Real estate can create income for investors in two ways. First, there’s the monthly rental income from qualified tenants. Next, there’s the potential appreciation in market value over the long-term.

While building equity is nice, most successful real estate investors view appreciation as icing on the cake and focus on cash flow first. That’s because monthly cash flow is much more predictable and controllable, while an increase in market value isn’t always guaranteed.

In this article we’ll look at what several expert sources have to say about the best real estate markets for cash flow, and also take an in-depth look at why so many rental property investors focus on cash flow.

Best markets to buy rental property

Investing in the right rental property in the right market can generate healthy cash flow and a stronger ROI (return on investment).

Here’s where five leading financial and real estate investing organizations say are the best markets to buy rental investment property in 2020:

Motley Fool

Realtor.com anticipates that 2022 will be another whirlwind year for homebuyers and investors alike.

In selecting the top 10 housing markets for 2022, the organization considered factors such as: Geographic hotspots that are home to healthy local economies and low unemployment rates, places with growing tech scenes where people can easily work from home, and high demand for housing.

These top 10 markets from Realtor.com are generally smaller and less crowded and are witnessing a large percentage of in-migration from bigger cities. Forecast growth is a combination of sales and price growth, year-over-year:

- Salt Lake City, Utah: 23.7%

- Boise, Idaho: 20.8%

- Spokane-Spokane Valley, Washington: 20.5%

- Indianapolis-Carmel-Anderson, Indiana: 20.4%

- Columbus, Ohio: 20.0%

- Providence-Warwick, Rhode Island-Massachusetts: 17.7%

- Greenville-Anderson-Mauldin, South Carolina: 17.1%

- Seattle-Tacoma-Bellevue, Washington: 17.1%

- Worcester, Massachusetts-Connecticut: 16.6%

- Tampa-St. Petersburg-Clearwater, Florida: 16.4%

Fortune

While home prices overall are predicted to rise by just 2.9% this year, some housing markets are predicted to perform much better than others. In addition to cash flow, increase in potential appreciation is another way investors make money in rental property.

Fortune recently crunched the numbers to compile this list of the 5 best places to make real estate investments in 2022, based on where home prices are expected to keep going up:

- Portland, Maine

- Providence, Rhode Island

- Salt Lake City, Utah

- Worcester, Massachusetts

- Boise, Idaho

Roofstock

To learn which markets will be best for real estate investors in 2022, Roofstock reviewed reports from the Urban Land Institute and Realtor Magazine to rank the 10 best overall markets for real estate investors:

- Nashville, Tennessee

- Raleigh/Durham, North Carolina

- Phoenix, Arizona

- Austin, Texas

- Tampa/St. Petersburg, Florida

- Charlotte, North Carolina

- Dallas/Fort Worth, Texas

- Atlanta, Georgia

- Seattle, Washington

- Boston, Massachusetts

In addition to researching the best overall markets Roofstock also created best lists for:

- Major capital markets

- Housing markets with a consistent record of capital inflows and transaction volumes

- Real estate markets that are ripe for discovery

- Thrifty choices for investors looking for under-the-radar investment opportunities

- Markets that are consistently meeting expectations

DoughRoller

Although the real estate market has performed exceptionally well over the last several years, the truth is it’s never too late to start investing in real estate. Investors who buy today aim to generate monthly rental income plus an increase in equity to maximize potential profits over the long term.

If you’re wondering where to begin looking for rental property, DoughRoller recently compiled a list of 8 best U.S. housing markets for real estate investing to help answer that question. To determine the best real estate markets, DoughRoller analyzed key investment metrics such as projected growth, jobs added and planned, current home prices, and vacancy rate.

After collecting data on more than 3,000 markets, here are 8 great markets to consider for investing in rental property:

- Florida: Orlando

- Utah: Ogden

- North Carolina: Raleigh/Durham

- Utah: Provo

- Tennessee: Nashville

- Missouri: Springfield

- Texas: Fort Worth, Arlington

- California: Sacramento, Arden, Arcade, Roseville

National Association of REALTORS

Resilience is defined as the ability to face adversity and to bounce back and even grow. When the pandemic swept across the U.S., some economies and real estate markets were more resilient than others.

The National Association of REALTORS (NAR) has identified the top 10 markets during and in a post-COVID environment in 2021-2022, considering a variety of indicators including the percentage of people working from home, net domestic migration to a metro area, in-bound movers from expensive West Coast areas, and unemployment rate.

Here are the top 10 real estate markets with the best expected post-pandemic performance, according to the NAR, listed in alphabetical order:

- Atlanta-Sandy Springs-Alpharetta, Georgia

- Boise City, Idaho

- Charleston-North Charleston, South Carolina

- Dallas-Fort-Worth-Arlington, Texas

- Des Moines-West Des Moines, Iowa

- Indianapolis-Carmel-Anderson, Indiana

- Madison, Wisconsin

- Phoenix-Mesa-Chandler, Arizona

- Provo-Orem, Utah

- Spokane-Spokane Valley, Washington

Why cash flow matters

The two main components of potential profit from rental real estate are cash flow and appreciation. However, investors who put too much focus on appreciation may also incur too much risk.

That’s because appreciation can take years to receive. In the meantime, if a property is overpriced or over-leveraged, monthly cash flow may not be high enough to cover normal operating costs and mortgage payments.

Key benefits of cash flow

A recent article from The Wall Street Journal explains why people may want to add real estate to a retirement portfolio. Some of the reasons why real estate investors should concentrate on adding income-earning, cash-flowing properties to their portfolios:

- Cash flow helps protect investors from economic change and the routine cycles that real estate markets move through.

- Rental yields act as a hedge against inflation because annual rents can be adjusted to market and real estate values tend to increase more than the annual rate of inflation.

