A lot of real estate investors are losing money without even realizing it.

They buy property based on “gut instinct” or emotion without taking the time to accurately forecast property expenses. At the end of the day, they pay more taxes on their rental income than they have to.

Today’s tax laws are extremely friendly to rental real estate investors. In fact, investment real estate provides unique tax benefits that other assets don’t offer. But before you can reap the rewards of those benefits, you need to know what they are.

In this article we’ll cover rental property expenses that investors need to account for. You can also refer to the checklist at the end of this post for a simple guide of everything you should be keeping track of.

Estimating Expenses Before You Buy

It’s easy to estimate rental income. Look at market comparables and performance, get a basic sense for supply and demand in the area, and you’ve got a pretty accurate idea of how much rent you’ll receive each month.

But estimating expenses is much more difficult, simply because there are a lot more expected - and unexpected - variables.

Many investors use what's called the 50% rule as a starting point to estimate the expenses on a deal they're analyzing, but let’s first begin by looking at the three steps that will help you more accurately estimate your rental property expenses before you buy.

Step #1 - Talk to property managers in the market

Property managers are an excellent source for accurate expense information that you won’t find anywhere else. Contact several and let them know you’re thinking about buying an investment property. Let them know you’re considering hiring a manager and ask them what they think expenses on the rental property should run.

Step #2 - Speak with fellow real estate investors

People that you’ve met in your local real estate investment club are another excellent source for estimating rental property expenses. Active investors know that networking is the name of the game. If they help you out, they know you’ll repay the favor down the road.

Step #3 - Call the utility companies

Even if you’re buying a single-family house to rent where the tenant pays the bills, it’s a good idea to research the cost of monthly utilities. Prospective tenants may ask about these, and if the cost of utilities have been running too high with the property there may be a hidden defect. The utility company may only give you an average over the past few months, but it’s a good way to ballpark your pro forma.

>>Properties listed on Roofstock’s marketplace already have expenses estimated for you. Roofstock, in general, uses conservative estimates as the default view, but investors can customize all expense estimates which then updates financials in real time.

%20(1).gif?width=699&name=onboard%20day%200%20gif_2%20(1)%20(1).gif)

How to Put Together a Pro Forma P&L

Now that you’ve done some basic due diligence, the next step is to put together a pro forma statement for your prospective rental property. A pro forma is an estimated projection of your income and expenses. You can put one together in a few easy steps:

First, itemize your routine operating expenses

These are the most common fixed expenses for a rental property. Some of them may not apply or may be paid by the tenant, depending on the property type you’re buying. But it’s a good idea to include them in your list of rental property operating expenses so that they’re not accidentally overlooked:

- Water/sewer/gas

- Electricity

- Trash collection

- HOA fees

- Insurance

- Property management fees

- Property taxes

- Mortgage payment

Next, list your variable expenses

Variable expenses can be expressed in two ways. They can be based on the percent of the rental income that comes in, or you can use a flat expense for upcoming repairs that you’re budgeting for.

Variable expense items include:

- Vacancy factor for turning the property between tenants

- Leasing fees paid for finding a new tenant

- Routine repairs for normal wear and tear

- Landscaping (and snow removal) can vary from month-to-month depending on your climate

- Capital improvements such as a new roof, heating system, or updating the electrical system

Finally, add everything up

With a little addition, subtraction, and multiplication you can quickly determine if your investment property will be cash flow positive. Some investors use a basic spreadsheet for their pro forma.

However, it’s easy to make mistakes this way and harder to scale up and track your rental property portfolio as you grow. (Later in this article we’ll take a quick look at some online software options for putting together a pro forma.)

Don’t forget closing costs

Closing costs are one-time expenses paid in a real estate transaction. Depending on your market and property type, closing costs can range from 2.5% - 5% of the total purchase price.

Costs associated with a real estate closing include loan fees, appraisal fees, property inspection fees, title and recording fees; impound accounts for prepayment of insurance, mortgage interest, and property taxes; and broker or finder fees.

Helpful tips from the IRS

You can’t forget about the IRS, because let’s face it, the IRS won’t forget about you.

Here are some helpful Tips on Rental Real Estate Income, Deductions and Recordkeeping from the Internal Revenue Service to help you accurately report your income and expenses.

Tip #1: Understand what constitutes rental income

Any money received for use or occupation of the property is considered to be rental income by the IRS. Rental income includes:

- Tenant application fees

- Monthly rent and late fees

- Prepaid rent

- Lease cancellation fees

- Landlord expenses paid by the tenant

- Repairs made by the tenant in lieu of rent

Refundable security deposits received and held by the landlord are not treated as rental income. However, security deposits can be turned into income. This occurs when the deposit is applied to the last month’s rent or part of the security deposit is used to pay for damage caused by the tenant.

