Investment capital that was once earmarked for commercial real estate is now flowing into the single-family rental (SFR) sector. As The Real Deal recently reported, SFRs have become a big focus of Wall Street players, start-ups, and venture capital.

We’ll look at 2 well-known industry names, Roofstock and RealtyShares, and compare how each company helps both individuals and institutional firms invest in real estate.

How Roofstock and RealtyShares work

Both Roofstock and RealtyShares operate platforms for investing in income-producing real estate, but in entirely different ways.

Roofstock is a good option for anyone who wants to invest in SFR homes, while RealtyShares offers investment opportunities limited to accredited investors seeking to invest in commercial real estate projects alongside other investors.

Investors buying or selling a property on the Roofstock Marketplace pay a small, one-time transaction fee. Although rental property purchased through Roofstock is owned directly, many investors turn the day-to-day operations over to a vetted local property manager.

Roofstock One is intended to be a passive investment, providing an efficient alternative to direct investing. Accredited investors can focus on assembling targeted portfolios with allocations across markets, focusing on specific investment goals, while enjoying passive income with potential long-term growth from home price appreciation.

RealtyShares allows accredited investors to invest in commercial real estate with as little as $25,000. After creating an account, investors can explore opportunities and invest online. Investment performance is tracked on each user’s dashboard.

Fees paid by investors using the RealtyShares platforms vary based on an individual offering memorandum and may include deal initiation fees, revenue shares after hurdle rates are met, and a share of any profits when a property is sold.

Roofstock

Investors have options for investing in rental property with Roofstock: through Roofstock One, the Roofstock Marketplace, or a combination of both.

Roofstock One

Roofstock One provides an efficient alternative to direct investing (avoiding the need to be on title, obtain mortgages, supervise rehabilitation activities, find property managers, and handle ownership and tenancy issues).

Investors can instead focus on assembling targeted portfolios with allocations across markets, focusing on specific investment goals while enjoying passive income with potential long-term growth from home price appreciation.

Investors purchase shares of Tracking and Common Stock in Roofstock One to construct a customized portfolio that best suits their needs and/or investment goals.

Fee structure

- Standard initial investment of $5,000

- Additional purchases for as little as $100 after the initial investment

- No limit to number of shares purchased, subject to the maximum allowable amount for a single Tracking Stock

Feature summary

- Tracking Stock provides exposure to multiple properties and markets.

- Common Stock provides broad exposure to all homes in the Roofstock One real estate investment trust (REIT).

- Both options can potentially help investors avoid the risks of single-property ownership.

- Roofstock One investors can pick and choose from curated property portfolios to suit their investment goals.

- Roofstock, through one or more property managers, takes care of all the day-to-day management of the properties, providing a more hands-off experience to investors.

- Investors are eligible to receive pro rata quarterly distributions, subject to board approval, based on the economic performance of the underlying properties, a portion of which may be tied to available depreciation.

- Roofstock One investors are required to have an investment horizon of at least 5 years.

- Roofstock One is available to accredited investors only.

Roofstock Marketplace

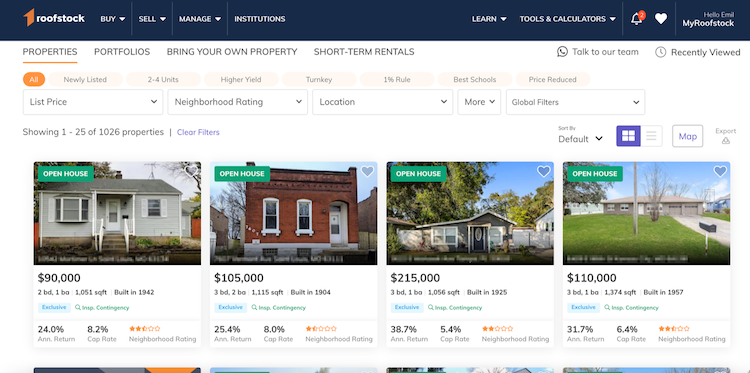

The Roofstock Marketplace is a good match for investors seeking direct ownership of SFRs, small multifamily buildings, short-term vacation rentals, and larger portfolios of residential rentals. Property on the Roofstock Marketplace is purchased directly from the seller, with Roofstock acting as the facilitator, following the same process as any other residential transaction.

