171 or 17.1%

As with ROI, what makes a “good” cash-on-cash return varies from one investor to the next. As a rule of thumb, many cash flow investors aim for a minimum return of 10% on the cash they invest.

Using the 1% rule to calculate gross cash flow

The 1% Rule is a quick and easy way to “ball park” what the gross rent from a property should be. According to the Rule, the gross monthly rent from a home should be at least 1% of the purchase price:

- Property price = $100,000 x 1% = $1,000 per month gross rent

So, the more rental income there is relative to the property price, the greater your potential return could be. By using the 1% Rule, you can filter out homes that don’t have enough cash flow and identify those that do, for further due diligence.

For example, let’s say you’re looking at a rental property with an asking price of $97,500 and a monthly rent of $800 and want to know if the rental income is at least 1% of the purchase price:

- Gross monthly rent / Property price = X%

- $800 Gross monthly rent / $97,500 Property price = .008 or .8%

Based on the above calculation using the 1% Rule, the property’s gross rent compared to the purchase price is less than 1%. However, before discarding the property from your list of potential acquisitions, keep in mind there are several reasons why the gross rents are less than 1% of the price:

- Property is overpriced, is located in a seller’s market where prices are high relative to the going rents, or is in a market where property prices are appreciating faster than rents are rising

- Rent is below market, offering the opportunity for increased cash if the rent can be increased to the market rent

- Home has deferred maintenance, creating the possibility of increasing the property value and raising the rent once repairs and upgrades are completed

So, depending on your investment strategy, the property could still be a good investment.

For investors with a short-term horizon, buying homes that are in markets with rapid appreciation could make sense, although there’s the risk that prices will stop increasing. For buy-and-hold investors, below-market rents could offer a significant opportunity to generate healthy profits over the longer-term.

Finally, investors who have a reliable local property management and rehab team may have a double-header on their hands by making repairs that can increase the property value and also generate a higher at-market rent.

How to increase cash flow

Savvy rental property investors always look for opportunities to increase both gross and net cash flow. Although it may not sound like a lot, increasing cash flow by just $10 a month can increase property value and yields by thousands of dollars over the long term.

Some of the biggest variables to review when looking for ways to increase cash flow include:

- Vacancy rate by keeping tenant turnover low

- Screen tenants and conduct background checks to find the most qualified tenants

- Strategically make value add improvements that tenants see value in and are willing to pay a higher rent for, such as energy-efficient appliances or updated finishes

- Employ a professional property management company that understands the local market and has a cost-effective network of handymen and suppliers

- Perform seasonal maintenance on major items such as heating, cooling, and plumbing systems to help prevent major repairs

Other features of a good rental property

There are a variety of factors that help to make a rental property good. Some of these criteria can lead to higher gross cash flow, while others can help keep tenant turnover and operating expenses low:

- Average rents in the market and historical rent growth

- Amount of listings and vacancies indicate how strong the demand for rental property is

- Amenities such as shopping, public transportation, and parks and recreation help to make one property more attractive to renters than another

- Job market and planned development are indicators of future population growth, income levels, and the demand for housing in the marketplace

- Property taxes vary widely from one city to the next and can have a major impact on the net cash flow of your rental property (even if the gross rents are high)

- Neighborhood, school, and crime ratings affect the demand for rental property and the quality of potential tenants

It can be difficult and time-consuming to compile and analyze important criteria like these. That’s why the Roofstock Neighborhood Rating system – the industry’s first single-family rental ratings index for U.S. neighborhoods - is so valuable for rental property investors.

By entering the property address you’ll discover neighborhood insights that help understand the risk and rewards of investing in different neighborhoods. Roofstock computes data at the census tract level, then uses a proprietary algorithm to assess neighborhood-specific risks and benefits based on key criteria such as school district quality, employment rates, home values, and much more.

Final thoughts on cash flow properties

Cash flow is the lifeblood for any rental property investor. Fortunately, unlike some other more complicated financial formulas, calculating cash flow can be done in three easy steps.

In many real estate markets today, it’s not always easy to find rental property with solid cash flow. But when you do, you’ll sleep easier at night knowing your property is generating enough cash flow to pay for itself while creating consistent passive income to build your long-term wealth.

Gross yield is another term for the gross cash flow that a rental property generates. It’s easy to find an income-producing property with a high cash flow (aka high yield) on the Roofstock marketplace.

Simply select the “Higher Yield” tab, and you’ll receive a list of single-family and small multifamily property with a gross yield of 11% or higher. In addition to the percentage of gross yield, you’ll also receive a complete breakdown of the property’s financial performance including key metrics such as:

- Monthly rent

- Cash flow

- Appreciation

- Gross yield

- Cap rate

- Annualized return

- Neighborhood and school ratings