More than 50% of the households in Columbia rent rather than own, which is one of the reasons WalletHub lists Columbia as one of the best cities for renters.

The most recent Market Indicators report from the Central Carolina Realtors Association (January 2022) notes that competition in the market remains fierce, with inventory levels the lowest at the lowest point since 1999. Median home sales prices have increased by 24.4% year-over-year, while inventory is down by more than 25% over the past 12 months.

The Columbia metro area consistently sees strong demand for rental property from a variety of tenant types, including the military, students, and retirees.

Columbia is the capital of South Carolina and the state’s second-largest city. Located in the central part of the state, the city is home to the University of South Carolina and Fort Jackson – the largest U.S. Army base for basic combat training.

In addition to education and the military, the diversified economy and job market in Columbia are driven by the healthcare, technology, transportation and logistics, manufacturing, and financial services sectors.

Keep reading to learn why there's demand for rental property in Columbia in 2022.

>>Explore Roofstock's Columbia, SC properties.

Population growth

Both the City of Columbia and the surrounding suburbs have posted impressive population gains over the last 10 years, according to the most recent census. The population of Columbia grew by 5.7%, while Lexington and Richmond counties posted population gains of 12.0% and 8.2% respectively.

Moving forward, employers should continue to be attracted by the region’s well educated workforce and low cost of doing business. People keep coming to Columbia because of the job opportunities, low cost of living, and high quality of life.

Key Population Stats:

- City of Columbia is home to over 136,000 residents with more than 832,000 people living in the metropolitan area.

- Population of Columbia has increased by 7,360 new residents over the past 10 years, for a growth rate of 5.7%.

- Columbia is the capital of South Carolina and the 2nd most populated city in the state, right behind Charleston.

- Metropolitan Columbia – also known as the “Midlands of South Carolina” – consists of eight counties, including Richland (where Columbia is located) and Lexington.

- Between 2010 and 2020 the Columbia MSA had a net population increase of nearly 80,000 people.

- Population of the Columbia metro area is projected to exceed 900,000 residents by 2030.

Job market

Columbia expects to see more business and residential growth in the upcoming years, according to a report from WLTX News 19. As the city’s Director of Economic Development notes, "I think what we've seen over the past decade does tell us that Columbia is an attractive market, and developers, and investors, and companies are interested in being here."

As the economy in Columbia continues to recover, the BLS reports that employment sectors showing the fastest signs of growth include manufacturing, trade and transportation, financial activities, and leisure and hospitality.

Nearly 43% of the residents in the Columbia metro area hold a bachelor’s degree or higher. In fact, Columbia ranks 23rd in the nation for holders of doctoral degrees and 32nd for holders of college degrees.

Key Employment Stats:

- The GDP of Columbia MSA is more than $44.3 billion, according to the Federal Reserve Bank of St. Louis, and has grown by nearly 40% in the last ten years.

- Job growth in Columbia increased by 0.83% year-over-year, while unemployment is down to 2.5% (as of April 2022).

- Future job growth in Columbia is expected to be 27.4% over the next 10 years.

- Target industry sectors in Columbia include advanced manufacturing, healthcare, insurance information and technology, green energy production, and transportation and logistics.

- Top five employment sectors in the Columbia MSA are health care and social assistance, retail trade, accommodation and food services, educational services, and public administration.

- Largest employers in Columbia include Amazon, Blue Cross Blue Shield of SC, Department of Defense, Michelin North America Inc., Richland County, United Parcel Service, Fort Jackson Army Base, and the University of South Carolina.

- Major manufacturing companies in Columbia include Square D, International Paper, Honeywell, Westinghouse Electric, Trane, and Bose Technology.

- University of South Carolina main campus is in Columbia, and the area is also home to other institutions of higher learning including Benedict College, Columbia College, and Midlands Technical College.

- Over 90% of the residents in Columbia are high school graduates or higher, while more than 33% hold a bachelor’s degree or advanced degree.

- Interstate highways passing through the Columbia metro area include I-20, I-26, and I-95.

- CSX Transportation and Norfolk Southern provide freight rail service in the Columbia region.

- Deepwater seaport of Port Charleston is less than two hours from Columbia.

- Columbia Metropolitan Airport (CAE) provides nonstop service to eight cities including Miami, New York, Chicago, and Washington, D.C. and also serves as the Southeast Regional Air Hub for UPS.