Roofstock also helps buyers conduct due diligence by vetting property markets and assigning neighborhood ratings using key factors, such as home values, median income levels, school district quality, and crime rates.

Buyers can also be preapproved for financing online and ask to be referred to prescreened local property managers to handle the daily management and maintenance of the property and take care of the tenants, making it much easier for remote investors to invest in real estate beyond their local markets.

Fee structure

The fee structure on Roofstock is similar to buying or selling property through a real estate agent, at a competitive cost:

- Sellers pay a 3% fee of the sale price or $2,500 (whichever is greater).

- Buyers pay a fee equal to 0.5% of the purchase price or $500 (whichever is greater).

- No recurring fees, revenue splits, or profit participation fees are paid to Roofstock after the initial sales transaction.

Similar to owning a primary residence, investors are responsible for the traditional recurring expenses of owning rental property, including:

- Maintenance and repairs

- Property taxes and insurance

- Mortgage (if the property is financed)

- Property management fees (if using a property manager)

Rental income collected from a tenant generally covers normal operating expenses and the mortgage payment, unless the property is vacant during a tenant turnover period.

Feature summary

Investors can negotiate with sellers, open escrow, arrange financing, and purchase preinspected (when applicable) rental properties on Roofstock. Researching rental property is easy with pictures, street views, property inspection reports, tenant lease information, and payment history if a home is already rented.

Investors can search for available rental property using key metrics, including:

- List price

- Location

- Monthly rent price

- 2 to 4 units

- Neighborhood rating

- Best schools

- Minimal repairs

- Annual appreciation

- Higher appreciation

- Price reduced

- Higher yield

- Gross yield

- Cap rate

Pros

- Available to everyone, including nonaccredited investors, first-time buyers, and institutional investors

- SFRs, small multifamily homes, and entire portfolios of residential rental property available for purchase

- Large deal flow of several hundred transactions per month

- Easier due diligence with single-family houses and small residential properties versus more complex commercial real estate projects and sponsors

- Direct property ownership with no sharing of net income or profits, or limitations on when and how a property can be sold

- Accessible way to remotely invest in real estate in markets across the U.S.

- Immediate cash flow with a property that has been preinspected and is already leased to qualified tenants

- Low one-time transaction fee, referrals to vetted local property managers upon request, and fast closings facilitated by Roofstock

- Increased liquidity of the real estate investment because a secondary market for residential rental properties is always available, and investors can resell using the Roofstock platform if they choose to do so

- Ability to use self-directed individual retirement accounts (SDIRAs) and 1031 exchanges to invest in property through the Roofstock platform

Cons

- High minimum investment needed to make a down payment if financing is used or paying for a property in cash

- Additional capital potentially required for maintenance, repairs, and capital improvements

- Time required to sell since real estate is an illiquid, long-term investment

RealtyShares

RealtyShares is a crowdfunding platform for investing in fractional ownership of commercial real estate in the “middle market,” which consists of properties valued at $50 million or less. According to the company’s website, the commercial real estate middle market accounts for over 90% of commercial real estate transactions each year.

RealtyShares was acquired by IIRR Management Services in April 2019 and currently offers new investors 2 offerings from its affiliates, iintoo Investments and RREAF Holdings, LLC:

- iintoo is a platform that provides accredited investors opportunities to invest in real estate, with minimum investment amounts starting at $25,000.

- RREAF Holdings is a privately held commercial real estate firm based in Dallas that helps high-net-worth individuals and institutional capital partners to invest in multifamily apartment properties, beachfront hospitality properties, resort properties, and ground-up development.

Investments on iintoo and RREAF Holdings are restricted to accredited investors.

The U.S. Securities and Exchange Commission (SEC) defines an accredited investor as a natural person whose income has exceeded $200,000 in each of the prior 2 years (or $300,000 together with a spouse or spousal equivalent) or who has a net worth of $1 million or more, excluding the value of the person’s primary residence. Accredited investors may also include holders of a Series 7, 65, or 82 license in good standing or a trust or investment entity, provided specific qualifications are met.

