The most common way to invest in residential real estate is by using equity to make a small down payment and financing the balance of the purchase price. But did you know that it’s also possible to invest in real estate debt by acting as a lender to earn a fixed rate of return?

We’ll compare purchasing rental property directly on Roofstock and shares of stock in Roofstock One versus PeerStreet fractional debt investments, along with the pros and cons of each.

How Roofstock and PeerStreet work

Roofstock and PeerStreet are platforms for investing in real estate but on different ends of the capital stack. A capital stack refers to the layers of capital that go into purchasing real estate, such as equity and debt.

Investors can use equity for a down payment to invest in single-family rentals (SFRs) on the Roofstock Marketplace or purchase shares of Tracking and Common Stock in Roofstock One. In both cases, an investor may receive potential profits generated from recurring net income, rent price growth, and increase in equity earned from property appreciation.

On the other end of the capital stack, PeerStreet operates a crowdfunding platform to invest in residential estate debt alongside other investors.

Investors seeking a fixed income rate of return may find making a fractional investment in debt to be an attractive option. In exchange for a fixed return (provided a borrower does not default), investing in debt does not offer additional returns if rent prices increase or property values appreciate.

Roofstock

Investors can directly purchase SFRs and small multifamily buildings listed for sale on the Roofstock Marketplace or purchase shares of Tracking and Common Stock in Roofstock One.

Direct ownership is appropriate for those who prefer direct control and active management of the property as a landlord, whereas Roofstock One is intended to be a passive investment for accredited investors.

Let’s take a closer look at each option, beginning with Roofstock One.

Roofstock One

Roofstock One provides an efficient alternative to direct investing (avoiding the need to be on title, obtain mortgages, supervise rehabilitation activities, find property managers, and handle ownership and tenancy issues).

Investors can instead focus on assembling targeted portfolios with allocations across markets, focusing on specific investment goals while enjoying passive income with potential long-term growth from home price appreciation.

Investors purchase shares of Tracking and Common Stock in Roofstock One to construct a customized portfolio that best suits their needs and/or investment goals.

Fee structure

- Standard initial investment of $5,000

- Additional purchases for as little as $100 after the initial investment

- No limit to number of shares purchased, subject to the maximum allowable amount for a single tracking stock

Feature summary

- Tracking Stock provides exposure to multiple properties and markets.

- Common Stock provides broad exposure to all homes in the Roofstock One real estate investment trust (REIT).

- Both options can potentially help investors avoid the risks of single-property ownership.

- Roofstock One investors can pick and choose from curated property portfolios to suit their investment goals.

- Roofstock, through one or more property managers, takes care of all the day-to-day management of the properties, providing a more hands-off experience to investors.

- Investors are eligible to receive pro rata quarterly distributions, subject to board approval, based on the economic performance of the underlying properties, a portion of which may be tied to available depreciation.

- Roofstock One investors are required to have an investment horizon of at least 5 years.

- Roofstock One is available to accredited investors only.

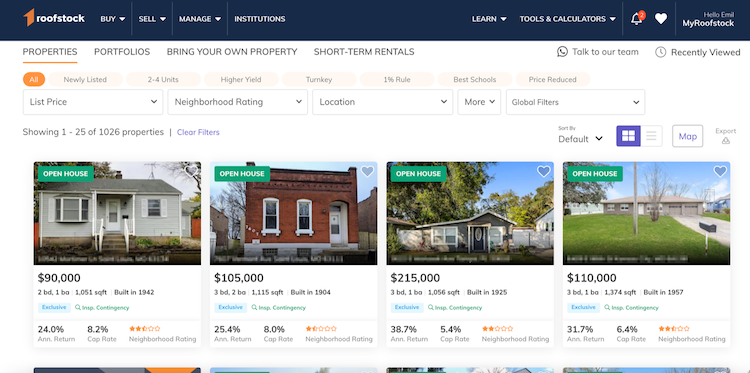

Roofstock Marketplace

The Roofstock Marketplace has hundreds of listings of SFR homes, small multifamily properties with 2 to 4 units, short-term vacation rentals, and rental property portfolios. Since its launch in 2016, buyers and sellers have completed more than $5 billion in transactions across 27 states on the Roofstock platform.

