Single-family rental (SFR) property continues to attract capital from both private investors and large institutional firms.

Annual rent growth in the SFR asset class hit a record high in 2021, increasing 12% in December 2021, the fastest year-over-year increase in more than 16 years. In fact, single-family rents in 2021 increased by more than 3 times the 2020 rate.

Investors are purchasing rental property for recurring income, long-term appreciation, and a hedge against rapidly rising inflation and an increasingly volatile stock market. In today’s real estate market, people are using online platforms like Roofstock.com and RentersWarehouse.com to buy and sell SFR property.

In this article, we’ll take a look at how each company works and review key differences between the two.

Key takeaways

- Both Roofstock and Renters Warehouse provide online platforms for investing in rental property.

- Roofstock is the #1 marketplace for buying and selling SFR homes.

- The Roofstock Marketplace has hundreds of single-family and small multifamily properties listed for sale, including homes already occupied by tenants.

- Renters Warehouse lists homes that have never been rented before but provides leasing and property management services to help investors achieve their goals.

How Roofstock and Renters Warehouse work

Roofstock and Renters Warehouse both provide online platforms for investing in rental property, but they do so in slightly different ways.

Roofstock operates the #1 marketplace for buying and selling SFR homes that are currently used as rental property, many of which are already occupied by tenants. In less than 6 years, buyers and sellers have completed more than $4 billion in transactions on the Roofstock Marketplace.

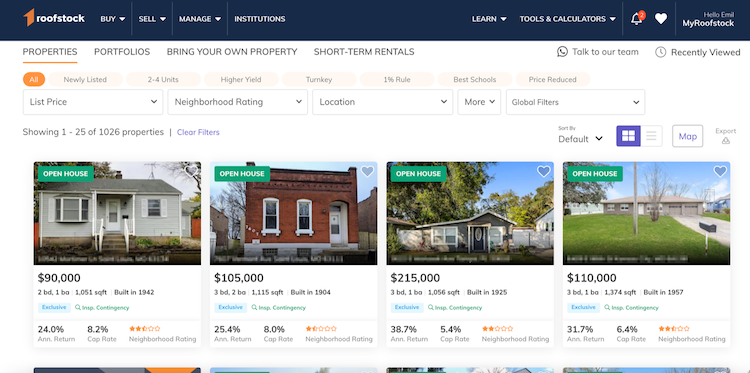

At any one time, there are hundreds of SFRs and small multifamily properties listed for sale in more than 70 markets and 24 states. Investors can browse rental properties listed for sale using over 30 different search criteria, such as list price, higher yield, occupancy, school ratings, and price reduction.

Renters Warehouse calls itself America’s full-service property management and investment services company for SFR homes and provides property management and leasing services. These services are important because many of the homes listed for sale on the company’s website have never been used as rental properties before.

The company operates in 25 states and over 42 markets, and it also sells franchise opportunities to people wishing to become a Renters Warehouse franchisee.

Roofstock

Roofstock is a good choice for investors looking for SFR homes that are already rented to tenants or currently waiting for a new tenant.

The Roofstock Marketplace has hundreds of homes listed for sale, including SFRs, small multifamily properties, short-term vacation rentals, built-to-rent homes by Lennar Homes, portfolios of rental properties, and Tracking Stocks tied to the economic performance of fully managed property portfolios through Roofstock One.

Investors are able to search for rental property using over 30 different search filters. Having more options to find a property can make it easier to find investment properties that match an investor’s chosen strategy, such as maximizing cash flow or homes in markets with high levels of appreciation.

The buying process on Roofstock is similar to the way any other home-buying transaction works, except the entire purchase can be done entirely online from start to finish. After escrow closes, a new owner has the option of selecting a local property management company or self-managing the rental home. Roofstock can even recommend professional property managers to buyers.

Fee structure

Roofstock is completely transparent about the fees buyers and sellers pay to transact an investment property sale on the website:

- Sellers pay a fee equal to 3% of the sale price or $2,500 (whichever is greater).

- Buyers pay a fee equal to 0.5% of the purchase price or $500 (whichever is greater).

- No recurring fees are paid to Roofstock after the sales transaction closes.

Operating expenses

In addition to a one-time purchase fee, there are other expenses of owning and operating a rental property investors are responsible for:

- Property management fees (if using a property manager)

- Maintenance and repairs

- Property insurance

- Property taxes

- Mortgage (if the property is financed)

- Capital expense reserves (such as setting aside money for a major repair)

Operating expenses like these are normally covered by the income from tenant rent payments, unless the property is vacant or it takes longer than expected to find a qualified tenant.

Feature summary

Roofstock makes researching a property easy by including pictures and street views, title reports, and tenant lease information and a rent roll if the home is currently occupied.

Investors can search for rental property using more than 30 different search filters and key metrics, including:

- Location

- List price

- Occupancy (rented long term, month to month, or vacant)

- Monthly rent price

- Remaining months on lease

- Square footage

- Number of beds and baths

- Higher yield

- 1% Rule

- Gross yield

- Cap rate

- Annual appreciation

- Price reduction

- Cash only

- Discount to valuation

- New listings

- Minimum year built

- Neighborhood rating

- School rating

- 2 to 4 units

- Section 8

Pros

- Roofstock has hundreds of listings for SFRs and multifamily homes that are currently used as rental property, often with a tenant already in place.

