The balance between supply and demand is a fundamental factor that determines how successful real estate investments are. Based on this simple rule, rental property investors in Mobile, Alabama might very well have a banner year as the city battles the pandemic and weathers the recession.

According to the Alabama Center for Real Estate, the months of supply of houses on the market (as of April 2022) was just 1.5, an indication of how strong the sellers market in Mobile currently is. A housing market balance between buyers and sellers normally has about a 6 month supply, with anything less tipping in favor of sellers.

Climate, culture, economy, job growth and an affordable cost of living are some of the reasons why so many people and businesses are investing in this Gulf Coast city located between New Orleans and St. Petersburg, Florida.

Founded back in 1702, Mobile is the oldest city in Alabama and has always played a significant role in the state’s economic growth.

Today, the metro area is home to industry growth sectors such as aerospace, transportation, and retail. Mobile is often called a miniature melting pot, thanks to the dynamic mix of French, Spanish, British, Creole, Greek, and African cultures.

Read on to learn why investing in rental property in Mobile, Alabama is looking very attractive in 2022.

>>Explore Roofstock's Mobile properties here.

Population Growth

With about 413,000 residents, the population of Mobile County has stayed more or less the same over the past five years. Predictability is a factor that all real estate investors look for, and Mobile definitely delivers. Even though population growth in Alabama is slowing down, inbound international migration to coastal counties like Mobile has been on the rise.

Key Population Stats:

- Mobile has a city population of just over 187,000 people and nearly 430,000 residents in the metropolitan area.

- Over the last ten years the population of Mobile has remained the same, according to the U.S. Census Bureau.

- The population base of Mobile County is projected to grow by nearly 26,000 people by 2040, making it the 2nd-largest county in Alabama, according to the University of Alabama Center for Business & Economic Research.

- Mobile is the 4th-largest city in Alabama and ranks 126th among the nation’s largest cities.

Job Market

Mobile is home to a skilled workforce in a right-to-work state. Job mobility combined with a low cost of living and doing business are three of the reasons why more than 50 companies from 20 different countries are located in the City of Mobile and Mobile County.

Key Employment Stats:

- The GDP of Mobile is over $18.8 billion, growing by about 3% over the past 10 years.

- Job growth in Mobile is 6.6% year-over-year while the unemployment rate is just 2.8%, according to Data USA and the BLS.

- Median household income in Mobile is $49,370 and per capita income is $26,915.

- Cost of living in Mobile falls well below the national average, due in part to the relatively affordable cost of housing and renting, as U.S. News reports.

- Mobile Chamber of Commerce research reveals that key industry clusters in the metro area include aviation/aerospace, chemical, shipbuilding, and steel manufacturing.

- The Chamber cites the area’s low business costs, skilled workforce in a right-to-work state, and favorable taxes and incentives as three of the key reasons for investing in Mobile.

- Largest companies and employers in the Mobile area include shipbuilder Austal USA, steel product manufacturing company AM/NS Calvert, Kimberly-Clark Corporation, Mobile County Public Schools, and University of South Alabama and Medical Facilities.

- Largest colleges and universities in the Mobile area include the University of South Alabama, University of Mobile, Bishop State Community College Main Campus, and Spring Hill College.

- More than 87% of the residents of Mobile are high school graduates or higher, and 24% of people 25 years or older hold a bachelor’s or advanced degree.

- Interstate highway I-10 connects Mobile to Jacksonville, Florida and Los Angeles while I-65 extends from Mobile north to Chicago.

- More than 65 motor freight carriers transport products from the Mobile area, with major metro areas such as Atlanta, Houston, Charlotte, Nashville, and Orlando within a 600-mile radius.

- Six railroads serve the Port of Mobile, including CSX, Burlington Northern, Norfolk Southern, and Canadian National Railroad.

- The Port of Mobile is operated by the Alabama State Port Authority and ranks as the 13th-largest full-service seaport in the U.S. based on total tonnage.

- Mobile Regional Airport handles nearly 600,000 passengers per year with flights from Delta and United, while the Mobile Downtown Airport near the Port and Downtown has FedEx air cargo service.

- Mobile Aeroplex is a leading industrial and trade complex accommodating the largest aircraft, along with road and rail access.

Real Estate Market

A pandemic wasn’t supposed to increase the demand for real estate, but that’s exactly what happened in Mobile, Alabama. According to the Alabama News Center, home sales in Alabama are white hot - and have been for more than a year - as prices surge and inventory plummets.

Key Market Stats:

- Median listing price of a home in Mobile is $194,900, according to Realtor.com (as of October 2021).

- Home values in Mobile have increased by 18.5% over the past 12 months and by more than 52% over the last five years based on the Zillow Home Value Index.

- Median sales price of homes in Mobile is up 19% year-over-year while the total number of homes for sale is at the lowest level in 20 years, based on the most recent report from the Alabama Center for Real Estate (ACRE).

- Some of the best neighborhoods in Mobile are Milkhouse, Berkleigh, and Carlen, according to Realtor.com.

- Dauphin Acres is the most affordable neighborhood in Mobile, with a median listing price of $112,000.

