Cash flow is the amount of money left over at the end of the day (i.e. your profit after paying all expenses). While that might sound simple enough, finding good cash flow property isn’t quite as easy as it might seem.

Buying the wrong investment property can create “negative” cash flow, which means that every month you’ll need to contribute money out of your personal account. That’s a situation that no real estate investor wants to be in.

In this article, we’ll show you ways that investors typically find and analyze positive cash flow properties.

What are Cash Flow Properties?

There are two main ways that rental property investors make money:

- Cash flow left over after collecting tenant rent and paying expenses out of that rental income

- Appreciation in market value over the long term

Cash flow property is rental real estate that generates a higher level of cash returns than comparable property, and usually a lower level of appreciation.

Why Cash Flow is Important

In a way, investing in cash flow property is similar to owning dividend-paying stock. The higher the level of net cash flow you receive, the more money you’ll have to reinvest and the faster you’ll be able to pay off the mortgage and diversify your real estate portfolio.

Net cash flow is also used in various other real estate investment calculations such as:

- Cash on cash return = Net cash flow / Cash invested

- NPV = Net present value of discounted future cash flows

- IRR = Internal rate of return used to calculate ROI (return on investment)

- DSCR = Debt service coverage ratio is calculated by dividing NOI (excluding the mortgage payment) by the debt payment

Calculating Property Cash Flow

Property cash flow is calculated by adding all sources of potential income together, then subtracting all the expenses out. The bottom line number is your net cash flow that the property generates.

Here’s what a simplified cash flow statement looks like for a single-family house:

- Annual rent = $12,000

- Vacancy rate estimate 5% = <$600>

- Annual mortgage payment (PITI) = <$7,000>

- Annual operating expenses & repairs = <$1,400>

- Projected net cash flow = $3,000

How to Find and Analyze Cash Flow Property

Now, let’s take an in-depth look at how to find and analyze cash flowing properties.

1. Focus on cash flow real estate marketsThe key characteristics investors look for to find the best real estate markets for cash flow property are typically:

- Diverse economy not dependent on one major employer

- Strong population growth and job market

- Strong demand for rental property where the number of renter households is greater than owner-occupied households

- Affordable property prices since paying too much can reduce your net cash flow

- Drill down to the neighborhood level because cash flow can vary from one zip code to the next

The Roofstock Marketplace place is a free resource you can use to find cash flow rental properties. Looking for single-family houses and small multifamily property with the highest yield to compare returns among different cash flow markets.

2. Value property based on cash flow calculations

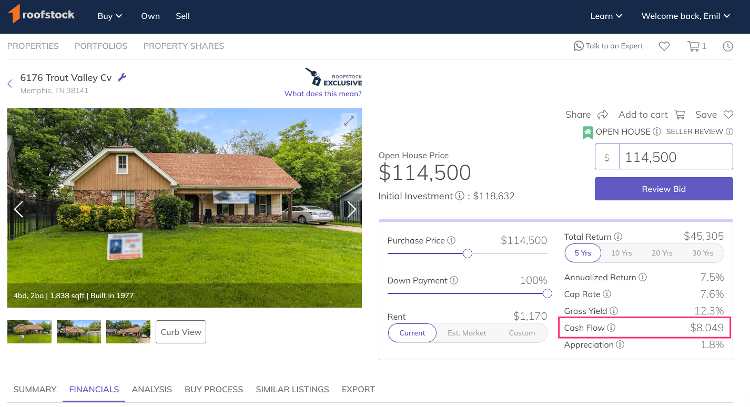

As you analyze each opportunity, you’ll notice that rental property with the highest cash flow usually has a very low rate of projected appreciation, oftentimes less than 2%. That’s one of the reasons why cash flow property also goes by the name ‘cash cow.’

The property likely won’t see big gains in market value, but it will throw off steady streams of cash that you can use to increase your capital for future investments. In addition to a low rate of appreciation, two other financial metrics you can use to find solid cash flow property are:

- Price to rent ratio: The price to rent ratio is calculated by dividing the average property price by the average rent. Generally speaking, the higher the ratio is the better it is for people to rent rather than become homeowners. However, when you’re investing in cash flow property, a price to rent ratio that’s too high can make it harder to find positive cash flow property because the property prices in the area will also be too high.

- Cash on cash return: This percentage compares the amount of cash generated to the amount of cash you invested. For example, if you pay all cash for an $80,000 house with an annual cash flow of $6,000, your cash on cash return is 7.5% ($6,000 / $80,000 = .075). The higher your cash flow is compared to the cash invested, the greater your cash on cash return is.

3. Prepare a CMA to understand rents and competition

A comparative market analysis (CMA) helps you to understand what the fair market rents really are, choices tenants have on where to rent (in other words, who your potential competition is), and what a reasonable price to pay for a property with good cash flow is.

