The Greensboro real estate market is a place where both rents and housing prices are on the rise. These dynamics are creating the potential for increased yields for the buy-and-hold investor seeking opportunity in one of the most affordable real estate markets in North Carolina.

Greensboro is part of the Piedmont Triad (along with Winston-Salem and High Point) in the central part of North Carolina. The city is small enough for people to know their neighbors, yet large enough to be home to a thriving economy. Numerous corporate headquarters and a stable job market make Greensboro a great place for both workers and business.

Keep reading to learn why the Greensboro real estate market could be an attractive investment in 2022.

>>Explore Roofstock's Greensboro properties here.

Population growth

Although population growth in Greensboro may not be as large as other top metros, the number of people moving to the region is still impressive. According to the most recent U.S. Census, the population of the city of Greensboro grew by nearly 11% over the past decade, with 29,370 new residents calling the city home.

That’s good news for real estate investors. Millennials in Greensboro make up about 30% of the population. The city has been diligently working on attracting and retaining even more workers to boost the size of the workforce and keep Greensboro moving forward.

Key Population Stats:

- City of Greensboro is home to nearly 300,000 residents with more than 776,000 people residing in the Greensboro-High Point metropolitan area.

- Greensboro is the 3rd-most populated city in North Carolina and – along with Winston-Salem and High Point – is part of the Piedmont Triad.

- Population growth was approximately 0.54% last year and 10.9% over the past 10 years.

- Over the next 10 years, Guilford County (where Greensboro is located) is projected to grow by 20%.

Job market

Greensboro is ranked as one of the best cities for jobs in North Carolina by WalletHub, based on criteria including job opportunities and employment growth, average starting salary, and employment outlook.

As the economy in Greensboro continues to recover, the U.S. Bureau of Labor Statistics (BLS) reports that the employment sectors showing the fastest signs of growth include professional and business services, manufacturing, trade and transportation, and leisure and hospitality.

Key Employment Stats:

- GDP of Greensboro-High Point MSA is over $35.7 billion, according to the Federal Reserve Bank of St. Louis.

- Employment growth in Greensboro has declined by 0.78% year-over-year, although the job market here has grown by 12% since 2010.

- Unemployment rate in Greensboro-High Point MSA is 3.8% according to the most recent report from the BLS (April 2022).

- Targeted industries in Greensboro include aerospace, innovative manufacturing, supply chain logistics, furniture design and manufacturing, life sciences, specialized business services, and art and design.

- Honda Aircraft Company, Kayser-Roth, Mack Trucks, International Textile Group, Fusion3, and Wrangler are some of the companies with headquarters in Greensboro.

- Largest employment sectors in Greensboro are education and healthcare, wholesale and transportation, business and technical services, management and administrative support, and retail trade.

- Major employers in Greensboro-High Point include Guilford County Schools, Ralph Lauren Corporation, Bank of America, Volvo Group, AT&T, BB&T, Lincoln Financial Group, and Procter & Gamble.

- Gateway Research Park in Greensboro is a partnership between local universities and city leaders to attract new businesses in the high-tech, nanotech, and logistics sectors.

- Regional colleges and universities in Greensboro include University of North Carolina at Greensboro, North Carolina A & T State University, and Elon University.

- 89.6% of the residents of Guilford County are high school graduates or higher, while 36.6% have earned post-secondary degrees.

- Four interstate highways run near Greensboro including I-40 and I-85.

- Norfolk Southern provides freight rail service in the Greensboro metro area.

- Four deep water seaports are less than 300 miles from Greensboro-High Point.

- FedEx Mid-Atlantic Air Hub is based in Greensboro.

- Piedmont Triad International Airport (GSO) in Greensboro is served by major airlines like Delta, United, and American Airlines and provides non-stop service to 14 cities including Chicago, Dallas, Miami, and New York.

Real estate market

Investors looking for single-family rental property just might want to consider Greensboro and the surrounding suburbs. Some of the smaller cities around Greensboro with the fastest growing home prices include Liberty, High Point, and Gibsonville. Home prices in these Greensboro suburbs have increased by more than 20% over the past year (April 2022 vs April 2021).

Key Market Stats:

- Zillow Home Value Index (ZHVI) for Greensboro is $238,951 as of May 2022.

- Home values in Greensboro have increased by 24.2% over the last year.

- Over the last five years home values in Greensboro have increased by over 75%.

- Median listing price of a single-family home in Greensboro is $280,000 based on the most recent research from Realtor.com (April 2022).

- Median listing price per square foot is $143.

- Days on market (median) is 35.

- Median sold price for a single-family home in Greensboro is $281,000.

- Sale-to-list price ratio is 104.58%, meaning that homes in Greensboro are typically selling for more than the asking price.

- Of the 132 neighborhoods in Greensboro, Grandover is the most expensive to buy a home with a median listing price of $651,900.

- Most affordable neighborhood in Greensboro to buy a home is The Thicket where the median listing price is $130,000.

Attractive Renters’ Market

Greensboro is rated by WalletHub as one of the best cities for renters based on important investment factors such as the rental market, affordability, and quality of life. Nearly 30% of the population of Greensboro is between the ages of 20 and 39, a key age group that traditionally prefers to rent rather than own where they live.

