Investing in rental real estate may provide recurring rental income, appreciation in property value over the long term, and tax benefits that are unique to investment real estate. With an increasingly volatile stock market and rapidly rising inflation, the single-family rental (SFR) asset class is attracting capital from both private and institutional investors.

Attractive rental properties can be found in smaller secondary and tertiary markets across the country, which is one reason people are using online platforms like Roofstock and Rent to Retirement to remotely invest in real estate.

In this article, we’ll discuss how Roofstock and Rent to Retirement work, along with pros and cons of each company, to help you decide which platform suits your investment goals and strategies.

Key takeaways

- Both Roofstock and Rent to Retirement help investors purchase rental property remotely.

- Roofstock is the #1 marketplace for buying and selling SFR properties and has hundreds of homes listed for sale at any given time.

- Rent to Retirement offers both rehabbed and newly built homes to investors.

How Roofstock and Rent to Retirement Work

Both Roofstock and Rent to Retirement make investing in SFR real estate easier, but they do so in radically different ways.

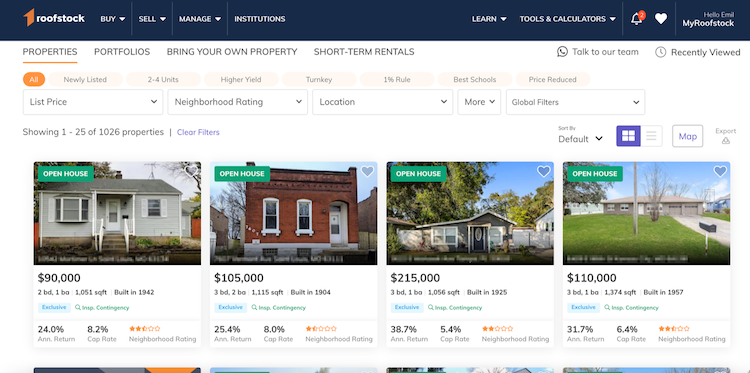

Roofstock provides investors with a wide range of choices. At any given time, there are hundreds of single-family, small multifamily, and short-term vacation rental properties listed for sale on the Roofstock Marketplace. An investor can conduct their own analysis and due diligence, use their own lender or ask Roofstock for a referral, and complete the purchase process entirely online.

In less than 6 years, Roofstock buyers and sellers have completed more than $4 billion in transactions, helping Roofstock to become the #1 marketplace for investing in SFR homes. After purchasing properties, investors have an opportunity to connect with professional local property managers vetted by Roofstock and sign up for free with Stessa, a Roofstock company. Stessa is a robust cloud-based software system that makes tracking real estate investment simple.

In contrast, Rent to Retirement has a couple dozen properties listed for sale in a handful of states. The company employs a purchase process that some investors might describe as fix and flip.

After getting preapproved for a loan by one of Rent to Retirement’s recommended lenders, an investor develops a plan with help from a company advisor to purchase a property that has been rehabbed or newly built by Rent to Retirement.

Roofstock overview

Roofstock provides an online platform for investing in SFR homes, short-term vacation rentals, and small multifamily properties. Roofstock is a good choice for investors who like to make their own decisions and be in charge of the entire transaction from start to finish.

Investors purchase homes on the Roofstock Marketplace directly from sellers, and the platform is designed so that investors can proceed without real estate agents. Of course, investors who wish to use their own agents can do so, or can receive a referral for a certified real estate agent in the market in which the property is located.