Let’s take a closer look at how each one works.

iintoo Investments

iintoo bills itself as a “new kind” of investment company and social investment network specializing in exit-oriented real estate investments. According to the company, investments that were once only available to high-net-worth and affluent investors are now available on iintoo for accredited investors.

Investors may choose from commercial property, mixed-use developments, multifamily property, student housing, storage facilities, industrial distribution, and more. Interested parties must sign up for a free account with iintoo to view investment opportunities and must be verified as an accredited investor before contributing capital to a project.

iintoo uses artificial intelligence (AI) technology to conduct automated due diligence, make recommendations to investors to help ensure an investment is optimized, and conduct underwriting backed with human expertise.

- iintoo works with Meridian Capital Group to access high-yield Class B and Class C investment opportunities.

- The minimum investment size begins at $25,000.

- The average investment term is 18 to 36 months.

- Exited projects have delivered an average historical annualized return of 9.37% and a median historical annualized return of 10.96%, net of fees, since iintoo’s inception in 2015 (as of December 2021).

- Equity investors are entitled to a preferred return relative to the equity amount invested and pursuant to the waterfall of the investment.

- iintoo earns a deal initiation fee, which is usually equal to 7% of the value of an investment, plus an equity split and distribution with sponsors (project developers) who raise capital from iintoo.

- Investors may use funds from an SDIRA to invest in iintoo offerings.

- Investment opportunities through iintoo may also be used for a 1031 tax-deferred exchange.

RREAF Holdings

RREAF Holdings is a privately held commercial real estate firm based in Dallas formed in 2010. According to the company’s website, the firm has a history of success in the acquisition, development, asset management, ownership, repositioning, and financing of complex real estate projects throughout the U.S. RREAF Holdings has offices in Dallas, Memphis, and New York City.

The company offers 3 platforms for accredited investors:

Multifamily properties

- Platform established in early 2014

- Acquires and operates multifamily assets in secondary and tertiary markets in the South, Southeast, and Southern Atlantic coastal regions

- Has acquired 56 multifamily properties with more than 11,700 units and plans to scale up to 15,000 to 18,000 units with a market value of greater than $1.5 billion

- Identifies markets with an imbalance between supply and demand, little to no new development, and strong population and job growth in employment sectors such as government, health care, industry, and manufacturing

- Primarily serve the workforce housing demographic, including teachers, nurses, medical students, government employees, and factory workers

Beachfront hospitality and resort properties

- Platform established in 2012

- Acquires and operates assets in strong beachfront markets in the Southern Gulf Coast regions of Florida and along the Southern Atlantic Coast

- Currently owns and operates assets in markets such as Panama City Beach, Cocoa Beach, and Pensacola Beach

- Identifies markets where demand is outpacing supply and where there are high barriers to entry due to a lack of developable beachfront land

Ground-up development

- Selectively considered

- Does not seek to raise outside equity until a project is 100% shovel-ready

- Developing projects that include multifamily projects in Kerrville, Texas, and Gallatin, Tennessee, and hospitality development projects in Charleston, South Carolina, and Southlake, Texas

To access investment opportunities and learn about minimum investments and projected returns, interested parties must contact RREAF Holdings.

Roofstock or RealtyShares: How to decide?

The main factors in deciding between Roofstock and RealtyShares’ iintoo Investments and RREAF Holdings opportunities are whether an investor is accredited, the type of real estate asset class one wishes to invest in, and whether an investor wishes to contribute capital to a project or own an SFR property directly. RealtyShares may be a good option for accredited investors looking to contribute funds to commercial projects.

On the other hand, Roofstock offers opportunities for everyone from first-time investors to global asset managers to acquire SFR homes, small multifamily properties, and short-term vacation rentals. Both nonaccredited and accredited investors may purchase individual rental properties and portfolios directly, and accredited investors also have the option of fractional ownership shares of fully managed investment properties.