Hudson County, where Jersey City is located, is ranked as one of the top hottest housing markets in New Jersey to watch as demand continues to zoom. Not every New York City resident can move to Florida, so living in Jersey City is the next best thing.

Property and rents are more affordable than in NYC. Homes with off street parking, open space, and an extra room for working from home are overwhelmed with appointments and offers.

Although property prices and rents do keep rising, this urban area across the Hudson River from New York City is still much more affordable than living in the Big Apple. The City is a great market for rental property owners, with a growing percentage of the residents in Jersey City renting rather than owning.

Jersey City is part of the New York City metropolitan area and borders the Hudson River, Upper New York Bay, and Newark Bay. The economy is driven by a variety of business sectors including transportation and distribution, manufacturing, retail, and financial services. In fact, Jersey City has been nicknamed “Wall Street West” and is home to one of the largest banking centers in the country.

Here’s what investors should know about the Jersey City real estate market in 2022.

>>Explore Roofstock's Jersey City properties here.

Population growth

The population of Jersey City jumped by more than 18% over the last decade, making the city the 2nd largest in the state.

Key Population Stats:

- Jersey City is the 2nd most populated city in New Jersey and is the seat of Hudson County.

- More than 292,000 people live in Jersey City, while Hudson County is home to more than 724,000 residents.

- Jersey City’s population grew 18.1% over the past 10 years, according to the most recent census, more than three times as fast as the entire state.

- Although the population of Jersey City declined by 2.9% last year, Jersey City has grown by over 18% since 2010 while Hudson County’s population has increased by more than 14%.

- Business Insider predicts that Jersey City will be a booming market over the next decade as more people keep moving to the area.

- Per capita income is $44,761 while median household income is $76,444.

Job market

Jersey City is ranked among the best cities for jobs by WalletHub, based on a variety of key indicators such as job opportunities, employment growth, starting salaries, industry variety, and job security. Employment sectors in Jersey City showing the fastest signs of growth include professional and business services, education and health services, leisure and hospitality, and government jobs.

Key Employment Stats:

- GDP of Jersey City (including NYC and Newark) is over $1.8 trillion, according to the Federal Reserve Bank of St. Louis.

- Employment growth in Jersey City was 2.34% last year while household incomes increased by 12.6% year-over-year.

- Unemployment rate in Jersey City/NYC is 4.4% according to the most recent information from the BLS (as of May 2022).

- Target industry sectors in the Jersey City metro area include health care and social services, business and professional services, education, construction, and finance and insurance.

- Major private sector employers in Jersey City/Hudson County include the United States Postal Service, UBS Financial Services, publishing company John Wiley & Sons, Goldman Sachs & Co. Inc., Bayonne Hospital, and JP Morgan Chase Bank.

- Companies with headquarters and major operations centers in Jersey City include Verisk Analytics, money management firm Lord Abbett, Computershare, NEX Group, and Fidelity Investments.

- New Jersey City University, Saint Peter’s University, Stevens Institute of Technology, and Hudson County Community College are some of the major colleges and universities in the Jersey City metro area.

- 88.4% of the residents of Jersey City hold a high school diploma or higher, while 49.8% hold a bachelor’s degree or advanced degree.

- 41% of the residents of the Jersey City metro area use public transit.

- I-78 (the New Jersey Turnpike) passes through Jersey City.

- Port Newark-Elizabeth is a main container shipping facility and a key part of the Port of New York and New Jersey.

- Newark International Airport, John F. Kennedy International Airport, and LaGuardia International Airport are all less than 25 miles from the Jersey City metro area.

Real estate market

WalletHub ranks Jersey City among the top markets for buying real estate based on 24 key criteria such as strength of the economy, job growth, median home-price appreciation, and sales turnover.

People from New York City are migrating to the real estate market here for more value and relatively lower rents while still having access to the Big Apple. The Jersey Journal notes that Jersey City and Hudson County are proving to be a haven for renters working from home and looking for more space.

Key Market Stats:

- Zillow Home Value Index (ZHVI) for Jersey City is $606,537 as of May 2022.

- Home values in Jersey City have increased by 8.3% over the last year.

- Over the past five years home values in Jersey City have increased by 35.0%.