Attractive Renters’ Market

Mobile is ranked as one of the best places to rent in the U.S. by WalletHub. The city receives high markets for rental market affordability and quality of life, helping to explain why the demand for good rental property in Mobile is so strong.

Key Market Stats:

- Median rent in Mobile is $1,332 per month for a 3-bedroom home, according to Zumper (as of December 2021).

- Rents in Mobile have increased by 22% year-over-year.

- 38% of the households in Mobile are occupied by renters.

- 44% of the housing units in Mobile rent for between $701 and $1,000 per month, according to RENTCafé.

- Single-family homes make up 73% of the housing units in the Mobile metro area.

- Renting a home in Mobile costs less than the national average.

- Neighborhoods in Mobile with the lowest rents include Georgia Avenue, Hannon Park, and Leinkauf where rents average $607 per month.

- Areas of Mobile with the highest rents include Summerville, Church Street East, and Lower Dauphin where rents range between $1,193 and $1,334 per month.

- According to RENTCafé, the most popular neighborhoods in Mobile for renters are Lower Dauphin, Airmont, Sheldon, and Westhill.

Historic Price Changes & Housing Affordability

Each month Freddie Mac publishes the Freddie Mac House Price Index (FMHPI) tracking the historic price changes for housing across the U.S.

The most recent House Price Index report for Mobile, Alabama shows that seasonally adjusted home prices have increased by more than 58% over the last five years (as of April 2022). Over the last 12 months, home prices in the Mobile metropolitan area have increased by 18.2%, and by 1.5% over the last month.

In addition to analyzing short- and long-term pricing trends, real estate investors also consider the affordability of housing in the market to help forecast the demand for rental property. Affordability compares the median cost of housing to the percentage of income needed to purchase a home in Mobile.

Recent research on housing affordability in Mobile from the Alabama Center for Real Estate noted that Mobile is one of the most affordable metropolitan areas in Alabama to buy a home. Mobile has an AHA Index Score of 177, meaning that the average household has a little more than one and one-half times the median family income needed to qualify for a loan based on current interest rates and home prices.

Quality of Life

Mobile’s pro-business government combined with a laid-back waterfront lifestyle make the city feel like a little New Orleans. In fact, Downtown Mobile is considered by many to be the social, economic, and creative hub of the entire Gulf Coast.

Key Quality of Life Stats:

- Residents of Mobile give the city high rankings for cost of living nightlife, and outdoor activities, according to Niche.com.

- U.S. News & World Report ranks Mobile among the top 135 metro areas to live and one of the best places to retire.

- The Report gives Mobile a Value Index Rating of 5.7, noting that newcomers to Mobile find their dollar goes much further than in other metro areas.

- Mobile serves as a regional medical center for the Gulf Coast region, with four major medical centers in the city limits and a wide range of surgical centers, emergency clinics, and assisted-living facilities.

- Community art walks, ballet, opera, park and museums, and the Gulf Coast beaches make living and working in Mobile hard to beat.

Get Out the Map

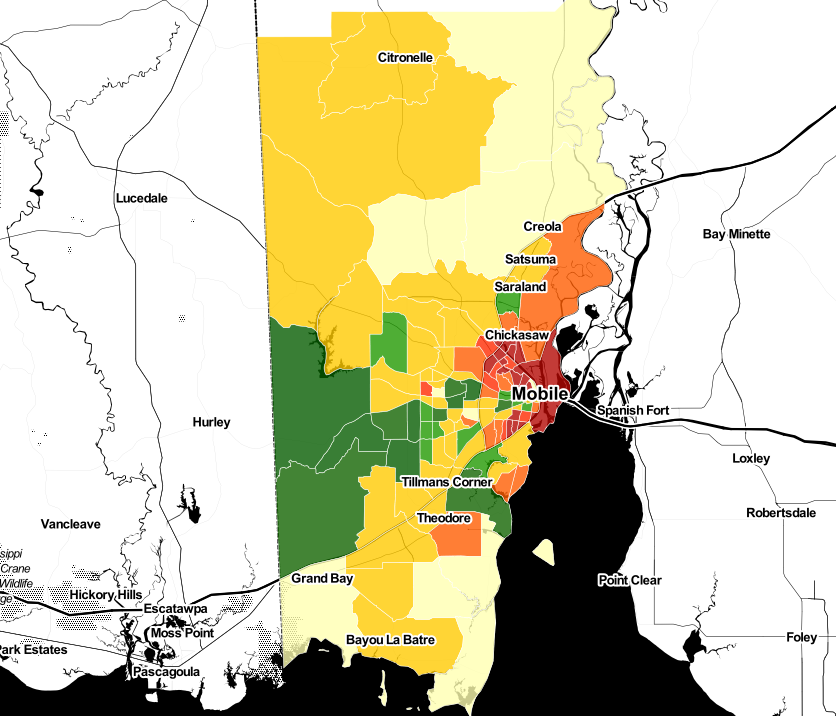

Where to begin your search? Roofstock created a heat map of Mobile based on our Neighborhood Rating, a dynamic algorithm that enables you to make informed investment decisions by measuring school district quality, home values, employment rates, income levels and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the Mobile housing market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a Mobile investment property that matches your search criteria.