Competition and housing price increases in Philadelphia were “insane” last year, although the market may have begun to cool, creating potential opportunity for real estate investors in Philly. According to one local real estate expert speaking about buyers, “Now would be the best time for them to buy because it’s not as competitive” as it was the first part of the year.

Sold listings leaving the market in 8 days, median home sales prices rising by 10.2% year-over-year, and the number of listings down 10.9% (April 2022 vs April 2021).

Kiplinger Personal Finance ranks the city as one of the most affordable places in the U.S. to buy a house, even while the percentage of renters keeps growing.

Philadelphia – also known as “Philly” and “The City of Brotherly Love” - is the largest city in Pennsylvania, is the urban center of the 8th largest metropolitan area in the U.S., and is the economic and cultural core of the Delaware Valley. The city was founded in 1682 by William Penn, making Philadelphia one of the oldest municipalities in the country.

The economy of Philadelphia is one of the most diverse in the country, with key business sectors including financial services, biotechnology and health care, information technology, trade and transportation, oil refining, and food processing.

Keep reading to learn why the real estate market in Philadelphia is attracting rental property investors in 2022.

>>Explore Roofstock's Philadelphia properties here.

Population growth

Philadelphia and the suburbs are driving population growth in the state, attracting new out-of-state residents and relocations from other parts of Pennsylvania. Over the past decade, the population of Philly grew by 5% while the suburban counties of Montgomery and Chester each grew by about 7%.

Key Population Stats:

- Philadelphia is the largest city in Pennsylvania with a population of over 1.6 million people and over 6.2 million residents in the greater metropolitan area.

- Population of Philadelphia decreased 1.7% year-over-year and by 5% over the past 10 years, according to the most recent census.

- Philadelphia has grown for 12 years in a row.

- There are 3.06 million employees in Philadelphia with employment growing 1.17% year-over-year.

- Unemployment in Philadelphia is 4.1% according to the most recent report from the BLS.

Job market

The economy in Philadelphia continues to show signs of recovery, with industries such as life sciences and the Center City District boosting economic growth.

Prior to the pandemic, the economy in Philadelphia had been expanding over the last several years, thanks to a growing job market, rising educational attainment, and a strong increase in residential building activity as developers struggled to meet the demand for housing in metropolitan Philadelphia.

As the economy and job market began growing again, the U.S. Bureau of Labor Statistics reports that the job sectors showing the fastest signs of rebounding include the construction, information, professional and business services, and leisure and hospitality sectors.

Key Employment Stats:

- GDP of the Philadelphia-Camden-Wilmington MSA is over $439 billion, according to the Federal Reserve Bank of St. Louis, and has grown by more than 27% over the last ten years.

- Job growth rate in Philadelphia is 1.17% year-over-year with median household incomes growing by 5.35% over the same time period.

- Median household income in Metro Philadelphia is $74,825 while per capita income is $40,420.

- Forbes ranks Philadelphia #88 as the best place for business and careers.

- With over 3.4 million workers, Philadelphia has the 7th largest labor force in the U.S.

- Key industry sectors in Philadelphia include financial and professional services, energy, information technology, life sciences, and logistics.

- Largest employers in the Philadelphia region include the University of Pennsylvania and Health System, Thomas Jefferson University and Jefferson Health, Virtua Health, and Comcast Corporation.

- Philadelphia is also home to the Philadelphia Stock Exchange, Comcast, Cigna, Colonial Penn, food services firm Aramark, GlaxoSmithKline, Pep Boys, and The Vanguard Group.

- Greater Philadelphia has nearly 100 colleges and universities, including the University of Pennsylvania (Wharton), Princeton University, University of Pennsylvania, and three of the top 30 liberal arts colleges in the U.S.

- Over 91% of the residents in Philadelphia are high school graduates or higher, while nearly 39% hold a bachelor’s degree or postgraduate degree.

- Philadelphia is a key location located midway between New York City and Washington, D.C.

- About 40% of the U.S. population is located within a one-day drive of Philly, and 60% of the population of the U.S. and Canada is within a two-hour flight.

- The Philadelphia metropolitan region is home to six international airports, UPS’s second-busiest shipping hub, the Port of Philadelphia, three major Interstate Highways, and the New Jersey and Pennsylvania Turnpikes.

Real estate market

Investors focusing on workforce housing rental property may find Philadelphia to be the perfect match. As recent research from The Pew Charitable Trusts notes, housing prices and rents in Philly have historically been lower than other big cities.

But over the last few years, prices have been moving up, with more people deciding to rent instead of own. Over one-third of renters surveyed by Pew say renting in Philadelphia is more affordable than owning, with less hassle and stress.

Key Market Stats:

- Zillow Home Value Index (ZHVI) for Philadelphia is $233,563 as of May 2022.

- Home values in Philadelphia have increased by 6.5% over the last year.

- Over the past five years home values in Philadelphia have increased by nearly 58%.

- Median list price of a home in Philadelphia is $279,900 according to the most recent research from Realtor.com (as of April 2022).

- Median listing price per square foot for a home in Philadelphia is $211.

- Days on market (median) is 55.

- Median sold price for a single-family home in Philadelphia is $280,000.

- Sale-to-list price ratio is 100%, meaning that on average homes in Philadelphia are selling for approximately the full asking price.

- Of the 152 neighborhoods in Philadelphia, Graduate Hospital is the most expensive with a median listing price of $670,000.

- Most affordable neighborhood in Philadelphia to buy a home is Frankford where the median listing price is $141,000.

