As the cost of housing continues to rise across the country, it’s becoming more and more difficult for families to make ends meet.

Section 8 housing vouchers provide tenants with a safe and well-maintained home, while offering investors in Section 8 real estate potentially strong cash flow, a pre-screened pool of tenants, and rental property with very low tenant turnover.

What is Section 8 housing?

Section 8 is part of the Housing and Community Development Act of 1974 created to assist low-income renters.

The program is overseen by the Department of Housing and Urban Development (HUD) and is administered by the local public housing agency (PHA) found in all 50 states.

The requirements for a tenant to become eligible for Section 8 vary from state to state and are based on income and family size. If approved, Section 8 tenants receive rent vouchers that pay up to 70% of their monthly rent and utility costs.

How Section 8 real estate works

Here’s an overview of how Section 8 real estate works for property investors and tenants with housing vouchers.

Tenant-based vs. project-based Section 8

- Tenant-based Section 8 vouchers move with the tenant. They’re difficult to obtain, and tenants often wait years to receive one. Once they do, there are strict rules the tenant must follow to avoid losing the voucher and having to reapply.

- Project-based Section 8 vouchers are attached to a specific property. If the tenant moves, the property remains Section 8 for the next qualified resident.

How tenants qualify for Section 8

State PHAs determine the eligibility for housing vouchers based on total gross income and family size. Assistance is limited to U.S. citizens and certain categories of non-citizens who have eligible immigration status.

Total family income can’t exceed 50% of the median income for the country or metropolitan area where the family lives, in most cases. PHAs by law must provide 75% of their vouchers to applicants whose incomes don’t exceed 30% of the area median income levels that are published by HUD.

Tenants applying for Section 8 assistance must provide the PHA with information on family income, assets, and family composition. Once the PHA verifies the applicant information, the agency determines program eligibility and the amount of housing assistance payment. Then, the tenant goes on a waiting list for an available Section 8 property if there isn’t one available right away.

Tenant, Landlord, PHA, and HUD in Section 8

Tenants, landlords, PHA, and HUD all play specific roles in Section 8 housing:

Tenant: After the PHA approves the lease and house the tenant wants to rent, the tenant signs a minimum one-year lease with the landlord. The landlord may require a security deposit, depending on local housing law. At the end of the lease, the landlord and tenant may renew the lease or stay month-to-month, if allowed by the landlord.

Tenants must follow the terms of the lease, keep the property in good condition, and notify the PHA of any changes to family income or composition.

Landlord: After passing the PHA property inspection, the landlord must provide the tenant safe and well maintained housing and a reasonable rent for the period the home is occupied by the Section 8 tenant. The landlord must also provide all agreed-to services and adhere to the terms of the lease.

PHA: PHA administers the Section 8 voucher program at the local level, examines the tenant income and family composition, and inspects the quality standards of the rental property annually. If the landlord fails to meet the owner obligations under the lease, the PHA may terminate the housing voucher payments to the landlord.

HUD: HUD monitors PHA programs to ensure rules are being properly followed, provides funds to PHAs to make housing assistance payments, and reviews PHA applications for additional funding as money becomes available.

Pros and cons of investing in Section 8 real estate

At one time or another, almost every single-family rental property investor will be asked by a prospective tenant if they accept Section 8 housing vouchers. The decision on whether or not to rent to a Section 8 tenant depends on the investor, investment strategy, and property.

Here are some of the top pros and cons of Section 8 real estate.

Pros of Section 8

- Stable and guaranteed monthly rental income with the government paying up to 70% of the Section 8 tenant’s monthly rent and utility bills.

- Vacancy rates in Section 8 real estate can be lower because tenants tend to stay where they are and renew year after year.

- Fast unit turns and lease-up periods because in many markets there’s a waiting list of Section 8 tenants looking for a home to rent.

- HUD knows that there’s frequently a shortage of landlords willing to rent to Section 8 tenants, so the government agency often allows owners to set rental rates at the higher end of the fair market rent spectrum.

- Marketing costs can be lower with Section 8 real estate because landlords are able to list their available property on local public housing authority websites for Section 8 voucher holders to see.

Cons of Section 8

- Government bureaucracy, red tape, and the length of the approval process for becoming a Section 8 landlord can be frustrating, potentially reducing the profits a property owner could make by renting to non-Section 8 tenants.

- Delayed payment processing of up to 60 days before the first payment from the government is received each time the property is rented to a new Section 8 tenant.

- Additional property inspections are required by HUD for Section 8 tenants, both at the time the landlord applies for Section 8 and every year.

- Property owners should still conduct the same routine tenant application process, credit and background checks used for non-Section 8 tenants.

- Evicting a tenant using a housing voucher for rent is much more complicated than a regular eviction – in fact, HUD publishes a 29-page guide on the required procedures to evict a Section 8 tenant.

Another potential argument against investing in Section 8 real estate is potential crime issues. Some academic research reports that housing vouchers increase violent crime, while others find that housing voucher recipients don’t cause crime.

How to become a Section 8 landlord

Section 8 landlords are required to provide decent, safe, and sanitary housing to a tenant at a reasonable rent, according to HUD.

Section 8 real estate must pass the housing quality standards set by HUD and be maintained to those standards as long as the owner receives housing assistance payments. Property owners sign a contract with the state PHA (public housing agency) and are required to provide the services agreed to in the tenant’s lease and the PHA agreement.

