One of the fastest-growing housing markets in the U.S. is Northwest Indiana, home to the Gary real estate market.

In fact, the Gary metro area is quickly becoming a popular suburb of Chicago because of the short driving distance to the Windy City, low tax base, and extremely affordable homes. Just recently, the Miller Beach neighborhood in Gary notched its first $1 million sale for a home along the Lake Michigan shoreline.

An influx of people from neighboring Illinois where the cost of living is high are looking for homes in Gary and Northwest Indiana. The housing market in Gary is seeing high demand with prices on the rise and inventory at all-time lows.

Gary, Indiana is located in Lake County along the southern border of Lake Michigan and only 25 miles from the Downtown Chicago Loop.

Hometown to Michael Jackson and The Jackson Five, the city was once renowned for its steel mills. While steel and manufacturing are still big business in Gary, the city is diversifying its economy to include the service and tourism industries.

Keep reading to learn more about what the Gary real estate market could look like in 2022.

>>Explore Roofstock's Gary properties here.

Population growth

Many counties in Indiana are projected to decline in population as more people move from rural to urban areas, creating long-term population growth in Gary. Lake County (where Gary is located) is among the top Indiana counties expected to gain residents over the next few years.

Key Population Stats:

- City of Gary is home to about 69,000 people with nearly 703,000 residents in the Gary metropolitan area.

- Four Indiana counties, including Lake County where Gary is located, are part of the Chicago-Naperville-Elgin IL-IN-WI MSA.

- Lake County is the 2nd-most populated county in Indiana.

- Between now and 2050 the population of Gary is projected to grow by about 2.0%, more than South Bend and Cincinnati.

Job market

The economy in Gary is recovering with employment growth coming in at 3.1% over the past 12 months. According to the BLS, employment sectors in Gary showing the most growth include manufacturing, construction, leisure and hospitality, and education and health services.

Key Employment Stats:

- GDP of Metro Gary, Indiana is $21.8 billion and ranks as #2 in the State of Indiana for gross domestic product.

- Cost of living in the Gary metro area is 7% below the national average, according to Forbes.

- Employment growth in Gary was 3.1% year-over-year with unemployment down to 3.4%.

- Fastest-growing private industry sectors by employment gain include ambulatory health care services, food services, administrative and support services, specialty trade contractors, and machinery manufacturing.

- Largest employers in Gary and Lake County include U.S. Steel Corporation, St. Margaret Mercy Healthcare, Horseshoe Casino, BP Pipeline North America, call center services company Americall Group Inc., and steel and mining company ArcelorMittal.

- Indiana University-Northwest, Purdue University-Calumet Campus, Calumet College of Saint Joseph, and Valparaiso University are some of the largest colleges and universities near Gary.

- Over 90% of the people in Gary are high school graduates or higher, and nearly 24% hold a bachelor’s degree or advanced degree.

- Interstate highways I-80/I-94, I-65, and the Indiana Toll Road I-80/I-90 provide direct access from Gary to Chicago, Indianapolis, Milwaukee, Detroit, Cleveland, and St. Louis.

- Port of Indiana is less than nine miles from Gary and handles more ocean-going cargo than any other Great Lakes port and 15% of the U.S. steel trade with Europe.

- Seven railroads including CSX, Norfolk Southern, and Canadian National Railway provide freight rail service in Gary/Lake County.

- Gary/Chicago International Airport (GYY) is the official “third airport” for the Chicagoland area providing general aviation, corporate, commercial, and cargo services.

Real estate market

It’s a seller’s market in Gary and Northwest Indiana, with median sales prices up by over 10% year-over-year.

According to the Greater Northwest Indiana Association of Realtors (GNIAR), there are fewer listings on the market compared to the same time last year, with homes selling for the original list price on average. The demand for homes in Gary is driven in part by an influx of buyers from neighboring Illinois looking for a home in Northwest Indiana.

Key Market Stats:

- Zillow Home Value Index for Gary is $76,722 (as of April 2022).

- Home values in Gary have increased by 40.6% over the last year.

- Over the past five years home values in Gary have increased by more than 100%.

- Median listing price of a home in Gary is $97,500 based on the most recent report from Realtor.com (April 2022).

- Median square foot listing price for a home in the City of Gary is $64.

- Median sale price for a home in the seven-county region of Northwest Indiana is $230,000 through October 2021, according to GNIAR.

- Of the 11 neighborhoods in Gary, Miller is the most expensive with a median listing price of $214,900.

- Most affordable neighborhood in Gary is Pulaski where the median listing price is $45,500.

Attractive renters’ market

Affordable and workforce housing can offer some of the most attractive and stable returns for rental property investors, and Gary is no exception. Recently, a multi-building affordable housing portfolio changed hands for nearly $10.4 million, according to REjournals.

Experienced real estate investors know that big players investing in a market like Gary signals potential future opportunity. Especially since the Gary metro area is quickly becoming known as an affordable suburb just outside of Chicago.

Key Market Stats:

- Median rent in Gary is $1,003 per month for a 3-bedroom home, based on the most recent research from Zumper (December 2021).