Tip #2: Understand what qualifies as rental property deductions

The IRS allows real estate investors to deduct rental expenses from income on the tax return. Normal expenses include items such as operating expenses, mortgage interest, repairs, materials and supplies, and property taxes.

The cost of improvements made for the betterment or restoration of the property are recovered through depreciation.

Tax law allows investors to deduct a certain percentage of the property value and any improvements made during the time they own the property annually. Two helpful IRS publications are Tangible Property Regulations and Deducting Business Expenses.

Tip #3: Understand how to report rental income and expenses

Real estate investors who report rental income and expenses on their personal tax return normally use Form 1040, Schedule E, Part 1 to list the total income, expenses, and depreciation for each investment property. Form 4562 is used to calculate the annual depreciation expense.

Some investors set up a separate LLC for each property as they scale up their rental portfolio. In addition to being a good way to protect your assets, rental property LLCs make it easier to keep business income and expenses separate from personal finances.

Tip #4: Keep accurate records

Records kept on rental property must support the income and expenses reported on the tax return. If you’re selected for an audit, the IRS will expect the back-up documents to support the return, including the source of the expense. Real estate investors who can’t provide written evidence may be subject to additional taxes and penalties by the IRS.

The Biggest Tax Deductions for Real Estate Investors

Tax deductions can sometimes make the difference between losing money or turning a profit on a rental property. There are unique tax benefits to investing in rental real estate, so why pay more taxes than you have to?

Here are the biggest tax deductions for residential rental property investors:

- Interest paid on mortgages, loans used to improve the property, or credit card interest on goods or services used for the property

- Repairs and routine maintenance –- Remember that repairs can be fully deducted in a single year while improvements may have to be fully depreciated over 27.5 years

- Depreciation expense to recover the cost of the real property and any improvements made, usually over 27.5 years

- Personal property cost deduction for items like appliances, furniture, and gardening equipment belonging to the property owner

- Pass-through tax deduction of up to 20% of net rental income created by the Tax Cuts and Jobs Act

- Travel expenses for going to tenant showings, the hardware store for supplies, and overnight travel expenses for long distance real estate investors

- Home office expenses -– including a workshop if you do your own maintenance -– for the part of your personal residence used for business

- Wages paid to employees such as an on-site leasing manager, or money paid to a 1099 independent contractor like your landscaper or handyman

A good accountant will also advise you to report as much of your income and expenses as you can. Some expenses and budgeting techniques that real estate investors can’t afford to ignore include:

- Closing costs like lender fees, points, and title fees

- Advertising and marketing expenses

- Tenant screening costs such as credit checks and background reports

- Budgeting for vacancies and downtime due to tenant turns

- Roof maintenance costs to catch small leaks before they turn into major ones

- Pest control services (should be routine rather than as-needed to avoid major infestations)

- Emergency expenses, which can be covered by cash set aside in a special reserve fund

- Capital expenditures for big-ticket repairs or property upgrading (can be paid for from funds placed in a “capex account”)

- City or county business permits and tax licenses

- Value of your time for self-managing the property

Basic Accounting For a Rental Property

Many real estate investors focus on doing deals and save the administrative paperwork for a rainy day. Unfortunately, admin days can be few and far between, and before you know it invoices, receipts, and paperwork are overflowing. Cash flow suffers, vendors get paid late, and tenant turnover increases.

