For real estate investors, a pro forma is a report that gathers current or estimated income and expense data to project the net operating income and cash flow of a property.

In this article we’ll discuss - in plain English - everything there is to know about a real estate pro forma.

Why is a Real Estate Pro Forma Important?

It’s critical for investors to make their pro forma as accurate as possible.

That’s because the NOI (net operating income) and cash flow projections from a real estate pro forma are used in other investment property calculations such as cap rate, cash-on-cash return, and ROI (return on investment). A pro forma with an inaccurate NOI and cash flow can wreak havoc on the other financial metrics and lead to a poor investment decision.

Granted, it can be difficult for beginning real estate investors, or for experienced investors diversifying their rental property portfolio, to find accurate market information.

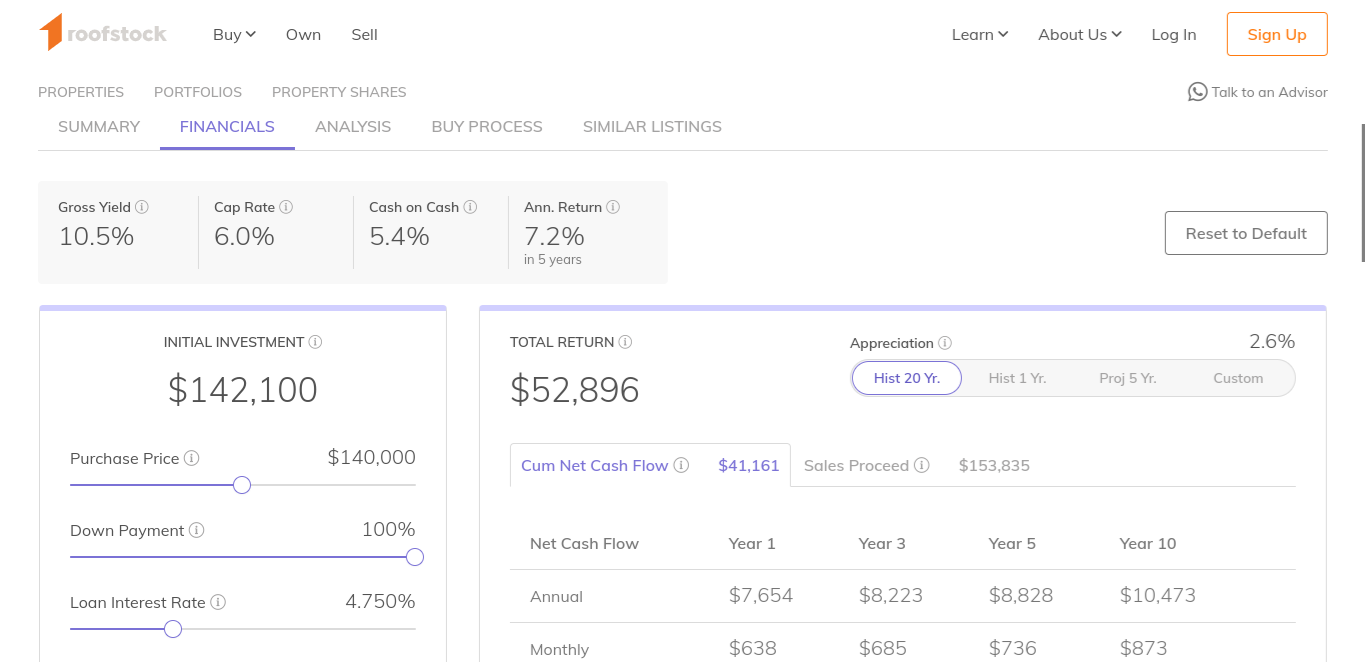

That’s why the Roofstock Marketplace has pro formas built into every property listed on the Marketplace so you don’t have to break out your excel spreadsheet.

How to Create a Real Estate Pro Forma

Here are the items needed for investors preferring to create their own real estate pro forma:

Income

- Projected gross income: Total rental income the property would generate if it was 100% leased all of the time.

- Vacancy allowance or loss: Rental income that is lost between tenant turns, including the time it takes to make repairs from normal wear and tear and to re-lease the house.

- Other income: such as late fees or coin-operated laundry.

- Effective gross income: total of projected gross income plus other income minus vacancy allowance.

Operating expenses

- Repairs: Even if the property is brand new, investors should still allocate (or set aside) a portion of the monthly gross income in a reserve account to cover future repair expenses and capital improvements.

- Property management: This expense should always be included, even if the property will be owner-managed, because the investor should be compensated for self-managing the property.

- Mortgage payment: If the property is leveraged, this includes principle, interest, taxes and insurance.

- Other expenses: including recurring costs of taxes and insurance (if not included in the mortgage payment), and one-time fees for leasing, legal and marketing.

- Total expenses: total of repairs, property management fees, and all other expenses.

Net operating income

- Net operating income – sometimes called “before tax cash flow” - is calculated by subtracting all operating expenses from effective gross income.