The accuracy of a CMA depends on how well the comparable properties are chosen. Comps should be as similar as possible to the subject property being purchased, in the same neighborhood, and with very recent closing dates. Also, potential comps that have sales prices significantly higher or lower than the subject property should be discarded.

After that, there are eight steps to follow when creating a CMA to analyze your potential cash flow property purchase:

- Collect detailed data for the subject property

- Review previous sales date for the subject property and the tax assessor’s most recent assessment

- Analyze the neighborhood for amenities and potential issues that would affect rentability

- Carefully select comparable properties that most closely match the subject property

- Make value adjustments to the comparables so that you can make an apples to apples comparison with the subject property

- Calculate the average price per square foot of each comp

- Compare the comps to your subject property

- Have a member of your real estate team view the property

4. Use a pro-forma to itemize income and expenses

Once you’ve determined a fair purchase price for your cash flow property, create a pro-forma P&L (profit and loss) statement to drill down on the income and expenses.

Start by creating an individual line item for every income and expense. For example, rather than using a single entry for “rental income”, break the income down into individual components such as monthly rent, late fees, application fees, etc.

Do the same thing on the expense page of your pro-forma. Instead of having a single expense labeled “repairs & maintenance,” itemize each expense such as landscaping, lock changes, and drain cleaning. It will take more time, but taking the time to detail each dollar coming in and out will help you unlock hidden value – and additional cash flow potential – of the property you’re thinking about investing in.

5. Set fair market rents

The website Rentometer is a good resource to use if you’re purchasing a turnkey cash flow property already rented to a tenant. By entering the property address and the current rent you can see if the tenant is paying too much rent, too little, or a fair market rent compared to other local properties. It’s also a good way to forecast what your future property cash flow will be.

This simple spreadsheet by Roofstock provides an easy way to view the potential financial performance of a given property. You can use it to forecast the potential return of a property. Simply enter some information to view projected key return on investment (ROI) metrics, including cash flow, cash-on-cash return, net operating income, and cap rate.

6. Remember, good tenants are like gold

Vacancy in your rental property can take a big bite out of the potential cash flow. Successful cash flow investors know that it’s always better to keep a good tenant than run the risk of trying to find another.

Make sure your property manager visits the property on a regular basis, responds to maintenance issues quickly, and is always friendly and professional. Not giving your tenants a reason to look around goes a long way toward getting the lease renewed year after year, even as annual rent increases are passed through.

How to Avoid Negative Cash Flow

Just as water can flow in two directions, cash flow can, too. As a cash flow investor, the last thing you want is negative cash flow that goes down the drain.

Some of the most common reasons for negative cash flow include:

- Tenants who always pay late or make partial rent payments

- Vacancy rate higher than forecast

- Failure to budget for emergency repairs or capital expenses

- Financing with an LTV higher than 75% results in a bigger mortgage payment that leaves too little of a cash flow cushion in case income is low or expenses are high

Four Ways to Increase Property Cash Flow

Did you know that in a 6% cap rate market, for each additional $1 in cash flow that drops straight to the bottom line your property value increases by $16.67?

Here’s how the math works using the cap rate formula:

- NOI / Property market value = Cap rate

- NOI / Cap rate = Property market value

- $1 / 6% = $16.67 increase in property market value

So, increasing your annual cash flow by $120 – just $10 per month - raises your property market value by $2,000.

If your property is in a 5% cap rate market, each additional $1 adds $20 to the market value, and $14.29 in a 7% cap rate market.

The trick in increasing property value with more cash flow is to make sure your NOI (net operating income) increases as well. For example, if you increase your gross cash flow by $100 per year but also increase your expenses by $100 per year, you haven’t gained anything for your efforts.

Some of the best ways to increase your cash flow include:

1. Knowing what you’re looking for by having a solid business plan and sticking to it.Without having a long-term plan and a strategy to reach your end game of building cash flow, you could find yourself buying rental property that ends up being a waste of your time and money.

2. Selectively choose only the best markets and neighborhoods that cash flow.

Some real estate markets are good for appreciation, others for potential cash flow. Within the same market, you may find some neighborhoods that are loaded with ‘cash cow’ rentals, while just a few blocks away you can barely break even because the prices are so high.

3. Keep your operating expenses under control.

Your goal with a cash flow property is to maximize the money you have left over at the end of the day. Of course, you want to give your tenants a nice place to live in exchange for fair market rent, but never spend more money than you have to.

In fact, with many of the best cash flow properties, doing a large amount of updating will not increase the rents, simply due to the nature of the neighborhood or the tenants.

4. Build a local real estate team that understands cash flow.

When you’re investing in real estate long distance, it’s critical to have a local team whose interests and compensation is directly aligned with yours.

Ensure that your leasing agent, real estate broker, and property manager know that your goal is more cash flow. Then, consider developing an incentive plan that rewards your team as your cash flow grows.