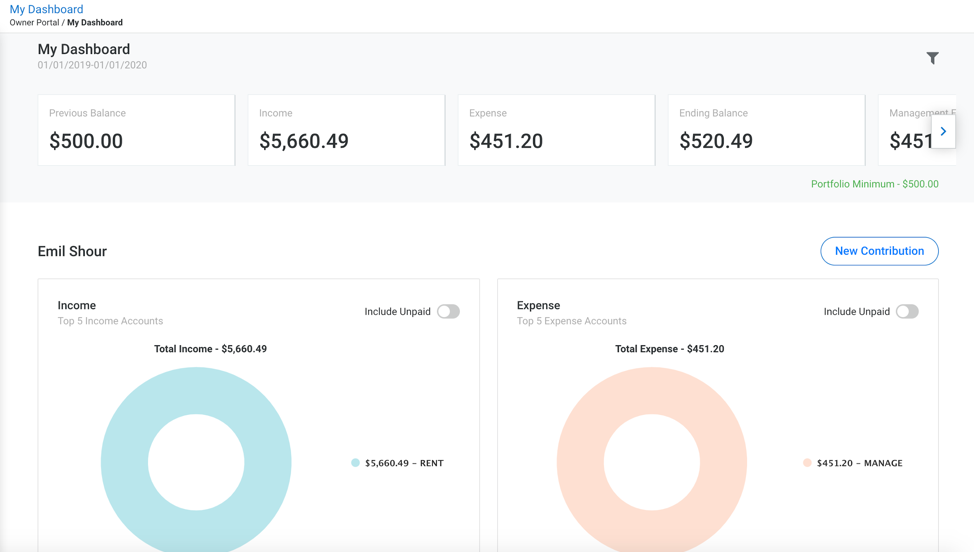

That’s why it’s a good idea to leave bookkeeping and property management to the professionals while you focus on investing. Good property management companies offer owners an online portal where you can track all of your income and expenses.

However, even when you delegate, it’s important to understand how a basic bookkeeping system for a rental real estate business works. You’ll have a better feel for how your business is running and be able to catch little mistakes before they become expensive.

Basic steps for rental property bookkeeping

A good rental property bookkeeping system will help you manage rent payment checks and maintenance invoices, easily track your income and expenses, and keep your business in peak financial performance.

The basic steps for setting up a rental property bookkeeping system are:

- Create business accounts to keep your personal finances separate

- Set up different accounts for each rental property

- Decide between the cash or accrual accounting method

- Implement a tracking system for your income and expenses

- Prepare for fluctuating and unexpected income and expenses

- Understand how to fill out monthly and annual tax forms correctly

- Use accounting software to leverage today’s cutting-edge property technologies

Bookkeeping & financial software for rental property

Keeping track of your expenses can be a hassle, but it doesn’t have to be. Take your rental property management to the next level with Stessa.

Over 250,000 landlords trust Stessa helps streamline the record-keeping process so you can stay organized, maximize your tax deductions, and make informed decisions.

You also get features that make the day-to-day management of your properties easier, including:

- Automated income and expense tracking: Instantly sort and classify transactions from linked bank, lender, credit card, and property management accounts, all without additional fees or required add-ons.

- Financial reporting: Generate income statements, net cash flow summaries, and balance sheets (available with the paid Pro plan), among other reports.

- Landlord banking: Open an FDIC-insured high-yield bank account* for each property and easily integrate them with Stessa’s financial tracking features.

- Rental applications and tenant screening: Use Stessa’s tenant screening services and free rental applications to find and select qualified tenants.

- eSigning (in partnership with DocuSign): Upload your document, tag it for digital signatures, and send it to tenants, vendors, partners, and others.

- Free rent collection: Collect rent from tenants through one-time or recurring ACH payments.

- Real-time performance metrics: Get round-the-clock insights into the performance of your property portfolio.

- Property management integration: Link your property management data portal to Stessa to import transactions and get a detailed portfolio overview.

- Unlimited properties: Add an unlimited number of properties to your Stessa account.

- Collaborative access: Invite other investors, CPAs, spouses, and others to share your Stessa account. Manage their access levels to view and/or edit the account.

- Tax resources: Access the yearly Tax Guide and a suite of educational materials created in partnership with The Real Estate CPA to make tax season a breeze.

Experience a more efficient, stress-free way to manage your rental properties. Sign up for a free account with Stessa today.

Rental Property Expense Checklist

There’s a lot to keep track of when managing the income and expenses of a rental property. Sometimes honest mistakes happen. When and if that happens, you’ll get a letter from the IRS letting you know you miscalculated, and you should be fine.

But accurately tracking rental property expenses is about more than just staying off of the IRS radar screen. Understanding all of the different expenses will help you create an accurate budget. Plus, you’ll capture all of the benefits and deductions offered by our country’s real estate-friendly tax laws:

- Closing costs, appraisal and mortgage fees, property inspection fees

- Real estate broker fees

- Marketing and advertising expenses

- Tenant screening costs

- Property management fees

- Materials and supplies

- Maintenance and repair expenses

- Pest control costs

- Landscaping expense

- Utility fees

- HOA fees and special assessments

- Vacancy cost allowance

- Property turn expense between tenants

- Property upgrade, rehab, and improvement costs

- Professional fees for legal and accounting

- Travel expenses

- Home office deductions

- Property taxes

- Income taxes

- Property insurance

- Business and license permit expenses

- Interest expense

- Emergency repair costs

- Funding reserve or “rainy day” accounts

- Depreciation and personal property deductions

- Pass-through deductions

- Cost of your time