Louisville has been named as one of the top cities for renters by WalletHub, with the metro area receiving solid ratings for rental market affordability and quality of life.

That may be why Realtor.com ranks Louisville as a real estate market that will outperform in 2022. According to the forecast, home prices in Louisville are predicted to rise by 4.5% while sales volume is expected to grow by 7.3%, compared to the U.S. average of 2.9% and 6.6% respectively.

Nicknamed the “Gateway to the South” and “Bourbon City," Louisville is located in north central Kentucky and borders Jefferson County in Indiana and the Ohio River. As the largest city in the state, Louisville boasts a low cost of living and a dynamic economy of public and private industry sectors including manufacturing, high tech, and transportation and shipping.

Louisville is home to the Kentucky Derby, Kentucky Fried Chicken, Louisville Slugger baseball bats, and Muhammad Ali – as well as a robust real estate market.

Keep reading to learn why the Louisville real estate market is attracting investors in 2022.

>>Explore Roofstock's Louisville properties here.

Population growth

Louisville is among the fastest growing cities in Kentucky, according to the Kentucky League of Cities (KLC). In fact, Jefferson County (where Louisville is located) grew by 5.7% over the last 10 years, and is now home to nearly 783,000 residents in the metropolitan area.

As the largest city in the state, Metro Louisville has added nearly 45,000 new residents over the past ten years. Kentucky also has one of the highest population growth rates of all states, providing real estate investors with the slow and steady performance they are looking for.

Key Population Stats:

- City of Louisville is home to more than 633,000 residents with nearly 1.4 million people living in the Louisville/Jefferson County MSA.

- Louisville is the largest city in Kentucky and the 29th-most populated city in the U.S.

- Population of Louisville declined by 2.35% last year and by about 3% over the past ten years.

- Between now and 2040 the population of the City of Louisville is projected to reach 872,000 people, representing a growth rate of nearly 12%.

Job market

Louisville has been ranked as one of the best places for jobs based on rating criteria such as job opportunities, employment growth, and average monthly starting salary. As the economy begins to recover, the construction, trade and transportation, education and health services, and leisure and hospitality sectors are showing the fastest signs of job growth.

Key Employment Stats:

- GDP of Louisville/Jefferson County is more than $74.3 billion, according to the Federal Reserve Bank of St. Louis, and has grown by nearly 37% over the past ten years.

- Employment in Louisville has declined by 2.12% year-over-year while median household incomes have increased by 6.56%.

- Unemployment is down to 2.7% according to the BLS (as of April 2022).

- Since October 2020, more than 9,400 new jobs have been created in Louisville.

- Louisville has been ranked as a top metro area for economic development, ahead of other cities in the region such as Nashville, Indianapolis, and Austin.

- Trade and transportation, education and healthcare, government, professional and business services, and leisure and hospitality are the Louisville industry sectors with the largest employment levels.

- Kiplinger notes that auto manufacturing is also important in Louisville, with companies like Ford Motor Co. and Piston Automotive LLC hiring hundreds of new people and spending millions of dollars on plant expansion.

- Major employers in the Louisville area include United Parcel Service at the company’s international air hub, Jefferson County Public Schools, Ford Motor Co.’s two plants, Norton Healthcare, Amazon, GE Appliances, and The Kroger Co.

- Top publicly traded companies based in Louisville include Humana Inc., Yum Brands Inc., Brown-Forman Corp., Texas Roadhouse Inc., and Papa John’s International.

- University of Louisville, Bellarmine University, Boyce College, and Louisville Bible College are some of the colleges and universities located in the Louisville metro area.

- 90.4% of the residents in Louisville have a high school diploma or higher, while 30.1% hold a bachelor’s degree or advanced degree.

- Interstate highways I-64, I-65, and I-71 in Greater Louisville provide one-day access to more than 66% of the U.S. population.

- The Louisville region has 48 private terminals and 3 public inland ports on the Ohio River, including Jefferson Riverport International and Port of Indiana-Jeffersonville.

- Canadian Pacific, CSX, and Norfolk Southern provide Class I freight rail service in Louisville.

- Louisville Muhammad Ali International Airport (SDF) provides commercial, private, military, and cargo services and offers non-stop service to more than 30 domestic destinations.

