Gross yield indicates the percentage of profit before deducting for expenses. Also known as gross rental yield, gross yield is a key measure to use when evaluating the potential financial performance of rental real estate.

Gross yield in real estate investing can be used to compare different investments to one another, and to compare one type of investment to another, such as a traditional stock mutual fund to rental property.

How to Calculate Gross Yield

The gross yield calculation can be used for any income-producing asset, including stocks and bonds, mutual funds, and real estate. “Gross” means there are no deductions or adjustments made for operating expenses or taxes, while “Yield” means the gross return compared to the market value of the property.

To calculate gross yield, take the income generated from the property (before any deductions) and divide that gross income by the property value. For example, if a single-family house has a gross rent of $8,000 per year and the market value of the house is $100,000, your gross yield is:

- $8,000 gross annual rent / $100,000 market value = .08 or 8%

It’s important to note that gross yields are not static, and can go up or down from one year to the next, or sometimes even within the same year.

Why do gross yields fluctuate?

During an economic downturn, some property owners who don’t realize that market cycles are normal may panic and sell, driving property prices down over the short term. When this occurs, gross yields can increase, assuming that gross rental income stays the same.

The same phenomenon can also occur in markets where housing is in short supply or investor demand is strong. In situations like these, gross yields may temporarily decrease, then adjust back to the market norm as rents increase and property owners look for a fair market return on their investment.

When to Use Gross Yield

Gross yield is a simple “back of the napkin” calculation that can be done in your head or using the calculator app on a smartphone. It’s also an easy way to compare the potential value of comparable rental properties in the same neighborhood or market area, and also to compare the gross yields in different cities to one another.

Everything else being equal, the rental property with the highest gross yield may be the best choice. However, there are three important questions investors should ask when looking at a property’s gross yield:

- Is the rent fair market?

There are two good websites you can use to conduct a “reality check” to learn if the rent is fair and at market value:

- Rentometer: By entering the property address, current rent, and number of bedrooms and bathrooms on the Rentometer website, you can see if the rent is too high or too low compared to other similar local properties.

- Stessa Rent Estimate reports: These reports through Stessa recommend a specific asking rent for your unit, based on an analysis of current listings, recent rent comps, market trends, and neighborhood demographics.

Once you’ve determined what the fair market rent should be, compare that number to the gross rent of the property you’re considering investing in. If the rent from your potential acquisition is higher than market, it’s a sign that the gross yield is inaccurate.

There are a number of reasons why the gross rent may be above-market. The property may have been used for short-term rentals or as a vacation rental, both of which generate rents that are higher than a long-term tenant would pay.

Or, the property may be rented to a tenant with a poor credit history or a prior eviction. The landlord might be charging the tenant a higher rent to compensate for the additional risk of renting to the unqualified tenant, creating a potential future problem for you if the tenant once again has trouble paying the rent after you buy the property.

- Are there tenant rent incentives?

During difficult economic times, many property owners will offer the tenant a temporary discount for paying the rent early or on time. While offering the tenant incentives can make good business sense, how this tenant incentive is recorded can also affect the gross yield.

Let’s use our rental property with a market value of $100,000 and a gross annual rent of $8,000 as an example. The landlord offers the tenant a 5% discount for paying the rent early or on time, but records it in two different ways that also impact the gross yield differently.

If the owner discounts the rent by 5% “off the top”, the gross yield decreases to 7.6% ($8,000 – 5% = $7,600 / $100,000 property value). However, if the owner collects the full rent then turns around and rebates the 5% incentive to the tenant in cash or credit, the gross yield of 8% remains unchanged even though the actual rent collected is less.

- What are the operating expenses?

A rental property with a high gross yield isn’t necessarily more profitable than a property with a lower gross yield.

For example, luxury rental properties or homes in communities with a lot of amenities may generate a higher gross rent, but also cost more to operate due to higher maintenance expenses or HOA fees.

What is a Good Gross Yield?