Real estate market

The Columbia real estate market was “famously hot” in 2021, with buyers scrambling and sellers in the money. This year, buyers may expect more of the same.

According to the 2022 National Housing Forecast from Realtor.com, home prices in the Columbia metro area are forecast to grow by 5.1% while sales volumes increase by 6.4%. Cost of living and taxes are low, and median home prices in Columbia are well below the national median.

Key Market Stats:

- Zillow Home Value Index (ZHVI) for Columbia is $211,366 through May 2022.

- Home values in Columbia increased 24.2% over the last year.

- Over the past five years home values in Columbia have increased by about 60%.

- Median list price for a single-family home in Columbia is $225,000 based on the most recent report from Realtor.com (April 2022).

- Median listing price per square foot for a home in Columbia is $128.

- Days on market (median) is 42.

- Median sold price of a single-family home in Columbia is $231,500.

- Sale-to-list price ratio is 103.39%, which means that on average homes in Columbia are selling for slightly above the full asking price.

- Of the 81 neighborhoods in Columbia, Elmwood Park is the most expensive with a median home listing price of $539,700.

- Most affordable neighborhood in Columbia to buy a home is Skyland where the median list price is $70,000.

Strong renters’ market

Although housing is relatively affordable in Columbia, there simply isn’t enough inventory to meet demand. The imbalance between supply and demand is one likely reason why more than 50% of the households in Columbia rent rather than own.

In fact, WalletHub recently listed Columbia among one of the best cities for renters, based on key investment criteria including activity in the rental market, affordability of rents, and quality of life.

Rental property investors in Columbia also benefit from the various demographic segments driving demand for rental housing, including the military from Fort Jackson Army Base and the National Guard, students from the University of South Carolina, and retirees drawn to the low cost of living and great climate.

Key Market Stats:

- Median rent in Columbia is $1,515 per month for a 3-bedroom place, based on the most recent research by Zumper (June 2022).

- Rents in Columbia increased by 10% year-over-year.

- Over the past 3 years, rent for a 3-bedroom place in Columbia has increased by about 26%.

- Renter-occupied households in Columbia account for 53% of the total occupied housing units in the metropolitan area.

- Neighborhoods in Columbia with the lowest rents include Rochelle Heights-Victory Garden, Seminary Ridge, and Belvedere where average rents are $925 or less per month.

- Neighborhoods in Columbia with the highest rents include Melrose Heights, Shandon, and Earlewood where average rents range between $1,725 and $2,250 per month.

Historic price changes & housing affordability

Rental property investors conduct a variety of financial analysis to determine which real estate markets to invest in. Two of the key data trends to review are the historic change in housing prices and the affordability of housing in a specific market.

Tracking the change in housing prices over the long term may indicate the potential for future appreciation, while housing affordability is one indicator of how strong the demand for rental property might be.

Generally speaking, markets where houses are relatively affordable see more homeowners than renters. However, the exact opposite is true in Columbia, where more than 50% of the households are occupied by renters. Reasons why more people rent than own here include a shortage of affordable housing and the strong demand for rental property from a variety of renter segments.

Each month Freddie Mac publishes the House Price Index (FMHPI) report with up-to-date data on the change in home prices for all markets across the U.S. The most recent FMHPI report for the Columbia, SC MSA shows:

- April 2017 HPI: 129.4

- April 2022 HPI: 207.6

- 5-year change in home prices: 60.4%

- One-year change in home prices: 20.4%

- Monthly change in home prices: 1.7%

The housing affordability index (HAI) is another statistic real estate investors review to determine the potential demand for rental property.

The most recent housing affordability report from Kiplinger’s Personal Finance surveyed home prices in the 100 largest metro areas in the country. The survey uses an affordability scale of 1 to 10, with 1 being the more affordable market to buy a home in and 10 being the least affordable.

The affordability index report for Columbia, SC shows:

- Since the last real estate cycle market peak in May 2006, home prices in Columbia have increased by 16.1%.

- Since the last real estate cycle market bottom in March 2012, home prices in Columbia have increased by 49.7%.

- Columbia has an affordability index of 3 out of 10, meaning that Columbia is one of the more affordable markets to buy a home.

