A recent news release from the Minneapolis Area Realtors sums up everything there is to know about the current state of the real estate market in Minneapolis-St. Paul. According to the Association, median sales price reached a record $370,000 in May, up 10% from last year, while inventory levels have declined for 25 consecutive months.

Not too long ago the StarTribune reported that the number of houses on the market for sale would rise and days on market would increase. But in fact, the exact opposite has occurred.

The biggest reason for the strong performance of the housing market in Minneapolis may have to do with a change in city zoning.

Recently, Minneapolis became the first large city in the U.S. to end single-family zoning. The city now allows small multifamily property to be built on single-family lots, which could end up increasing the demand for people who want to live in a traditional house.

Minneapolis is located in southeastern Minnesota, along the banks of the Mississippi River near the Wisconsin border. Minneapolis, along with neighboring St. Paul, make up the Twin Cities metropolitan area, the 3rd-largest economy and populated region in the Midwest.

Minneapolis is the main business center between Chicago and Seattle and is home to a diverse economy of commerce, finance, transportation, healthcare, and technology. The Twin Cities has the 5th-highest concentration of major corporate headquarters and receives consistently high rankings as a great city to live, work, and play.

Read on to learn what makes the Minneapolis real estate market worth considering in 2022.

>>Explore Roofstock's Minneapolis properties here.

Population growth

The population of the city of Minneapolis has grown by more than 12% since 2010, according to the most recent census, while the 7-county Twin Cities Metro region gained over 313,000 new residents over the past 10 years.

Key population stats:

- City of Minneapolis is home to nearly 430,000 residents with nearly 3.7 million people living in the Minneapolis-St. Paul Twin Cities region.

- Over the past year the population of Minneapolis-St. Paul has decreased by 0.7%.

- Minneapolis is the largest city in Minnesota and the 16th-largest metropolitan area in the U.S.

- Twin Cities is the 3rd-largest economy and population center in the Midwest, just behind Chicago and Detroit.

- The U.S. Census Bureau reports Minneapolis had a net inbound migration of 47,376 people over the past 10 years.

- Population of the Minneapolis-St. Paul region is projected to grow by 12% over the next ten years.

- Minneapolis is home to a labor pool of nearly 2 million people.

Job market

Much of the state’s job growth has been concentrated in the Twin Cities metro area. The Minneapolis MSA is home to 2 million workers, with employment growth increasing by 0.53% year-over-year.

According to the BLS, the unemployment rent is down to 1.5% (April 2022) and some of the job sectors showing the fastest signs of improvement include leisure and hospitality, construction, manufacturing, information, and professional and business services.

Key employment stats:

- GDP of Minneapolis-St. Paul-Bloomington, MN-WI MSA is more than $235 billion, according to the Federal Reserve Bank of St. Louis, and has grown by more than 16% over the past ten years.

- Job growth in Minneapolis last year was 0.53%.

- Over the last 8 years, IT jobs have grown by 63%, construction jobs by 27%, and natural resource/mining employment by 22% in greater Minnesota (source).

- Top industry sectors in Minneapolis are health and life sciences, food and water, headquarters and business services, financial services and insurance, and advanced manufacturing and technology.

- Minneapolis-St. Paul is home to 16 Fortune 500 company headquarters, including UnitedHealth Group, Target, Best Buy, 3M, General Mills, Ecolab, Xcel Energy, and Thrivent Financial.

- Major employers in the Minneapolis area include U.S. Bancorp, Ameriprise Financial, Wells Fargo, RBC Wealth Management, CenturyLink, and the Federal Reserve Bank of Minneapolis.

- Major colleges and universities in the Minneapolis region include University of Minnesota, Augsburg University, Minneapolis Community and Technical College, and Metropolitan State University.

- 93.9% of Minneapolis residents have a high school degree or higher, while 42.7% hold a bachelor’s degree or advanced degree.

- Several interstate highways pass through Minneapolis, including I-94, I-494, and I-694.