A good gross yield isn’t always the same as a high gross yield. Sometimes, rental property with the highest yields may also have more risk or a lower level of appreciation. But with that being said, a high gross yield also means there is more gross cash flow coming in.

Savvy real estate investors understand the importance of hiring an experienced local property manager and developing a strong real estate team. With the right people in place, rental property with a high gross yield can also generate consistently healthy profits by selecting good property and keeping operating expenses under control.

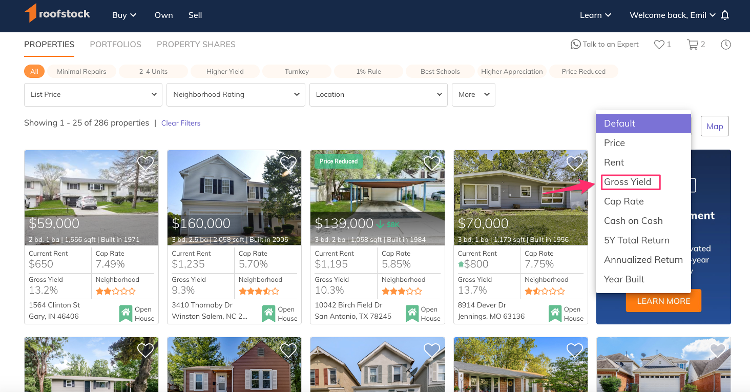

Check out properties listed on Roofstock’s marketplace and sort by gross yield to find what you’re looking for.

Gross Yield vs. Net Yield, Cap Rate, and Cash-on-Cash

A mistake many beginning real estate investors make is to focus on only one criteria when analyzing rental property performance. While gross yield is important, three other calculations to consider in addition to gross yield: Net yield, cap rate, and cash-on-cash return.

- Net yield takes into account the expenses of owning and operating a rental property including the mortgage payment

- Cap rate excludes the mortgage payment, then compares net operating income to property market value

- Cash-on-cash compares the cash generated from the property to the cash invested in the property

Now, let’s use our $100,000 rental property with a gross annual rent of $8,000 and a gross yield of 8% to calculate the net yield and ROI:

Net Yield

Common expenses of owning a rental property include leasing and property management fees, repairs and maintenance, landscaping, utilities, property taxes, and the mortgage payment if the property is financed or leveraged.

If our operating expenses total $4,000 per year, the annual net yield from the property would be 4%:

- Gross annual rent = $8,000 - $4,000 operating expenses = $4,000 net income

- $4,000 net income / $100,000 market value = .04 or 4%

Cap Rate

The cap rate formula is similar to calculating net yield, except that the mortgage payment is excluded from the operating expenses:

- Cap rate = Net operating income / Market value

- $8,000 gross income - $2,000 operating expenses = $6,000 net operating income (NOI)

- $6,000 NOI / $100,000 market value = .06 or 6% cap rate

By excluding the mortgage, an investor can make an unleveraged comparison and then analyze how different down payments affect the net yield and cash-on-cash return.

Cash-on-Cash

Cash-on-cash return (sometimes referred to as ROI or return on investment) compares the net annual income to the amount of cash put into the property. If you pay all cash for a rental property, your cash-on-cash return is the same as your net yield.

However, most real estate investors use conservative leverage to boost their returns and by more than one rental property with their investment capital. Using a conservative loan-to-value of 75% with a down payment of $25,000, our cash-on-cash return would be 16%:

- $4,000 net income / $25,000 cash invested = .16 or 16%

All four formulas – gross yield, net yield, cap rate, and cash-on-cash return – are easy to calculate and also take into account the skill of an investor’s local real estate team in keeping operating costs low along with the power of leverage.

Final Thoughts

Gross yield in real estate investing is a quick and easy way of comparing one rental property to another. The gross yield calculation compares the total amount of gross rental income generated to the property market value.

While the formula doesn’t include operating expenses or the mortgage payment, gross yield can be used to locate rental properties that generate high amounts of cash flow in relation to the purchase price of the property.