- Median listing price of a single-family home in Jersey City is $645,000 based on the most recent research from Realtor.com (April 2022).

- Median listing price per square foot for a home in Jersey City is $586.

- Days on market (median) is 68.

- Of the 9 neighborhoods in Jersey City, The Waterfront is the most expensive with a median listing price of $947,000.

- Most affordable neighborhood in Jersey City is Journal Square with a median listing price of $360,000.

Attractive renters’ market

Jersey City is one of the best cities for renters, with the area receiving high ratings from WalletHub for the rental market and affordability, along with a great quality of life.

Patch.com reports that demand for rental property in Jersey City is creating a landlord’s market, with owners having the power to set prices higher with little room for negotiation. Although the number of individual home sales has declined, the median price of real estate deals increased throughout all of Jersey City.

More than 70% of the households in Jersey City are renter occupied, even though the City is the 5th most expensive small city to rent in. Two of the reasons why there are so many renters in Jersey City is the high cost of buying property and the fact that although rents are high here, they’re still lower than nearby Manhattan and Hoboken.

Key Market Stats:

- Median rent in Jersey City is $2,725 per month for a 3-bedroom home, according to the most recent research from Zumper (June 2022).

- Rents in Jersey City grew by 30% year-over-year.

- Nearly 70% of the rental units in Jersey City rent for an average of $3,500 per month or less.

- Renter-occupied households in Jersey City make up 71% of the total occupied housing units.

- Most affordable neighborhoods for renters in Jersey City include Greenville, Bergen-Lafayette, and Hackensack River Waterfront where rents range between $1,998 and $2,200 per month.

- Neighborhoods in Jersey City with the highest rents include Historic Downtown, The Waterfront, and Journal Square where rents are between $4,425 and $5,500 per month.

Historic price changes & housing affordability

Analyzing the historic change in real estate prices in a market can help investors predict the potential future appreciation of property. Housing affordability is a metric used to estimate the current and future demand for rental property, because in markets where housing isn’t affordable, more people will generally rent than own, as is the case in Jersey City.

Each quarter the FHFA releases up-to-date data on the change in home prices for all markets across the U.S. The most recent FHFA 2022 Q1 House Price Index report for the New York-Jersey City-White Plains, NY-NJ MSA shows:

- Since Q1 1991 homes prices have increased by 265.83%

- Over the past five years home prices have increased in Jersey City by 38.43%

- Over the past year prices have increased by 11.61%

- Over the last quarter home prices in Jersey City have increased by 4.14%

The Housing Affordability Index (HAI) compares median family incomes to prices of median resale single-family homes. HAIs use 100 as a baseline index number. Real estate markets with an HAI above 100 tend to be more affordable to buy, while cities with an HAI below 100 tend to be more favorable for renting.

According to the most recent data, the HAI for Jersey City is 87. This means that buying a median priced home is less affordable for residents with a median household income, which could be a sign of a strong demand for rental housing in Jersey City and Hudson County and the surrounding area.

Quality of life

It’s easy to mistake Jersey City for the 6th borough of New York City. Located just 20 minutes from the Big Apple, Jersey City is often described as an intimate sophisticated urban community.

Key Quality of Life Stats:

- Nearby Ellis Island processed more than 12 million immigrant steamship passengers between 1892 and 1954.

- Powerhouse Arts District in Downtown Jersey City takes urban sophistication to an entirely new level.

- The 1,212-acre Liberty State Park is located in the middle of Jersey City, with nearby ferries to the Statue of Liberty and Ellis Island.

- Climate in Jersey City is moderate with hot humid summers and mild to cool winters.

- Commuting across the Hudson River to NYC is easy with plenty of public transportation.

- Hudson River waterfront in Jersey City is nicknamed “Wall Street West” due to the large concentration of jobs in the financial services and securities sectors.

- Jersey City is home to numerous landmarks and Registered Historic Places including Liberty National Monument, Ellis Island, Colgate Clock, and Loew’s Jersey Theatre.

- Jersey City is the place to be for lovers of New York sports teams including the Mets and Yankees, Nets and Knicks, Giants and Jets, Devils and Rangers.

- Jersey City Medical Center is rated as one of the best hospitals in the region by U.S. News & World Report.