- Burlington Northern Santa Fe and Canadian National are two of the largest freight rail operators in the Twin Cities.

- Minneapolis-St. Paul International Airport (MSP) is the 17th busiest airport for passengers and the 12th busiest for aircraft operations, and is the second largest hub for Delta Airlines.

Real estate market

A dearth of new listings is helping to keep sales activity in Minneapolis robust, with homes selling faster and for higher prices than ever before, according to MinnPost.

Recent data from the Minneapolis Area Realtors Association shows the economy is improving, unemployment is falling, and the housing prices are on the rise. The median sales price of a home rose 9.5% in November compared to the same time last year, with only 5,758 housing units for sale out of a metro area with nearly 3.7 million people.

Key market stats:

- Zillow Home Value Index (ZHVI) for Minneapolis is $345,909 as of May 2022.

- Homes values in Minneapolis increased by 6.5% over the last year.

- Over the past five years home values in Minneapolis have increased by more than 41%.

- Median listing price of a single-family home in Minneapolis is $325,000 based on the most recent research from Realtor.com (April 2022).

- Median listing price per square foot of a home is $205.

- Days on market (median) is 44.

- Median sales price of a home in Minneapolis is $337,000.

- Sale-to-list price ratio is 101.2%, which means homes in Minneapolis are selling for slightly above the asking price on average.

- Of the 87 neighborhoods in Minneapolis, Linden Hills is the most expensive with a median listing price of $829,900.

- Most affordable neighborhood in Minneapolis is Whittier with a median listing price of $189,900.

Attractive renters’ market

Minneapolis is ranked by WalletHub as one of the best cities for renters. The metropolitan area receives high ratings for rental market affordability and quality of life. The attractive rental market helps to explain why there are more renter-occupied households here than homes occupied by owners.

Key market stats:

- Median rent in Minneapolis is $1,945 per month for a 3-bedroom home, based on the most recent analysis by Zumper (as of June 2022).

- Rents in Minneapolis have increased by 2% year-over-year.

- Renter-occupied households in Minneapolis make up 51% of the occupied housing units.

- Neighborhoods in Minneapolis that are most affordable for renters include McKinley, Victory, and Phillips where average rents can go for $1,400 per month or above.

- Neighborhoods in Minneapolis with the highest rents include cedar Isles-Dean, Downtown East, and Nicollet Island where rents can go as high as $8,600 per month.

Historic price changes & housing affordability

Two of the most important metrics real estate investors can use when analyzing housing markets are historic price changes and housing affordability. Changes in housing prices are an indicator of potential appreciation, while housing affordability data can help indicate how good a market is for rental property investment.

Each month Freddie Mac publishes its House Price Index (FMHPI) report with up-to-date data on the change in home prices for all markets across the U.S. The most recent FMHPI from Freddie for the Minneapolis-St. Paul-Bloomington, MN-WI MSA shows:

- April 2017 HPI: 145.65

- April 2022 HPI: 214.04

- 5-year change in home prices: 46.9%

- One-year change in home prices: 11.7%

- Monthly change in home prices: 1.2%

Housing affordability research compares the median family income in an area to the median price of a single-family resale home. Using this ratio, housing markets are assigned a HAI – or housing affordability index – number that ranks how much income a family has to purchase a home, using a conventional mortgage with a 20% down payment.

Business forecast and personal finance publication Kiplinger publishes a housing affordability report for the top 100 metropolitan areas in the U.S. The firm ranks affordability on a scale of 1 to 10, with 1 representing the most affordable markets and 10 the least affordable.

Kiplinger’s analysis of housing affordability in Minneapolis-St. Paul reports:

- Since the last real estate cycle market peak in May 2006, home prices in Minneapolis-St. Paul have increased by 14.4%.

- Since the last real estate cycle market bottom in March 2012, home prices in Minneapolis-St. Paul have increased by 76.8%.