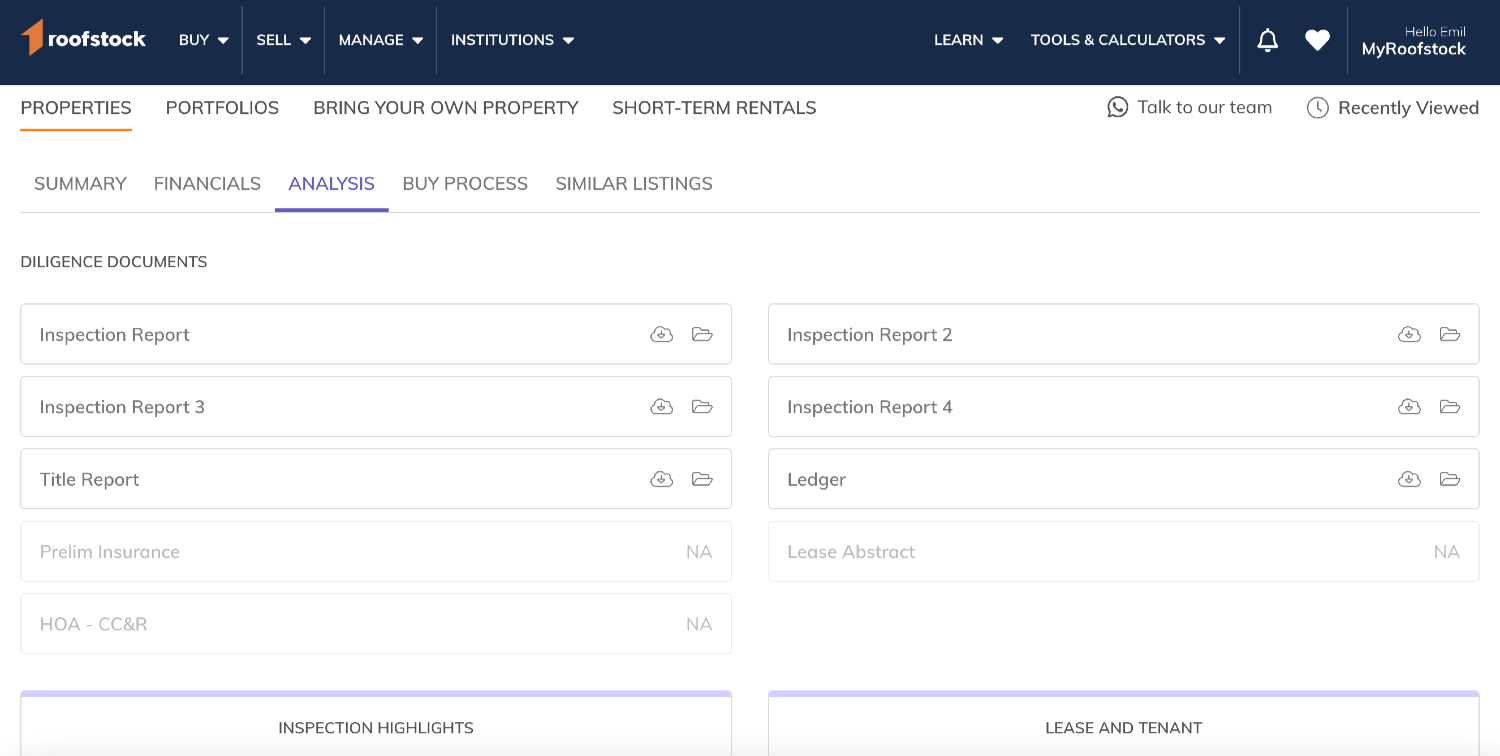

Investors are able to analyze rental property listed for sale on Roofstock and perform due diligence. Investors can research each real estate market and analyze neighborhood-specific risks and benefits using key criteria such as home values, employment rates, and school district or neighborhood ratings.

After transactions close, buyers have the option of interviewing a vetted local property manager to take care of day-to-day details, such as managing tenants and maintaining the property, which can make remote real estate investing easier.

In addition to SFR homes, small multifamily properties, and short-term vacation rentals, Roofstock offers portfolios of single-family and multifamily rental properties, newly built homes from Lennar Homes, tracking stocks tied to the economic performance of curated, fully managed portfolios through Roofstock One, and a Bring Your Own Property program for buyers who want access to all of the analytics Roofstock offers to investors on the Roofstock Marketplace.

Fee structure

Roofstock has a completely transparent and competitive fee structure. Making an offer on Roofstock is free. After an offer has been accepted, buyers pay a fee equal to 0.5% of the property purchase price or $500, whichever is greater. Sellers pay a commission of 3% of the property sale price or $2,500, whichever is greater.

Feature summary

Roofstock makes finding and researching a rental property easy. Each property listing includes pictures and street views, title reports, current lease information, and a rent roll with tenant history if the home is already rented.

Investors can search for rental property based on key criteria and financial metrics, including:

- Location

- List price

- Square footage

- Number of beds and baths

- Neighborhood rating

- Best schools

- Occupancy

- Minimum year built

- Newly listed

- Price reduced

- Cash only

- Discount to valuation

- Higher yield

- Monthly rent

- 2 to 4 units

- Annual appreciation

- Gross yield

- Cap rate

- 1% Rule

- Section 8

Pros

- Transparent, one-time transaction fees, referrals to vetted local property managers and financing partners, and closings facilitated on the Roofstock platform

- Hundreds of listings for SFRs and small multifamily properties at a wide range of price points

- Additional investment opportunities, such as short-term vacation rentals, existing portfolios of single-family and multifamily homes, newly built homes from Lennar Homes, and Roofstock One Tracking Stocks for passive investing.