- Cash flow begins immediately with rental property that has been pre-inspected and already leased to qualified tenants.

- Roofstock has seen more than $4 billion in completed SFR transactions on its platform in less than 6 years.

- Low, transparent, one-time transaction fees.

- Roofstock’s fully online process may simplify the process of remote real estate investing in primary, secondary, and tertiary markets across the country.

Cons

- Roofstock may not be the best choice for investors looking for homes also listed on the MLS, fix and flips, or properties with deep discounts.

- Roofstock does not sell franchise opportunities or directly provide property management and leasing services, instead focusing solely on democratizing the process for buying and selling rental property online.

Renters Warehouse

Renters Warehouse bills itself as America’s full-service property management and investment services company for SFR homes. The company has offices in over 42 markets and 25 states, and it also sells franchise opportunities for people wanting to become a Renters Warehouse franchisee.

There are thousands of homes listed for sale on the Renters Warehouse website, many of which are also listed by area real estate agents on the local MLS. Because not all of these homes are currently used as rental properties, the company provides online tools for estimating rent, modeling a mortgage, and creating pro forma financial statements using different financing, income, and expense variables.

In addition to connecting investors to local real estate agents with home listings, Renters Warehouse also provides resident placement and property management services.

Fee structure

Renters Warehouse does not explain on its website if the company receives a fee for selling a home listed by another real estate broker, although the company does participate in broker reciprocity. Generally speaking, broker reciprocity pools listings from participating listing brokers to allow another broker like Renters Warehouse to market the entire pool of listings as their own and receive compensation when property is sold.

The cost for an owner to sell a property on the Renters Warehouse website is 4% of the sales price, with the company taking listings on an exclusive right-to-sell basis. Homes listed by sellers are not marketed anyplace other than the Renters Warehouse website.

Renters Warehouse uses flat-rate pricing for property management, with prices varying from market to market. In addition to a flat price per unit per month, the company also may collect an account set-up fee and an eviction fee. Standard services include monthly rent collection, coordination of maintenance requests, assistance with compliance and legal paperwork, routine inspections, and monthly and year-end financial statements.

Resident placement services include marketing a vacant listing on hundreds of websites, showing properties to prospective tenants, screening applicants, and preparing and assisting with all lease documents. Each lease comes with a free 6-month warranty on all placed residents. Leasing fees vary from market to market, and may run between one and 2 months of rent depending on the length of the lease, plus a flat lease signing fee and lease renewal fee.

Feature summary

Some of the key features offered by Renters Warehouse include:

- Investor services, including shopping for a home online, listing a property for sale, creating pro forma financial reports for each property listing, free rent price analysis, and property valuation

- Property management services with flat-rate pricing, resident placement services, and added services, such as resident liability insurance and eviction plan protection

- Resident placement services include marketing vacant properties, showing homes to prospective tenants, tenant screening, preparation of lease documents, and a free 6-month resident warranty program for which the company will provide additional resident placement services for free if a resident defaults

- Portfolio services for large investors with a single point of contact, institutional level reporting, and standardized services

- Franchise opportunities for investors interested in becoming a Renters Warehouse franchisee

Pros

- Renters Warehouse has offices in 42 markets in 25 states.

- A wide array of services include home buying and selling, leasing, property management, and portfolio services for professional investors and institutions.

- Thousands of homes listed for sale by pooling MLS listings from other real estate brokers offer a wide range of available properties.

- Investors can receive a property valuation and rent analysis online and create pro forma financial statements for each property listing to calculate items such as net operating income (NOI), cash flow, cash-on-cash return, gross and net yield, and return on investment (ROI).

- Tenants can search for a home for rent on the Renters Warehouse website, speak with one of the company’s real estate advisors, and schedule a showing.

- Flat-rate monthly property management fees help to reduce profit and loss (P&L) variability.

Cons

- It’s unclear if Renters Warehouse earns money when a home listed on the company’s website is sold and if any compensation is factored into the asking price of listings.

- Search options for finding a home are limited to 14 filters, which may make finding the right property difficult.

- Many homes listed for sale are not currently rented, which may result in negative cash flow until a lease is signed with a qualified tenant.

- Short-term vacation rental properties and Tracking Stocks are not available for purchase on the Renters Warehouse website.

Roofstock vs. Renters Warehouse: How to decide?

Roofstock and Renters Warehouse provide online platforms for investors to purchase rental property. However, while Roofstock focuses mainly on homes that are already being used as rentals, Renters Warehouse may list homes that have never been rented before.

Roofstock provides investors with more options to search for investment properties and perform research on hundreds of SFR homes and small multifamily properties, many of which are already rented to tenants.

On the other hand, Renters Warehouse uses a broader approach by listing many homes that have never been used as rental property before. The platform also has less than half of the search filters Roofstock does, which may make finding the right investment property more difficult.

Before investing in a rental property, investors may wish to conduct their own due diligence and financial analysis by:

- Making sure that rent comparables are not over or understated, especially when a home has never been rented before

- Checking if property taxes will increase if a home that was previously a primary residence is turned into a rental property

- Ensuring the listing price of a property is correct by running sales comparables and ordering a professional property appraisal

- Including a realistic capital expense (CapEx) reserve based on the property condition and an accurate vacancy factor based on actual current market vacancy rates