Real estate market

A wave of pandemic buyers is pushing real estate prices in Louisville higher as inventory reaches all-time lows. According to a recent report from HousingWire, people are upsizing to bigger homes with more space now that they are spending more time at home working and schooling. Rental property investors should take note, in Louisville buying a larger house for investment might be better.

Key Market Stats:

- Zillow Home Value Index (ZHVI) in Louisville is $230,590 (as of May 2022).

- Home values in Louisville grew 12.1% over the last year.

- Over the past five years home values in Louisville have increased by nearly 50%.

- Median listing price of a single-family home in Louisville is $225,000 based on the most recent research from Realtor.com (April 2022).

- Median listing home price per square foot is $143.

- Day on market (median) is 24.

- Median sold price of a home in Louisville is $187,500.

- Median selling price of homes in Louisville is up 12% year-over-year according to the Greater Louisville Association of Realtors.

- Realtor.com predicts Louisville is shifting to a buyer’s market with the supply of homes on the market beginning to exceed demand.

- Of the 66 neighborhoods in Louisville, Cherokee Triangle is the most expensive with a median listing price of $440,000.

- Most affordable neighborhood in Louisville is Portland with a median home listing price of $52,500.

Attractive renters’ market

TV new station WLKY in Louisville recently reported that home prices continue to soar as homebuyers compete for a limited supply of homes. People still need a place to live, so when they can’t find a home they can afford they rent instead. Over the past year, rents in Louisville have increased by 12% with single-family homes accounting for the majority of housing units in the metro area.

Key Market Stats:

- Median rent in Louisville is $1,450 per month for a 3-bedroom home, based on the most recent research from Zumper (June 2022).

- Rents in Louisville have increased by 12% year-over-year.

- Renter-occupied households make up 40% of the occupied housing units in Louisville, according to RENTCafé.

- Neighborhoods in Louisville most affordable for renters include Park Duvalle, Germantown, and Southside where rents are $850 per month or less.

- Neighborhoods in Louisville with the highest rents include Deer Park, Audubon, and Bon Air where rents run as high as $1,980 per month.

Historic price changes & housing affordability

Two of the most important analyses real estate investors can conduct when deciding which markets to invest in are reviewing home price changes and housing affordability.

Historic price changes can help gauge the potential appreciation of a house over both the short- and the long-term. Housing affordability can provide a leading indicator of how much demand there may be for single-family rental property now and in the future.

Every month, the Freddie Mac House Price Index (FMHPI) report shows the changes in housing prices in all of the major markets in the U.S.

The most recent FMHPI from Freddie for Louisville/Jefferson County, KY-IN shows:

- April 2017 HPI: 143.00

- April 2022 HPI: 211.77

- 5-year change in home prices: 48.0%

- One-year change in home prices: 13.2%

- Monthly change in home prices: 1.2%

Housing affordability is an indicator of how many people may choose to rent rather than own. In markets where homes are less affordable, more people may rent rather than buy where they live, and vice versa. Of course, other factors such as lifestyle choice and demographic group influence the decision to rent as well.

According to the National Association of Realtors (NAR), the housing affordability index (HAI) compares the median income a family needs to qualify for a median priced single-family resale home, assuming they use a conventional mortgage with 20% down.

The HAI uses 100 as a baseline housing affordability index number. So, the greater a HAI is above 100 the more income a family has to purchase a home.

Based on the most recent report from the Home Town Locator, the HAI for the Louisville/Jefferson County, KY-IN MSA was 164 as of July 2021. This means that the median family has a little more than 1 ½ times the income needed to purchase a median priced, single-family resale home in the Louisville metro area.

Quality of life

Louisville is often described as a hidden gem that often flies under the radar of many people. However, the city is one of those special places that once you arrive, you never want to leave. As one local group says, here’s how to “find a new you in Lou.”

Key Quality of Life Stats:

- Forbes ranked Louisville among the top 100 places in the U.S. for business and careers, job growth, and the cost of doing business.

- Cost of living in Louisville is 6% below the national average.

- In fact, the cost of living, cost of housing, and cost of utilities in Louisville are all below the national average.