Attractive renters’ market

Philadelphia is a real estate investor’s dream destination, according to an article on Auction.com. As the report notes, Philly’s strong and diverse economy, stable job market, and population growth are three of the many reasons for investing in the City of Brotherly Love.

Key Market Stats:

- Median rent in Philadelphia is $1,900 per month for a 3-bedroom home, according to the most recent report by Zumper (June 2022).

- Rents in Philadelphia have remained steady year-over-year.

- Over the past 3 years, rents for a 3-bedroom place in Philly have grown by 10.1%.

- Renter-occupied households in Philadelphia account for 46% of the total occupied housing units in the metropolitan area.

- Neighborhoods in Philadelphia with the highest rents include Center City West, Bala Cynwyd, and Avenue of the Arts South where average rents range between $4,182 and $5,925 per month.

- Cheapest neighborhoods for renters in Philadelphia include Juniata Park-Feltonville, Hunting Park, and Oak Lane-East Oak Lane where rents run $1,200 per month or less.

- Most popular neighborhoods in Philadelphia for renters are North Philadelphia West, Northern Liberties-Fishtown, and Spruce Hill.

Historic price changes & housing affordability

Two key housing market statistics that real estate investors can analyze to help determine the present and future demand for rental property are the trend in home prices and the affordability of buying a house versus renting.

The Freddie Mac House Price Index (FMHPI) measures the change in housing prices for real estate markets in the U.S. The report assigns December 2000 with a benchmark of 100 and then compares the monthly change in housing prices in every city and major metro area in the nation.

The most recent FMHPI from Freddie Mac for the housing market in the Philadelphia-Camden-Wilmington MSA:

- April 2017 HPI: 169.7

- April 2022 HPI: 253.4

- 5-year change in home prices: 49.3%

- One-year change in home prices: 13.5%

- Monthly change in home prices: 1.3%

Housing affordability is another statistic real estate investors review to determine the potential demand for rental property.

As a rule of thumb, markets where it is more expensive to buy a house usually see a higher percentage of renters. However, even though houses are affordable in Philadelphia, there is still a high percentage of renter households.

The most recent housing affordability report from Kiplinger’s Personal Finance surveyed home prices in the 100 largest metro areas in the country. The survey uses an affordability scale of 1 to 10, with 1 being the more affordable market to buy a home in and 10 being the least affordable.

The affordability index report for Philadelphia shows:

- Since the last real estate cycle market peak in May 2006, home prices in Philadelphia have increased by 6.9%.

- Since the last real estate cycle market bottom in March 2012, home prices in Philadelphia have increased by 48.4%.

- Philadelphia has an affordability index of 1 out of 10, meaning that Philadelphia is one of the most affordable markets to buy a home.

Quality of life

Philadelphia consistently ranks as one of the best places to visit in the U.S., and judging from the population, job growth, and unrivaled amenities in the metro area, it appears that once people come to Philly they decide to stay.

Key Quality of Life Stats:

- Cost of living in Philadelphia is 3% below the national average, according to Forbes.

- Niche.com gives the city high scores for outdoor activities, commute, and nightlife.

- Philadelphia has more affordable housing, and a lower cost of doing business than neighboring high-priced cities such as Boston, New York, and Washington, D.C.

- Philadelphia is the first and only world heritage city in the U.S., and played a key role during the American Revolution and served as the meeting place for the signing of the Declaration of Independence.

- Philly is home to 30 public gardens, including Bartram’s Garden, the oldest still-living botanical garden in North America.

- The Circuit Trails runs for 300 miles with interconnected hiking trails in nine counties in southeastern Pennsylvania and southern New Jersey.

- Philadelphia is one of the few U.S. cities to have all four major league sports teams.

- Climate in Philadelphia is humid subtropical, with hot and muggy summers and moderately cold winters.

- U.S. News & World Report ranks the Philadelphia metro area as one of the best places to live in Pennsylvania, the 19th best place to retire in the U.S.

Get out the map

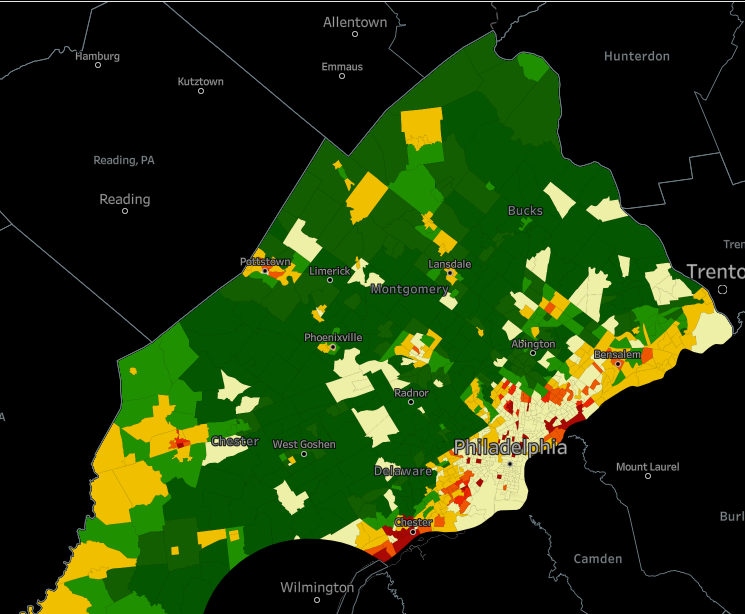

Where to begin your search? Roofstock created a heat map of Philadelphia based on our Neighborhood Rating, a dynamic algorithm that enables you to make informed investment decisions by measuring school district quality, home values, employment rates, income levels, and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the Philadelphia housing market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a Philadelphia, Pennsylvania investment property that matches your search criteria.