There are four general steps to follow to become a Section 8 landlord:

1. Inform the state public housing authority of the availability of your property, complete the application, and provide any requested personal information. The PHA will also review your rental rates to ensure they fall within the guidelines for comparable rental property in your area and may require you to lower the rent if it is too high.

2. After the PHA has approved you as a Section 8 landlord, an inspector will visit the property to make sure it meets HUD guidelines, and local building and safety codes.

3. Once your property has passed inspection, you can begin advertising your rental home as available to Section 8 voucher holders. The state PHA will add your property to their list, and you can also market your Section 8 real estate for rent on websites such as Zillow and GoSection8.

4. After you’ve completed your routine tenant screening and agreed to rent to a Section 8 tenant, there are several forms to submit to the state public housing authority:

- Landlord information form describing the property owner and unit

- HAP Contract or Housing Assistance Payments Contract

- Copy of your standard rental property lease agreement

- HUD Tenancy Addendum attached to your standard lease

- HUD Request for Tenancy Approval form

- W-9 form that includes your tenant’s information

It can take up to 60 days for a Section 8 landlord to receive HUD’s portion of the first rent payment. Once you’re in the system, funds will be deposited directly into your bank account.

Where to find Section 8 real estate for sale

Investing in Section 8 real estate can be a good choice for investors seeking houses with long-term cash flow potential. Some property management companies specialize in leasing and managing Section 8 rental property for investors, so they’re already familiar with the hoops to jump through to get your single-family rental Section 8 approved.

There are several good ways to locate Section 8 real estate for sale. HUD sells both single-family and multifamily property through HUD and various other federal agencies. Zillow and Zillow Research is another good source to locate areas where Section 8 housing is being advertised for rent, and to identify neighborhoods with incomes below the area’s median income.

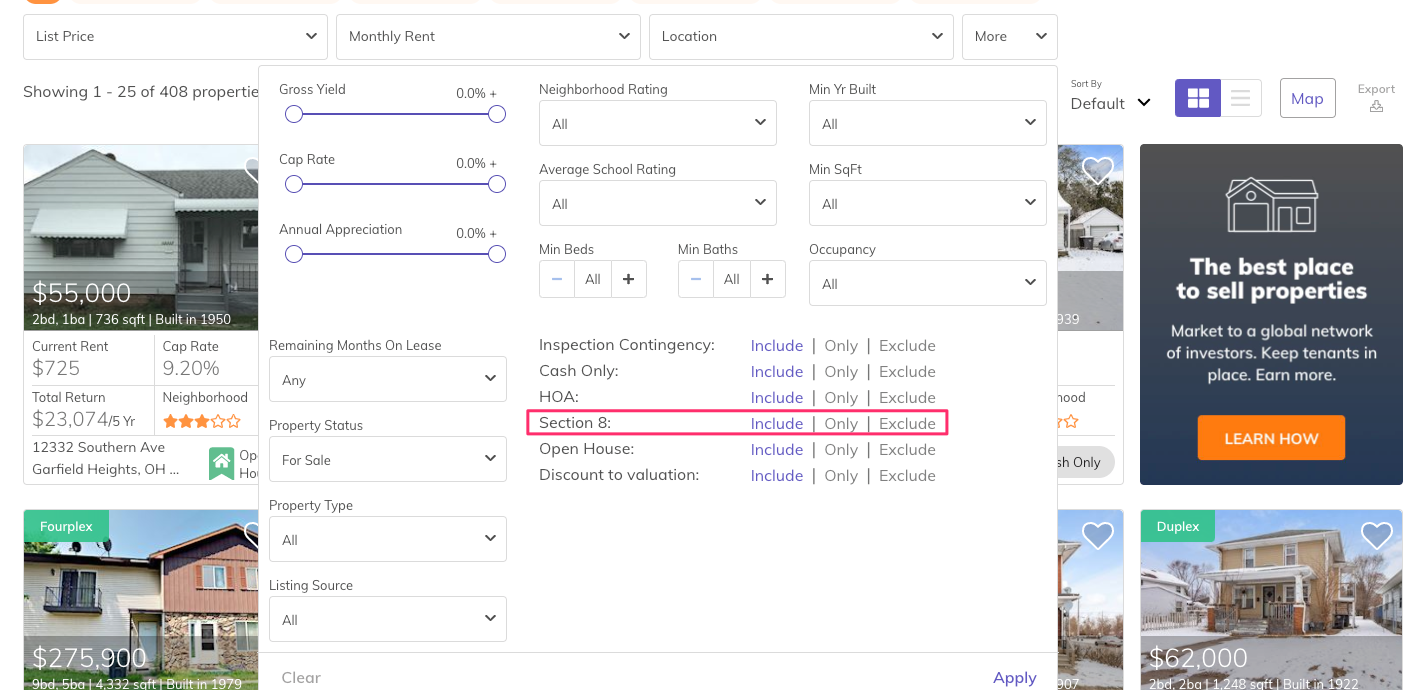

Once you’ve narrowed your search down to specific areas, the Roofstock marketplace makes it easy to search for Section 8 real estate for sale. Simply click on the “More” tab for additional search options, then scroll down and select the option for “Section 8 Only.”

From there, you’ll be able to view cap rates and yields, and generate a property pro forma for each Section 8 home you’re considering investing in.