- Over the past 3 years rents in Gary have grown by about 15%.

- 45% of the housing units in Gary are renter-occupied.

- Neighborhoods in Gary with the highest rents include Miller, Glen Park, and Aetna where rents are around $1,075 per month.

- Neighborhoods in Gary with the lowest rents include Brunswick, Emerson, and Westside where monthly rents average about $800.

Historic price changes & housing affordability

Price changes and affordability are two data sets that real estate investors can use to help predict the potential profitability of investing in rental property in a specific market.

Historic price changes are an indication of possible future property appreciation, while housing affordability is an indicator of the demand for rental property compared to owner-occupied housing.

The Federal Housing Finance Agency (FHFA) publishes a quarterly report showing the most recent short-term and long-term historical price trends in all markets across the U.S.

The most recent FHFA 2022 Q1 House Price Index report for Gary, Indiana shows:

- Since Q1 1991 home prices in Gary have increased by nearly 204.35%

- Over the past five years home prices have increased in Gary by 56.25%

- Over the past year prices have increased by 14.80% and by 4.74% over the last quarter

The Housing Affordability Index (HAI) measures the median family income needed to qualify for a conventional mortgage (assuming a 20% down payment) compared to the median price of a single-family resale home in the market.

The HAI uses 100 as a housing affordability index baseline number. The greater a market’s HAI is above 100, the more affordable it is to own a home, and vice versa.

Based on the most recent report from Home Town Locator, the HAI for Lake County (where Gary is located) is 159. This means that the median family has a little more than 1 ½ times the income needed to purchase a median-priced home.

Quality of life

Gary is right next to the Indiana Dunes National Lakeshore and borders Lake Michigan. Housing is affordable, the cost of living is low, and the city is located about 25 miles from the Chicago Loop.

Key Quality of Life Stats:

- Cost of living in Gary is 7% below the national average.

- The city receives high ratings from Forbes for the cost of doing business and business and careers.

- AreaVibes gives Gary above average livability ratings for cost of living and amenities.

- Munster, a town about 15 miles west of Gary, is rated as the 3rd-best place to live in Indiana.

- Gary is home to two state college campuses – Indiana University Northwest and Ivy Tech Community College Northwest.

- U.S. News & World Report rates Methodist Hospitals and St. Mary Medical Center-Hobart as two of the best healthcare facilities in the Gary metropolitan area.

Get out the map

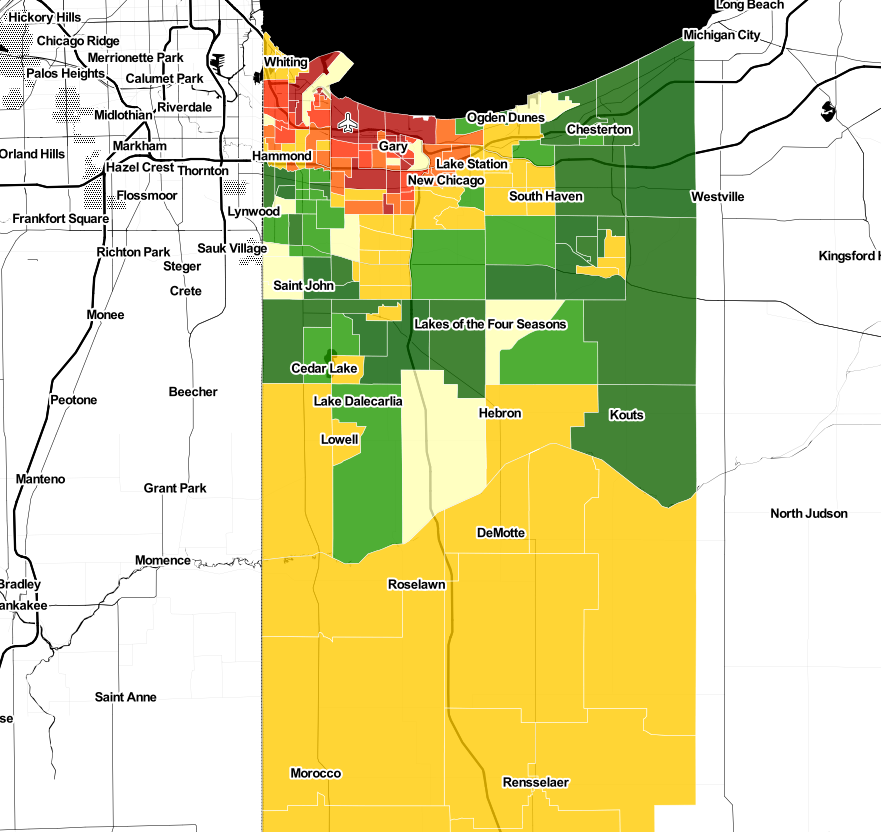

Where to begin your search? Roofstock created a heat map of Gary based on our Neighborhood Rating, a dynamic algorithm that enables you to make informed investment decisions by measuring school district quality, home values, employment rates, income levels and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the Gary housing market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a Gary investment property that matches your search criteria.