- Minneapolis-St. Paul has an affordability index of 5 out of 10, meaning that while housing in the market is very affordable, there are still a high percentage of people renting in Minneapolis-St. Paul.

Quality of life

There are so many good things about living in Minneapolis that it’s hard to know where to begin. There’s the riverfront skyline, art and theatre practically around every corner, year round festivals, and the infamous Juicy Lucy cheeseburger.

Key quality of life stats:

- Forbes ranked Minneapolis #21 in education, #32 as one of the best places for business and careers, and #104 for job growth.

- Patch.com recently ranked Minneapolis-St. Paul as #6 among America’s best largest metro areas to live.

- In fact, WalletHub ranked Minneapolis as one of the best cities to find a job.

- Despite the abundance of jobs and culture, cost of living in the Twin Cities is only 3% above the national average.

- Climate in Minneapolis is humid continental, with warm to hot humid summers and cold snowy winters.

- The number of parks in Minneapolis-St. Paul make people oh so nice, as the New York Times recently observed.

- Minneapolis was recently ranked as the 2nd fittest city in the U.S. and the 7th best city for runners, with more than 200 miles of trails.

- Minneapolis Farmers Markets are open year round to bring fresh foods in from the nearby country farms.

- Minneapolis Institute of Art has one of the most comprehensive collections in the world, and The Walker Art Center is one of the “big five” art museums in the U.S.

- University of Minnesota Medical Center in Minneapolis, Mercy Hospital, and Mayo Clinic in nearby Rochester are rated as three of the best hospitals in the Minneapolis-St. Paul region.

- NBA Minnesota Timberwolves, MLB Minnesota Twins, and NFL Minnesota Vikings are three of the championship-winning professional sports teams in the Twin Cities.

Get out the map

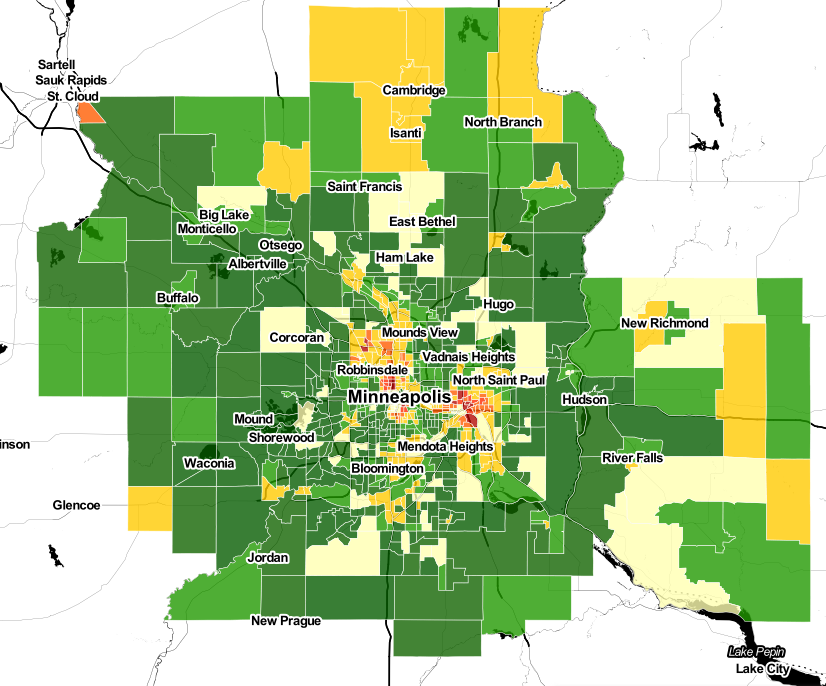

Where to begin your search? Roofstock created a heat map of Minneapolis based on our Neighborhood Rating, a dynamic algorithm that enables you to make informed investment decisions by measuring school district quality, home values, employment rates, income levels and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the Minneapolis housing market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a Minneapolis investment property that matches your search criteria.