Get out the map

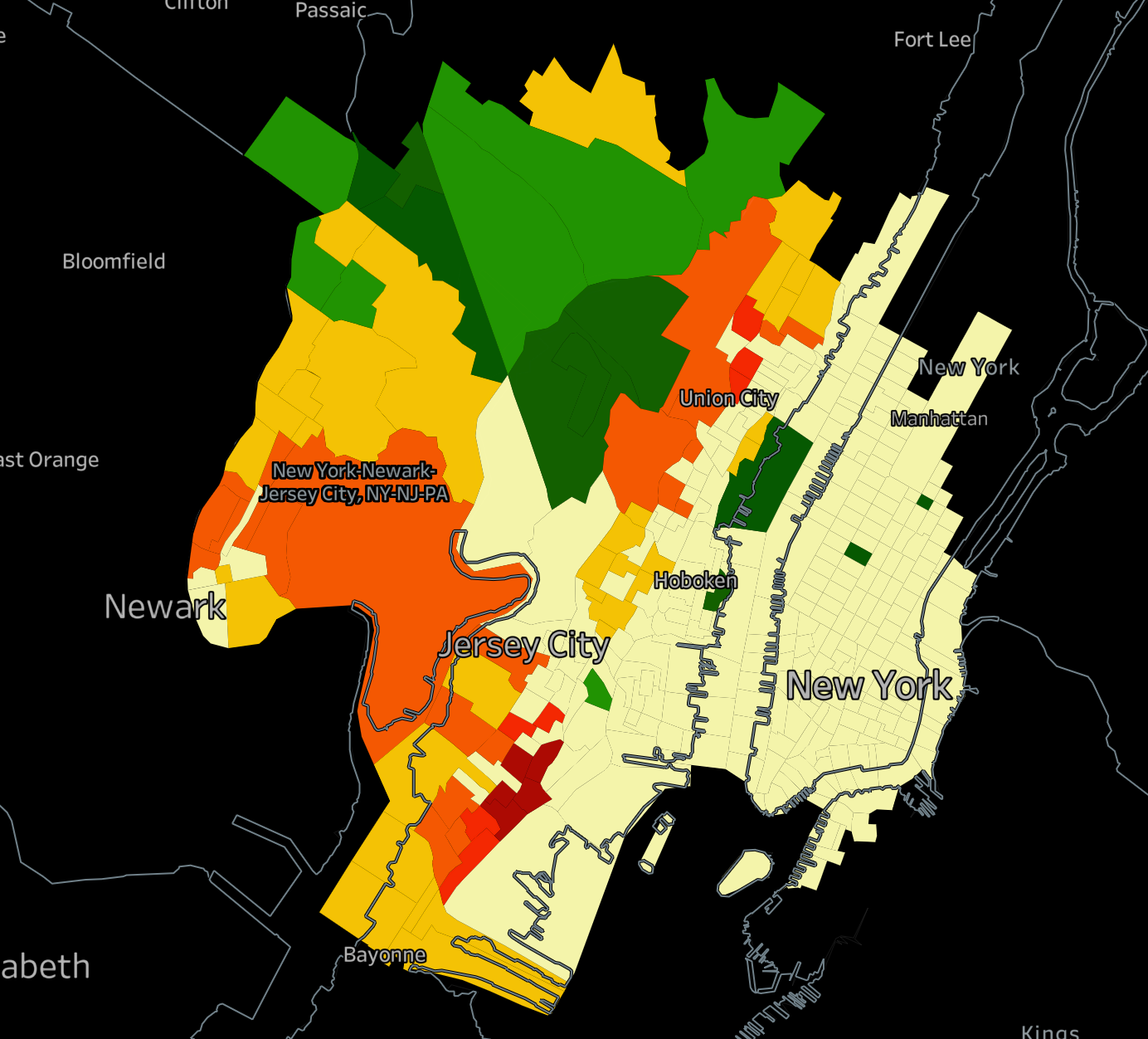

Where to begin your search? Roofstock created a heat map of Jersey City based on our Neighborhood Rating, a dynamic algorithm that enables you to make informed investment decisions by measuring school district quality, home values, employment rates, income levels and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the Jersey City housing market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a Jersey City investment property that matches your search criteria.