Example of a Real Estate Proforma

Now, let’s look at typical pro forma for a single-family rental property using annualized income and expenses. Note that some of the income and expenses items are based on a percentage of gross income:

Income

- Projected gross income = $12,000

- Vacancy loss at 5% = <$600>

- Effective gross income = $11,400

Expenses

- Repairs at 5% = $600

- Property management 8% = $960

- Other expenses = $2,400 (such as property taxes, insurance, leasing fee)

- Total expenses = $3,960

Net operating income

- Net operating income = $7,440

- Mortgage expense = $5,112 (principle and interest only)

- Before tax cash flow = $2,328

Using a Pro Forma to Calculate Financial Performance

Next, let’s use the NOI and before-tax cash flow from the pro forma to calculate three of the most commonly used rental property performance metrics. We’ll assume the investor financed the property with a market value of $120,000 using a 25% ($30,000) down payment:

#1 Cap rate

- Cap rate = NOI / Market value

- Cap rate = $7,540 NOI / $120,000 market value = 6.3% pro forma

#2 Cash-on-cash return

- Cash-on-cash return = Before tax cash flow / Total cash invested

- Cash-on-cash return = $2,428 before tax cash flow / $30,000 total cash invested = 8.1% pro forma

#3 ROI

Let’s say an investor has a long-term buy-and-hold strategy of five years. Over the last five years, average home prices in the U.S. have increased by about 41%, according to Zillow. Based on this historical average, at the end of our five-year hold time, the market value of the house will be $169,200.

- Before tax cash flow = $2,428 x 5 years = $12,140

- Gain on sale = $169,200 - $120,000 = $49,200

- Cost of investment = $30,000 original down payment

Using the above data, the pro forma ROI for the five-year holding period will be:

- ROI = (Gain on investment – Cost of investment) / Cost of investment

- Gain on investment = $12,410 before tax cash flow + $49,200 gain on sale = $61,610

- ROI = ($61,610 - $30,000) / $30,000 = 21% ROI pro forma, annualized

Difference Between Actual and Pro Forma

Pro forma describes how a property could, should, or would be performing based on certain assumptions or “what if” scenarios. On the other hand, “actual” reports the true financial performance of a rental property.

Why do sellers use pro forma statements?

The value of a rental property is determined in large part by the net operating income (NOI). Of course, the square footage of a house and the number of bedrooms and bathrooms also affects the value, but those metrics are difficult for a seller to change using a pro forma.

A seller’s pro forma will sometimes try to inflate income and reduce operating expenses to artificially boost NOI. Their goal is to attract more buyers by suggesting that a property could be worth more than it really is based on actual performance.

For example, let’s use a single-family rental property with an actual NOI of $900 per month in a market where the cap rate for similar properties is 7%. The market value of the house based on actual performance is:

- Cap rate = NOI / Market value

- Market value = NOI / cap rate

- $10,800 NOI ($900 per month x 12 months) / 7% cap rate = $154,286 market value (rounded)

However, the seller believes that the current rent is too low and creates a pro forma market value for the house based on an increased NOI of $1,000 per month:

- $12,000 NOI ($1,000 per month x 12 months) / 7% cap rate = $171,429 pro forma market value

By using a pro forma rent increase the seller has increased the market value of the house by over $17,000 or about 11%, just by assuming the NOI could be more than it actually is.

When would a buyer use a pro forma?

Buyers who use the seller’s pro forma run the risk of overpaying for the property. If the buyer finances, the down payment is also larger than necessary due to the inflated value of the property.

Even if the fair market rent really boosts the NOI to $1,000 per month and not $900 per month, the buyer still runs the risk of having the tenant leave if the rent is increased. If that happens, the NOI would decrease due to vacancy loss, which in turn would decrease the market value of the property:

- $10,000 NOI ($12,000 pro forma NOI - $2,000 from 2-month vacancy loss) x 7% cap rate = $142,857 market value

In this scenario, the buyer overpaid for the house to the tune of $29,572 ($172,429 pro forma market value - $142,857 actual market value).

Now let’s look at the same scenario from a different angle and assume the seller doesn’t really know what the fair market rent is. Maybe the owner lives out-of-state and doesn’t have a local property management company, or maybe the seller isn’t an experienced investor.

In a situation like this, a buyer’s pro forma can unlock the potential value in the property.

Say the seller has listed the property for sale at $154,286 with a monthly NOI of $900 in a 7% cap rate market. A more experienced buyer-investor can raise the rent, boost the NOI to $1,000 per month and create almost instant equity of $18,143.

Four Things to Watch Out For in a Real Estate Pro Forma

If a pro forma seems too good to be true, it probably is. Here are four of the most frequent “gotchas" that create misleading pro formas:

- Vacancy rate is understated: instead of calculating vacancy based on a percentage of gross income, research the market to determine what the true vacancy rate is in your area.

- Appreciation: multi-year pro formas often assume the rental income will consistently rise at the rate of inflation, if not more, which may not be the case in a competitive market.

- Missing expenses: rental taxes, HOA fees, and insurance are often omitted from pro formas, creating an unrealistically high cash flow.

- Overly simplified lump-sum expenses: instead of expressing each expense as a dollar amount, some pro formas lump all expenses into one line item as a percentage of gross rental income to understate the true cost of operating expenses.

Creating an Accurate Real Estate Pro Forma

Sometimes it’s easy for real estate investors to be overly optimistic with the assumptions used to create a real estate pro forma.

They assume that rents and property values will always increase, and that expenses will remain unchanged from year to year. Unfortunately, wishful thinking more often than not leads to bad investment decisions.

To help single-family rental property investors make the best decisions possible, every house listed on the Roofstock Investment Property Marketplace has a pro forma built right into the listing.

You’ll have a rental property pro forma that’s as accurate as possible, plus see the monthly rent, cap rate, and yield for hundreds of available investments across the country.