Key Market Stats:

- Median rent in Greensboro is $1,623 per month for a 3-bedroom home, according to the most recent report from Zumper (June 2022).

- Rents in Greensboro have increased 8% year-over-year.

- Over the past 3 years, rent for a 3-bedroom place in Greensboro has grown by nearly 46%.

- Renter-occupied households make up 41% of the total occupied housing units in Greensboro.

- Neighborhoods in Greensboro with the lowest rents include Tolbert, Downtown Greensboro, and Brice Street Area where rents are $630 per month or less.

- Neighborhoods in Greensboro with the highest rents include Saddlecreek, Bellwood Village, and Idle Acres where rents range between $1,735 and $1,8180 per month.

Historic price changes & housing affordability

Two of the most critical factors to consider when choosing a real estate market to invest in are the potential for appreciation and the strength of the rental market. To help analyze these criteria, real estate investors can review a market’s historic change in home prices and the affordability of buying vs. renting.

Each month Freddie Mac’s House Price Index (FMHPI) report lists up-to-date data on the change in home prices for all markets across the U.S. The most recent FMHPI from Freddie Mac for the Greensboro-High Point MSA shows:

- April 2017 HPI: 119.7

- April 2022 HPI: 198.0

- 5-year change in home prices: 65.4%

- One-year change in home prices: 21.9%

- Monthly change in home prices: 1.7%

The Housing Affordability Index (HAI) that compares how affordable buying a house is in all markets across the U.S. The HAI uses a baseline index number of 100, then ranks each real estate market above or below 100. The higher a market is above 100, the more affordable it is to purchase a home.

The most recent HAI for the Greensboro-High Point MSA was 152 as of July 2021. This means that the median family has about one and one-half times the income needed to purchase a median priced, single-family resale home in the Greensboro metro area.

It’s important to note that when compiling these rankings, the researchers look at median family income and compare that to the median price of an existing single-family home purchased with a conventional mortgage and a 20% down payment.

The HAI report also doesn’t consider other factors such as lifestyle preference of renting vs. owning. So, even in markets like Greensboro where housing is relatively affordable, there are still a high percentage of renter-occupied households.

Quality of life

Living in Greensboro is like having the best of both worlds. It’s small enough to know who your neighbors are, yet large enough to offer plenty of options for entertainment, shopping, recreation and dining.

Nicknamed the “Gate City," Greensboro is part of the dynamic Piedmont Triad (including Winston-Salem and High Point), close to the Blue Ridge Mountains and a short drive to the beaches along the Atlantic Coast.

Key Quality of Life Stats:

- Forbes ranked Greensboro #10 in the cost of doing business and gives the city high rankings for best places for business and careers, education, and job growth.

- Cost of living in Greensboro is 10% below the national average.

- Niche.com gives Greensboro an overall “A-” grade with strong ratings for nightlife, housing, and public schools.

- The area is ranked by U.S. News & World Report as the 90th-best place to live in the nation and the 71st-best place to retire.

- Downtown Greensboro is home to hundreds of shops, restaurants, museums, parks, art galleries, and more.

- The Wyndham Championship PGA Tournament is held every year at the Sedgefield Country Club in Greensboro.

- Moses H. Cone Memorial Hospital is ranked as the #1 hospital in Greensboro/Winston-Salem.

Get out the map

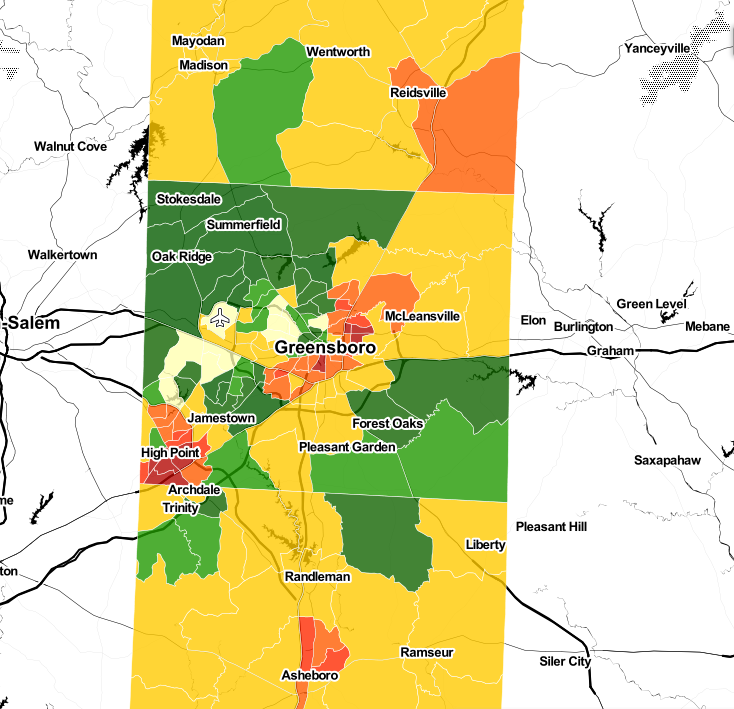

Where to begin your search? Roofstock created a heat map of Greensboro based on our Neighborhood Rating, a dynamic algorithm that enables you to make informed investment decisions by measuring school district quality, home values, employment rates, income levels and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the Greensboro housing market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a Greensboro investment property that matches your search criteria.