- Data from Roofstock’s Neighborhood Ratings and Cloudhouse Calculator can help investors estimate market rent, create pro forma returns using different investment scenarios, and compare multiple properties to make a more informed decision

- Opportunity for immediate cash flow beginning the day that escrow closes if the home is already tenant-occupied

Cons

- Looking for rental properties in dozens of different cities, and performing research and due diligence, may not appeal to every real estate investor

Rent to Retirement overview

Rent to Retirement claims to be a partner for investors seeking financial freedom and long-term wealth, helping people enjoy the benefits of real estate investing without the headache. The company uses what some people might describe as a fix-and-flip approach, by rehabbing homes and selling them to investors.

Investing options listed on the Rent to Retirement website include rehabbed and existing inventory, new builds, featured properties, and vacation rentals. The company has a team of professionals including attorneys, certified public accountants (CPAs), lenders, property managers, and insurance providers.

Rent to Retirement currently operates in 11 markets: Birmingham, AL; Montgomery, AL; Cape Coral, FL; Cincinnati, OH; Cleveland, OH; Detroit, MI; Greenville, SC; Indianapolis, IN; Kansas City, KS; Little Rock, AR; and Minneapolis, MN.

According to the spreadsheet Rent to Retirement provides on its website to report on active inventory, the company has 27 homes available for sale at time of publication, including 5 newly constructed homes in a Cape Coral subdivision. Each property has a link to a Google Docs brochure that includes basic property information and status, photos, and a pro forma cash-flow statement with projected cash-on-cash return on investment (ROI).

Buying with Rent to Retirement follows a 5-step process, which the company says is the same as any other real estate transaction:

- Get preapproved with one of Rent to Retirement’s recommended lenders.

- Have a strategy call with one of the company’s investment counselors to talk about goals and criteria.

- Collectively come up with a plan to pinpoint markets and properties.

- Identify a property and take action by putting the house under contract.

- Start underwriting and due diligence, with a typical closing time frame of 4 to 6 weeks.

Fee structure

Rent to Retirement doesn’t disclose a specific fee structure on its website but does say that the company’s profit margin is built into the purchase price of each home.

Although the purchase price can't be negotiated, the company states homes are priced “very appropriately—not to mention aggressively” to offer good returns and cash flow. That being said, Rent to Retirement may be able to offer “some sort of incentive” to repeat clients who have purchased multiple properties from the company.

Feature summary

Rent to Retirement currently has 27 homes listed for sale in Florida, Indiana, Kansas, Missouri, Ohio, and Pennsylvania. Properties are a combination of rehabs that are underway or that have been completed in the last 90 days, existing inventory that was rehabbed within the past 3 to 36 months, a short-term luxury vacation rental near Disney, and 5 new construction homes in a Cape Coral subdivision.

The company believes that the biggest differentiating factor between Rent to Retirement and other companies in the industry is the long-term relationship Rent to Retirement builds with its clients:

- Rent to Retirement provides clients with renovated or newly built properties that are leased and professionally managed by the time they close.

- Properties are chosen based on each investor’s goals and strategies, and each market may vary in terms of factors such as price points, appreciation, and taxes.

- Rent to Retirement operates in Missouri, Ohio, Florida, Alabama, Indiana, Arkansas, the Quad Cities, Minnesota, Michigan, and Pennsylvania.

- When determining investment markets, Rent to Retirement looks for markets based on criteria including landlord-friendly legislation, low taxes, population and job growth, high rental demand, and high rental rates relative to home prices.

Pros

- Rent to Retirement finds and renovates homes so that investors don’t have to.

- Homes may already be rented to a tenant or ready for a tenant.

- In addition to rehab homes, the company offers new construction and short-term vacation rentals.

Cons

- There are a limited number of properties to choose from in a limited number of markets.

- There is no mechanism for conducting due diligence and purchasing a property entirely online.

- Profit margins are built into the purchase prices of homes, although much profit percentage is not disclosed on the company’s website.

- Rent to Retirement does not negotiate on prices, noting that the company believes properties are priced appropriately and that all homes are usually sold within a few days at the prices listed.

- It’s unclear from the company’s website whether investors’ own lenders can be used. Rent to Retirement says the company’s goal is to connect investors with lenders that can help investors accomplish their goals.

Roofstock vs. Rent to Retirement: How to choose?

Both Roofstock and Rent to Retirement aim to make investing in real estate easier. However, while Roofstock provides investors with freedom of choice, Rent to Retirement uses more of a home-flipping approach.

Homes purchased from Rent to Retirement have been rehabbed by the company (or newly built), and investors who wish to purchase appear to need preapproval from one of the company’s recommended lenders and to pay the company’s nonnegotiable asking price.

On the other hand, Roofstock investors are free to pick and choose among hundreds of single-family homes, small multifamily properties, and short-term rentals listed for sale in more than 24 states. After analyzing potential returns and performing due diligence, buyers and sellers can negotiate via the Roofstock platform.