- Rental property income generated by a tenant can be used to pay the owner’s mortgage and maintenance expenses with any additional positive cash flow remaining as profit.

- Real estate tax deductions for items such as repairs, property management fees, insurance, and non-cash depreciation expenses can help reduce an investor’s taxable net income.

Why Rich Dad likes cash flow

Robert Kiyosaki (author of Rich Dad Poor Dad) says that cash flow – or passive income – is the primary focus for building infinite wealth. That’s because cash flow breeds more cash flow.

In fact, after a certain point in the investing process, recurring cash flow can support an investor’s living expenses and provide the capital to invest in more real estate.

Real estate with cash flow can:

- Be immediately generated the minute the property is rented to a tenant

- Eliminate the fear of running out of money during retirement

- Create the lowest-taxed type of income (although a 1031 exchange can also be used to defer the payment of capital gains tax)

How to calculate true cash flow

Not all cash flow is created equal.

Sometimes beginning real estate investors make the mistake of confusing gross cash flow – or the rent money collected from a tenant – with net cash flow, or the money left over at the end of the day after all of the bills have been paid.

It’s possible for a rental property to have positive gross cash flow, but negative net cash flow if the total cost of owning the property is greater than the income being generated.

Let’s take a quick look at how to accurately calculate the true monthly cash flow of a single-family home:

- Rental income $1,500

- Mortgage payment (PITI) $900

- Property management fee $100

- Vacancy allowance $150

- Maintenance and reserve $150

- Total expenses $1,300

Cash flow (net) $200 per month or $2,400 per year

Earlier in this article we mentioned the risk of focusing too much on potential appreciation.

If an investor uses too much leverage to purchase a property with a small down payment, or over bids for a property, it’s easy to see from the above example how a home with a positive gross cash flow and quickly turn net cash flow negative with a higher monthly mortgage payment.

Financial formulas that use cash flow

Real estate investors have other uses for cash flow besides paying the bills and putting money in the bank.

Accurately calculating and forecasting cash flow impacts a variety of other financial formulas that rental property investors use:

- NOI (net operating income) is another word for net cash flow and is the amount of money generated by an investment property after the cash operating expenses have been paid.

- Cash-on-cash return calculation compares the net cash income earned on a property to the cash invested in a property to calculate the annual rate of return.

- Cap rate formula measures the potential profitability of an investment by dividing the NOI (excluding the mortgage payment) by the market value of a property to compare one cap rate to the cap rates of similar investment property in the same market.

- IRR (internal rate of return) is the percentage rate that compares the net present value of future cash flows to an investor’s required rate of return.

How to find cash flowing property

The first step in knowing where to look for rental property is to understand the factors that can potentially help an investment cash flow. Signs that a market might be good for cash flowing rental property include:

- Housing affordability indicates the opportunity for investors to buy property at a reasonable price and the potential demand from tenants.

- Wage growth year-over-year should meet or exceed the forecasted rate of rent increases, otherwise tenants may be unable to pay the rent.

- Unemployment rates in good rental markets are at or below the national unemployment rate and indicate a strong job market.

- Population growth is a sign that more people are moving into a market for job opportunities, low cost of living, or a higher quality of life.

- Rental yield is the percentage of rental income compared to property market value, so the higher the rental yield is the more cash flow there is being generated.

- Property value appreciation can be measured by the change in median home values over the long term, creating a potential increase in equity to boost overall ROI and the capital to purchase more property with cash-out refinancing.

Locating rental property with strong cash flow potential

Once an investor has narrowed down markets that are good for cash flow rental property, the next step is to negotiate a good deal.

Successful real estate investors know that true profits are made when a property is purchased, not when it’s sold. That’s because if an investor buys above market price, they’re paying more for the property over the entire holding period and losing profits by leaving money on the table each month.

Ways to find rental property with the potential for good cash flow include:

- Owners in distress that are desperate to sell due to job loss, divorce, medical bills, or deferred property maintenance.

- Pre-foreclosure and REO (bank owned) real estate may offer investors the opportunity to buy below market, although investor competition for foreclosure property can make deals difficult to find.

- Buying rental property from wholesalers and fix-and-flip investors is another rent-ready option, but these types of investments won’t generate cash flow until they’re rented to a good qualified tenant.

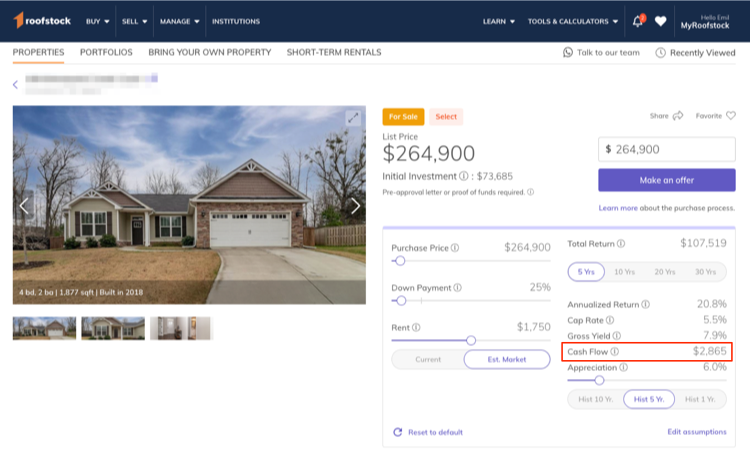

Another option is to purchase rental property already occupied by a tenant like the single-family homes listed for sale on the Roofstock Marketplace.

Using an online platform like Roofstock helps take the guesswork out of real estate investing. And because the listings are pre-vetted and can be managed by local property management companies, investors increase the likelihood that long-term cash flow will be healthy and strong.

You can also easily view cash flow projections for each property listed on the marketplace: