The demand for single-family rental (SFR) real estate is increasing due to a number of factors, including rapidly rising home prices and housing shortage.

Rent prices and home values have been increasing by double digits as the number of renter-occupied homes continues to rise. While institutional investors are entering the SFR market, individual investors still own the majority of SFRs.

If you’ve been thinking about investing in residential rental property, we’ve put together this guide on SFR investing to help make your research a little easier.

Key takeaways

- SFRs represent 35% of all rental units in the U.S., and, over the past 10 years, the number of SFRs has increased by 25%.

- More than 72% of single-unit properties are owned by individuals.

- The benefits of investing in SFRs include recurring rental income, an increase in equity over the long term, a hedge against inflation, and tax benefits.

- The potential drawbacks to SFRs are lack of liquidity, tenant challenges, and changes in the neighborhood where the rental property is located.

What is SFR real estate?

SFRs are freestanding or standalone rental homes.

There are over 326 million people in the U.S., and about 125 million occupied housing units, 16 million of which are SFRs. SFRs represent 35% of all rental units in the country and the number of occupied SFRs has increased by 25% over the last decade, according to the real estate research and advisory firm Green Street.

While the SFR asset class attracts institutional and private equity investors with large amounts of capital, most SFR housing is individually owned. The National Association of REALTORS (NAR) reported in 2020 that over 72% of 1- to 4-unit properties are owned by individuals.

Benefits of investing in SFRs

Many investors begin with SFR real estate because properties can be easy to find and easier to finance than commercial buildings, and they may generate recurring income and equity appreciation over the long term.

Here are some of the many benefits of investing in SFRs.

Strong demand

The growing demand for SFRs is driven by a variety of factors, including rising home prices and shortage of inventory. As Green Street notes, the number of SFRs continues to grow. The trend shows no signs of slowing.

Rental income

The strong demand for SFR properties has been generating double-digit increases in rent prices in many of the best markets in the U.S. According to John Burns, who provides independent research and consulting services related to the US housing industry, SFR prices grew by 3.9% YoY nationally as of May 2024, surpassing the historical average of +3.6% YOY.

Appreciation

Median sales prices of homes historically increase over the long term, creating a potential opportunity for a buy-and-hold investor to make a profit from equity appreciation. The Federal Reserve reports that the median sale prices of houses increased by more than 49% between Q3 2014 and Q3 2024, although there also were periods where home sales prices slightly declined.

Tax benefits

Residential rental real estate provides tax benefits that other assets do not. For example, SFR investors have a wide range of deductions to reduce taxable net income, including operating expenses, mortgage interest payments and property taxes, owner expenses, and depreciation. Real estate investors can also defer paying capital gains tax when a rental property is sold at a profit by using a 1031 Exchange and purchasing a replacement investment property within a certain period of time.

Financing options

SFRs are generally easier to finance than large multifamily buildings and commercial properties.

Options for financing SFRs include conventional loans from banks and credit unions, Federal Housing Administration (FHA) and Veterans Affairs (VA) loans backed by the government, blanket mortgages and portfolio loans for financing multiple properties, and private lenders. Down payments for SFRs are generally 20% and interest rates are typically about 1% greater than those for a primary residence.

Inflation hedge

SFRs may act as a hedge against inflation. While operating expenses and overall costs of living may increase, property owners have locked in the price and interest rate during a time of increasing rates.

For example, inflation as measured by the Consumer Price Index (CPI) increased by 8.5% YoY as of March 2022, while SFR rents increased by 22% and home values grew by 20.6%, according to Zillow (through March 31, 2022) over that same timeframe.

Volatility hedge

SFRs offer an alternative to stocks and bonds. According to research from Roofstock, SFRs have historically offered more attractive risk-adjusted returns than the S&P 500 and bonds, but with less volatility. In fact, since 1971, SFR rental prices and stock prices have been almost perfectly uncorrelated, which means that SFRs are not tied to larger fluctuations in the stock market.

Property management

SFRs are generally easier to manage compared to other types of rental real estate. In part, that’s because maintenance and repairs may be more straightforward and often can be done by do-it-yourselfers, a handyperson, or a local contractor.

Drawbacks of investing in SFRs

While there are plenty of advantages to investing in SFRs, there also are drawbacks for potential investors to consider.

Constant upkeep

SFR homes require constant upkeep and maintenance to remain safe and habitable. While monthly rental income from a tenant may generate enough cash to pay for operating expenses and a mortgage payment, there may be periods when an SFR has negative cash flow, such as in between tenants.

Vacancy

Unlike a multitenant property, when an SFR tenant leaves, the home is 100% vacant until a new tenant can be screened and a lease signed. During that time, operating expenses and the mortgage (if any) still need to be paid, requiring a landlord to tap into a capital reserve account or pay with personal funds.

Tenant challenges

Even with thorough tenant screening, every now and then a landlord may end up with a difficult tenant that damages property or pays the rent late (or not at all).

That may be why only 42% of rental properties are run day-to-day by owners, according to the NAR. Remote real estate investors who own rental property in a different city or state generally choose to hire a local property management company to take care of the property and tenants.

Neighborhood changes

Neighborhood decline may negatively affect the demand for rental property in a specific area, which could result in lower rental income and a decline in property value.

For example, crime rates could increase or school district quality could decrease over a period of time. A good way to understand the characteristics of a neighborhood is by using the Roofstock Neighborhood Rating tool. The SFR ratings index employs a proprietary algorithm to assess neighborhood-specific risks and benefits.

Taxes

While the Internal Revenue Code is friendly to real estate investors, the tax code could change, which could reduce or even eliminate some of the tax benefits that SFR investors currently enjoy. County property taxes on residential rental property can have a significant impact on SFR cash flows, and taxes on a property may increase when a home that was previously owner-occupied is turned into an SFR.

Illiquidity

Issues such as neighborhood decline and unfavorable changes to the tax code can be addressed by selling a property, but real estate is not liquid. While other investment assets can be bought and sold online with one click, it can take weeks or months to sell a home if market conditions begin to decline.

SFR investing strategies

While buying and holding a SFR property may be the most popular way to invest, there are quite a few SFR investing strategies to consider:

- Buy and hold rental property to potentially earn rental income and profit from long-term appreciation.

- Reinvest rental income to purchase an additional SFR every few years.

- House-hack by renting out part of a primary residence to generate rental income.

- Build, remodel, rent, refinance, repeat (BRRRR) to buy a fixer-upper, make repairs, rent the home, refinance to pull cash out, and repeat the process.

- Fix and flip by buying low and selling high is a strategy used by investors willing to accept more risk in exchange for more potential reward.

- Attempt to make money as a real estate wholesaler by locating a distressed property and motivated seller, putting the home under contract, and assigning the contract to another investor in exchange for a wholesale fee.

- Consider a real estate limited liability company (LLC), where several investors pool funds to invest in a SFR property, if you’re looking for a hands-off way to invest in SFRs.

Where to find SFRs

There are a number of ways to find houses for sale, including working with a real estate agent who has access to the local multiple listing service (MLS) or using online listing services, such as Redfin, Realtor.com, and Zillow. However, while many houses can be rented, not every house makes a good SFR.

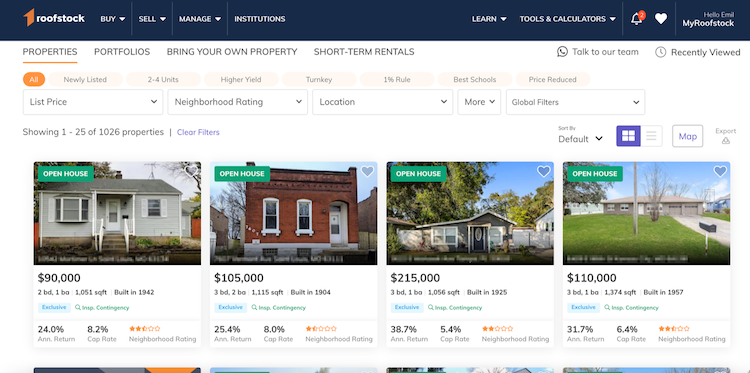

Roofstock is the leading online marketplace for buyers and sellers of SFR homes and property portfolios. Investors from around the world have completed more than $5 billion in SFR transactions for U.S. homes in less than 7 years.

The Roofstock Marketplace makes it easy to search for SFRs based on criteria like location, price, and potential returns.

Every SFR listed for sale on Roofstock comes with details and information needed to analyze a property, including pictures, valuation tools, and current lease and tenant details if the home is already rented.

After negotiating with a seller and making an offer online, buyers can get preapproved for rental property loans through third-party mortgage lenders and request referrals to local property managers to take care of the rental after the transaction closes.