Property is purchased directly from a seller, using the same process as any other residential real estate transaction, with Roofstock facilitating the transaction every step of the way. However, a couple of things make doing a deal on Roofstock different from a typical real estate transaction.

Roofstock also helps buyers conduct due diligence by vetting property markets, providing financial calculators to project different return scenarios, and providing neighborhood ratings based on key criteria, including household income, employment growth, home value trends, and school district ratings.

Investors can also request referrals for lenders for loan preapproval, learn about various policy options for third-party landlord insurance, and request referrals to local property managers to handle the daily maintenance and tenant relationships after the transaction closes. These services can make remote investing in real estate much easier, allowing investors to buy in markets with the best rental property returns.

Fee structure

The fee structure on Roofstock is similar to buying or selling property through a real estate agent, although at a much lower cost:

- Sellers pay a 3% fee of the sale price or $2,500 (whichever is greater).

- Buyers pay a fee equal to 0.5% of the purchase price or $500 (whichever is greater).

- No recurring fees, revenue splits, or profit participation fees are paid to Roofstock after the initial sales transaction.

After closing, investors are responsible for the traditional recurring expenses of owning and operating a rental property, such as:

- Routine maintenance and repairs

- Capital expenses for major improvements

- Property taxes

- Landlord insurance

- Mortgage payment (if the property is financed)

- Property management fees (if using a property manager)

Rental income collected from a tenant generally covers normal operating expenses and the mortgage payment unless the property is vacant during a tenant turnover period.

Feature summary

Investors can research available rental properties in different markets, negotiate directly with the seller online, arrange financing and make an offer, and purchase preinspected (when necessary) rental property on Roofstock.

Researching rental property is made easy with pictures, street views, property inspection reports, tenant lease information, and rent payment history if a home is already occupied.

Investors can search for available rental property on the Roofstock Marketplace using key metrics, including:

- Property type

- Location

- List price

- Monthly rent price

- Cash-on-cash return

- Cap rate

- Annual appreciation

- Higher appreciation

- Price reduced

- Higher yield

- Gross yield

- 2 to 4 units

- Neighborhood rating

- Best schools

- Minimal repairs

Pros

- Available to first-time buyers, nonaccredited investors, high net worth individuals, and institutional investors

- SFRs, small multifamily homes, short-term vacation rentals, and entire portfolios of residential rental property available for purchase

- Large deal flow of several hundred transactions per month with hundreds of homes typically available for sale at any given time

- Easier due diligence with equity investments in single-family houses and small residential properties versus researching the viability of a renovation project and a borrower’s credentials when investing in debt

- 100% direct property ownership with upside potential if net income increases, rent prices rise, and property values appreciate

- More flexibility, with no limitation on how or when the property can be sold

- Increased liquidity of the real estate investment because a secondary market for residential rental properties is always available, and investors can resell using the Roofstock platform if they choose to do so

- Accessible way to remotely invest in real estate in markets across the U.S.

- Some homes already rented to qualified tenants, with cash flow beginning the day escrow closes

- Low one-time transaction fees, referrals to vetted local property managers upon request, and fast closings facilitated by Roofstock

- Self-directed individual retirement accounts (SDIRAs) and 1031 tax-deferred exchanges to invest in property through the Roofstock platform

Cons

- High minimum investment if a property is purchased for cash or if a down payment is made and financing is used

- Additional capital potentially required for repairs, maintenance, and capital improvements

- Time required to sell since real estate is an illiquid, long-term investment

PeerStreet

PeerStreet is a real estate crowdfunding platform for making fractional investments in real estate debt.

