The fierce demand in the Pittsburgh real estate market has begun to slow, creating potential opportunity for investing in rental property in the Steel City. According to local real estate experts, the biggest reason why there is less competition is that many home buyers are putting their plans on hold. But in the meantime, home prices in the most desirable neighborhoods are still going up and selling faster than ever before.

Investors looking for cash-flowing housing to hold for the long term have known for several years that Pittsburgh, Pennsylvania may be an attractive place to buy rental property.

Back in 2019, said Mekael Teshome, vice president and senior regional officer of the Pittsburgh branch of the Federal Reserve Bank of Cleveland, noted that “Pittsburgh is on a slow and steady course. All in all, Pittsburgh’s outlook is favorable, with persistent and moderate growth ahead.”

But there’s a lot more to Pittsburgh than its strong and steady real estate market. From plentiful shopping areas, amazing restaurants, and outstanding views of the Allegheny, Monongahela, and Ohio Rivers, many people find the city the perfect place to call home.

Here’s a closer look at why Pittsburgh could be an attractive investment for rental property investors in 2022.

>>Explore Roofstock's Pittsburgh properties here.

Population growth

The population of Allegheny County (where Pittsburgh is located) grew in population for the first time in 60 years, outperforming pre-census estimates. Over the past 10 years, the County added more than 27,200 new residents while the population of the city itself declined by just over 2,700 people, according to the most recent census.

Although there’s been a decline in recent years, the population of Pittsburgh is the most stable it’s been in almost a century, according to the Pittsburgh Post-Gazette. Nicknamed the “Steel City,” the area’s population has declined since its mid-20th-century peak as Pittsburgh continues to transition from a manufacturing economy to one that’s home to high-tech firms like Google and Apple.

Key population stats:

- Pittsburgh is the second-largest city in Pennsylvania, just behind Philadelphia.

- The City of Pittsburgh has a population of nearly 303,000 people and almost 2.4 million residents in the Pittsburgh metropolitan area.

- Population of Pittsburgh declined by about 1% over the past decade, while Allegheny County grew by a little over 2.2%, according to the U.S. Census Bureau.

- Median household incomes in Pittsburgh have increased by 4.9% year-over-year while property values rose by 3.5%.

Job market

Pew Research notes that despite 4% fewer people living in Pittsburgh since 2000, the per capita income increased by 24% during the same time period. The economy in Pittsburgh is slowly but surely recovering from the recession.

According to the most recent report from the U.S. Bureau of Labor Statistics (BLS April 2022), employment sectors showing the fastest signs of recovery include leisure and hospitality, manufacturing, information, and professional and business services.

Key employment stats:

- GDP of Pittsburgh is more than $136.3 billion, an increase of more than 12% over the past ten years.

- Unemployment in Pittsburgh dropped to 4.2% through April 2022.

- Employment growth in Pittsburgh has declined by 0.04% year-over-year.

- Cost of living in Pittsburgh is 13% below the national average, according to Forbes.

- Pew Research reports that Pittsburgh has more STEM (science, technology, engineering, and math) jobs than any other city with a declining population.

- World-renowned companies such as Amazon, Facebook, Bossa Nova Robotics, and IAM Robotics are driving the demand for skilled employees in the Pittsburgh metro area.

- Five key business sectors of technology and robotics, advanced manufacturing, financial and business services, energy, and healthcare and life sciences have created more than 8,405 new jobs, according to the 2021 Annual Pittsburgh Region Business Investment Scorecard.

- Fortune 500 companies in Pittsburgh are PNC Financial Services, PPG Industries, U.S. Steel, The Kraft Heinz Corporation, WESCO International, and Dick’s Sporting Goods.

- Major companies located in the Pittsburgh metropolitan area include Allegheny Technologies, Mylan Bayer USA, GlaxoSmithKline, Thermo Fisher Scientific, Deloitte Touche Tohmatsu, and the RAND Corporation.

- University of Pittsburgh Medical Center is the largest employer in Pittsburgh, with about 92,000 employees around the world.

- Some of the most well-known colleges and universities in Pittsburgh are the private research institution Carnegie Mellon University, founded by Andrew Carnegie and Andrew Mellon, the University of Pittsburgh, and Duquesne University.

- Nicknamed “The Pitt,” the University of Pittsburgh has one of the largest research programs in the U.S.

- 94.3% of the people in Pittsburgh are high school graduates or higher, while 36% hold a bachelor’s degree or an advanced degree.

- Numerous Interstate Highways run through the Pittsburgh metro area, including I-376, I-76, I-79, and I-80.

- The Port of Pittsburgh moves more than 35 million tons of cargo each year, and is the second-busiest inland port in the U.S. and the 17th-busiest port of any kind in the country.

- Freight railroad operators CSX and Norfolk Southern have major operations in Pittsburgh.

- Pittsburgh International Airport (PIT) serves nearly nine million passengers while PIT cargo service provides shipping with airlines such as FedEx and UPS, Qatar Airways, and British Airways.

Real estate market

Despite the pandemic and resulting recession, the housing market is still going strong. According to the Pittsburgh Post-Gazette, bidding wars still occur whenever a new listing hits the market.

The report notes that there is a “ton of institutional money that needs to seek a return” and real estate is the place to be. Pittsburgh is an example of a tertiary market where homes can still be acquired for an affordable price.

The housing market is especially hard on first-time buyers, which may be one reason why 50% of the households in Pittsburgh are occupied by renters.

Key market stats:

- Zillow Home Value Index (ZHVI) for Pittsburg is $222,884 as of November 2021.

- Home values in Pittsburgh have increased by 14.5% over the last year.

- Over the last five years home values in Pittsburgh have increased by more than 63%.

- Median list price of a single-family home in Pittsburgh is $225,000 according to the most recent report from Realtor.com (November 2021).