Quality of life

Columbia is a city that mixes traditional Southern hospitality and tradition with today’s fresh perspectives. The city is a creative and tech hub fueled by the University, nearby military facilities, and the capital city community.

Key Quality of Life Stats:

- Forbes ranked Columbia as one of the best places in the U.S. for business and careers, cost of doing business, job growth, and quality of education.

- Cost of living in Columbia is 3% below the national average.

- U.S. News & World Report ranks Columbia as one of the best places to retire in the U.S.

- Columbia also receives strong ratings from U.S. News for value, job market, desirability, and net migration.

- Niche.com gives Columbia, South Carolina an “A” grade with strong scores for public schools, housing, and nightlife.

- Climate in Columbia is humid subtropical with cool to mild winters and hot humid summers.

- Must-see places in Columbia include the Northeast Farmers Market, The Winery Mercer House that’s only one of ten organic wineries in the U.S., and the award-winning 70-year-old Maurice’s Piggie Park BBQ.

- The Main Street District in Downtown Columbia is the perfect spot to enjoy the Capital City’s art, live entertainment, cultural events, and foodie hotspots.

- Providence-Hospital Columbia is among the best-ranked hospitals in South Carolina.

- Sports programs at the University of South Carolina provide Columbia’s most popular athletic events.

Get out the map

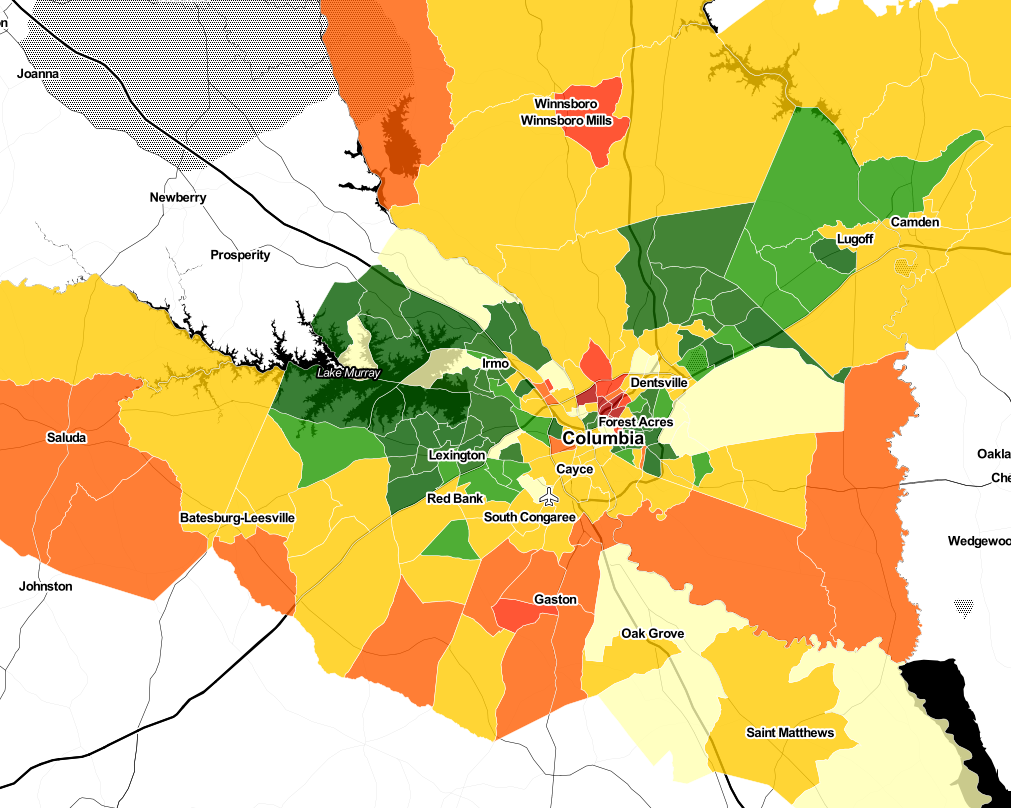

Where to begin your search? Roofstock created a heat map of Columbia based on our Neighborhood Rating, a dynamic algorithm that enables you to make informed investment decisions by measuring school district quality, home values, employment rates, income levels and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the Columbia housing market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a Columbia investment property that matches your search criteria.