Investors have completed over $4 billion in loan transactions in 44 states on the PeerStreet platform, earning over $225 million in interest payments. Accredited investors use the PeerStreet platform to loan money to borrowers looking for a short-term bridge loan in order to improve a property to sell or rent for profit.

An accredited investor is someone who has had an annual income of at least $200,000 for 2 consecutive years or has a net worth of $1 million, excluding the value of a primary residence. This updated investor bulletin from the Securities and Exchange Commission explains more about what it means to be an accredited investor.

Loan investments on PeerStreet are first-lien position loans backed by the real property and the borrower’s credentials. If a borrower defaults, a first-position lienholder is first in line to be paid back. Investors can browse and select debt investments offering different yields, terms, and loan-to-value (LTV) ratios for residential and multifamily properties. Loans on PeerStreet are sourced from the company’s network of vetted private lenders and mortgage brokers.

Fee structure

PeerStreet makes money on the interest rate spread, which is represented as the loan servicing fee. The spread typically ranges between 0.25% and 1.00%, which means if a note offers an annualized rate of 7.5%, an investor may earn a net interest rate of between 6.5% and 7.25%.

There may also be other fees charged by PeerStreet that are disclosed in an offering memorandum. For example, the company may make money on transaction or referral fees that directly impact investment returns.

If a loan goes into default, asset management fees charged by PeerStreet vary based on the loan. Default interest and extension fees are split 50%/50% between PeerStreet and investors. The company may also assess an asset management fee if a short pay is accepted, a 90+ day delinquent note is sold, or a property sells at a foreclosure auction or a real estate owned (REO) sells after foreclosure.

Feature summary

PeerStreet is an online marketplace for investing in residential real estate debt. Debt investment opportunities are transparent, and the platform helps to simplify sourcing and managing loans:

- Low minimum investment of $1,000

- Invest in real estate debt for residential and multifamily property loans

- Loan terms are short term, with durations typically ranging from 1 to 36 months

- Search criteria such as property type, geographic location, LTV, and loan term and interest rate

- Loan details on property and location, property valuation, photos, borrower credit details, and more

- Automated investing option for automatic investments in loans that match an investor’s criteria

- After funding, loans serviced by PeerStreet’s team to collect payments from borrowers and distribute proceeds to investors

- Monthly interest payments directly transferable to an account or reinvested in other debt offerings

- First-position liens, meaning an investor is first to be paid back if the loan doesn’t perform

- PeerStreet available if a loan doesn’t perform as expected

Pros

- Easy to diversify a portfolio with crowdfunded fixed-income debt investments

- Minimum investment size of $1,000

- Interest rates generally higher than conventional long-term loans

- PeerStreet services loans and investors receive shares of monthly payments

- First-lien position so an investor is first in line to be repaid

- Debt investments doable using an SDIRA for real estate

Cons

- Limited to accredited investors and institutional investors

- No upside to an investor if net operating income (NOI) increases or property value appreciates

- Capital illiquid and deployed for the life of the loan term, which could be shorter if a borrower prepays or longer if a borrower exercises an option to extend the loan

- Principal and interest (P&I) payments depending on the performance of the underlying mortgage and not guaranteed

- Possible for a loan to go into default, with estimated foreclosure costs between 3% and 7% of the loan balance, depending on the foreclosure process for the state in which the property is located

Roofstock or PeerStreet: How to decide?

While Roofstock offers a wide variety of opportunities to directly invest in residential rental property on the equity end of the capital stack, PeerStreet makes it easy to invest in debt with a fixed interest rate of return. However, one of the most significant drawbacks to PeerStreet is that opportunities are restricted to accredited investors.

The Roofstock Marketplace, on the other hand, has no limitations, and Roofstock provides investing options for both nonaccredited and accredited investors, including new investors looking for their first rental property, sophisticated investors seeking rental property portfolios, and global asset managers.