- Median listing price per square foot for a home in Pittsburgh is $155.

- Days on market (median) is 57.

- Median sold price of a home in Pittsburgh is $215,000.

- Sales-to-list price ratio is 100%, which means that homes are selling for approximately the asking price on average.

- Of the 83 neighborhoods in Pittsburgh, Squirrel Hill North is the most expensive with a median list price of $627,000.

- Most affordable neighborhood for buying a home in Pittsburgh is Sheraden where the median listing price is $130,000.

Strong renters’ market

Pittsburgh is one of the top 50 cities in the U.S. for renters, according to WalletHub. The city receives high ratings for many of the factors rental property investors look for, including activity in the rental market, affordability, and quality of life. Those may be some of the reasons why more people rent in Pittsburgh than own a home.

Key market stats:

- Median rent in Pittsburgh is $1,650 per month for a 3-bedroom home based on the most recent research from Zumper (December 2021).

- Rents in Pittsburgh have increased by 6% year-over-year.

- Renter-occupied households account for 50% of the total occupied housing units in Pittsburgh.

- Single-family homes in Pittsburgh make up 74% of the total housing units.

- Neighborhoods in Pittsburgh with the lowest rents include Elliot, Marshall-Shadeland, and Hays where average rents are $850 per month or less.

- Pittsburgh neighborhoods with the highest monthly rents include Strip District, Downtown Pittsburgh, and West Oakland where rents range between $3,291 and $5,530 per month.

Historic price changes & housing affordability

When real estate investors analyze the viability of investing in rental property in Pittsburgh, two metrics commonly used are historical price changes and the level of housing affordability. Along with other financial measurements, price history and affordability help to determine the future demand for rental housing in Pittsburgh.

The Freddie Mac Home Price Index (FMHPI) is published monthly and reports the monthly change in home prices in every metropolitan area in the U.S. According to the most recent FMHPI report for the Pittsburgh MSA:

- April 2017 HPI: 158.8

- April 2022 HPI: 233.8

- 5-year change in home prices: 47.2%

- One-year change in home prices: 11.8%

- Monthly change in home prices: 1.2%

Home price data from ATTOM Data Solutions was recently analyzed by Kiplinger to determine the housing affordability in Pittsburgh. The most recent research found that:

- Since the peak of the last real estate cycle, home prices in Pittsburgh have increased by 24.3%.

- Since the last real estate cycle market bottom, home prices in Pittsburgh have grown by more than 38%.

- Housing affordability in Pittsburgh is ranked as 2 out of 10, meaning that the Pittsburgh metro area is one of the more affordable places to own a home in the U.S.

Quality of life

The most recent Pittsburgh Regional Quality of Life Survey by the University of Pittsburgh found that 68% of the residents in Allegheny County (where Pittsburgh is located) rated the region as either an excellent or very good place to live.

Apartment List took a close look at Pittsburgh in December 2021, to learn why the Steel City is becoming so popular with so many people.

Key quality of life stats:

- Housing and rents are affordable compared to the rest of the U.S., with 50% of the residents in Pittsburgh choosing to rent rather than own.

- Bus service is free in Downtown Pittsburgh and the North Shore areas.

- Carnegie Museum of Art and the Andy Warhol Museum make the city perfect for art lovers.

- With 446 bridges, Pittsburgh is nicknamed the “City of Bridges” and has more than any other city in the world.

- Heinz Ketchup hails from Pittsburgh, the Big Mac was created here, and the first emoticon (think smiley face) was created by a Carnegie Mellon computer science professor.

- MLB Pittsburgh Pirates, NFL Pittsburgh Steelers, and NHL Pittsburgh Penguins all make people proud to live in Pittsburgh.

Get out the map

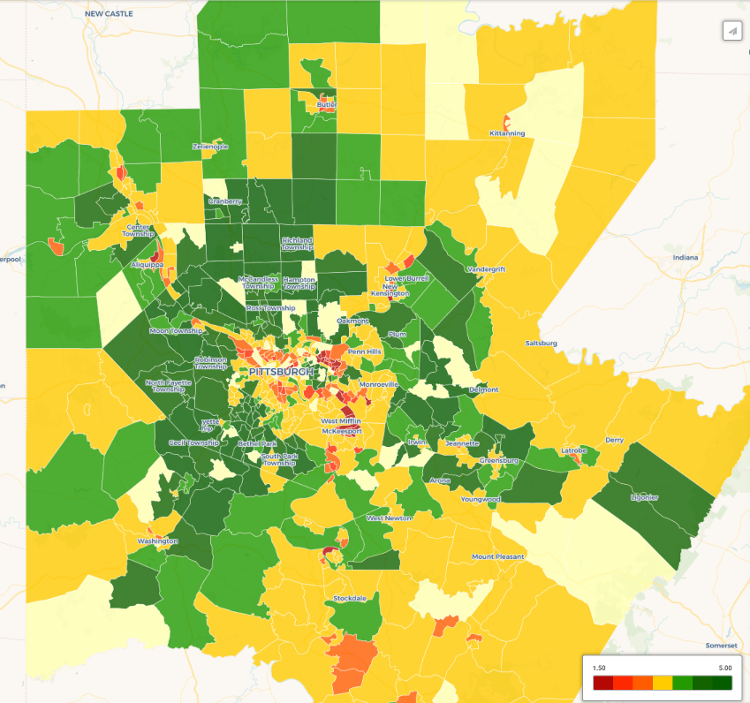

Where to begin your search? Roofstock created a heat map of Pittsburgh based on our Neighborhood Rating, a dynamic algorithm that enables you to make more informed investment decisions by measuring school district quality, home values, employment rates, income levels, and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the Pittsburgh market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a Pittsburgh investment property that matches your search criteria.