- Niche.com gives Louisville high ratings for housing, outdoor activities, and nightlife.

- Climate in Louisville is humid subtropical with four distinct seasons and an average annual snowfall of only 12.7 inches.

- Louisville is home to the Kentucky Derby, Maker’s Mark Bourbon, and the Louisville Slugger.

- National Geographic ranked Louisville as one of the top 10 food cities in the world.

- Louisville hosts Abbey Road on the River, the world’s largest annual Beatles Festival.

- Summer events in Louisville include the Kentucky Shakespeare Festival, Forecastle Festival at the Louisville Waterfront Park, and the Kentucky State Fair.

- Louisville consistently receives top ratings for the NCAA men’s basketball team the Louisville Cardinals.

- U.S. News & World Report ranked Baptist Health Louisville and Norton Hospital as two of the best hospitals in Kentucky.

Get out the map

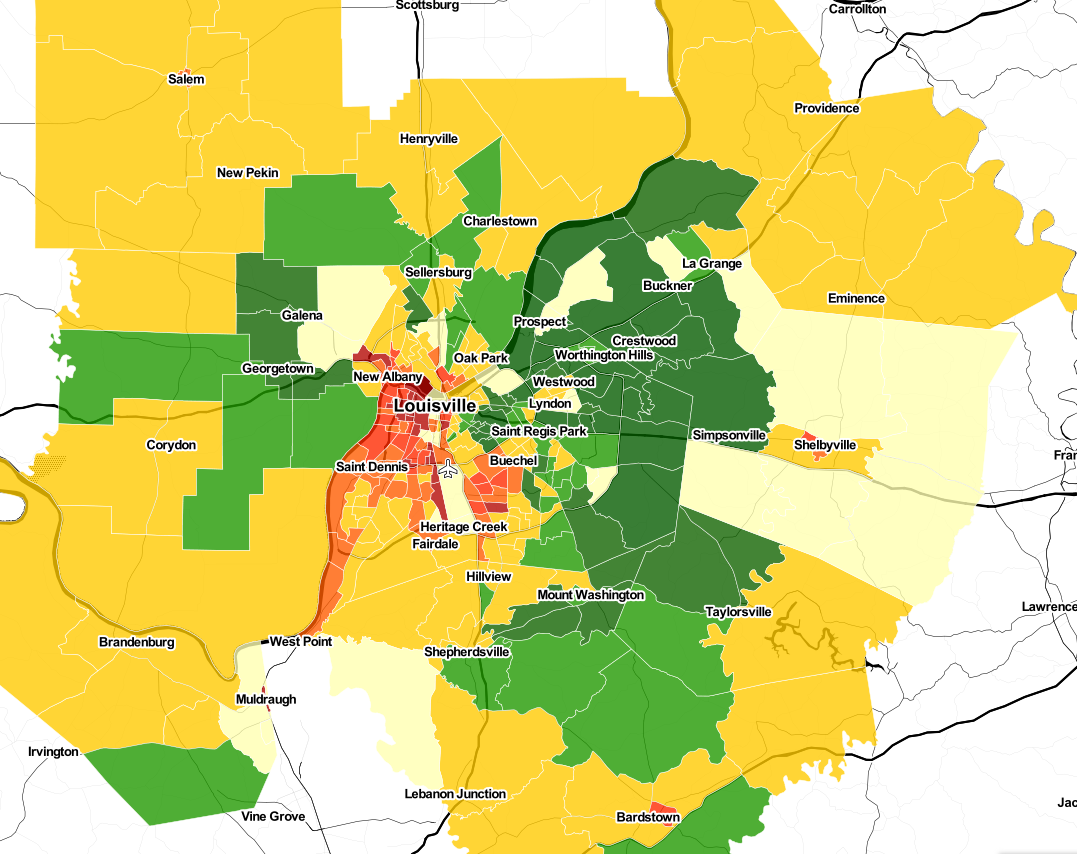

Where to begin your search? Roofstock created a heat map of Louisville based on our Neighborhood Rating, a dynamic algorithm that enables you to make informed investment decisions by measuring school district quality, home values, employment rates, income levels and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the Louisville housing market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a Louisville investment property that matches your search criteria.