The St. Louis real estate market is grappling with a lack of housing inventory, pushing median sales prices up month after month and inventory down to near all-time lows. A shortage of homes to buy in St. Louis is one reason that the market ranks as one of the best for rental property, with more than half of the households in St. Louis occupied by renters.

Nestled on the banks of the Mighty Mississippi River, just below its confluence with the Missouri River, sits the vibrant and storied Gateway to the West, St. Louis.

Known for beer, barbecue, and the Blues, this town boasts the kind of appeal that makes it an ideal real estate investment market.

With a growing population working in the tech and creative sectors, and anchored by established brands like Anheuser-Busch, Boeing, and Emerson Electric, St. Louis seamlessly blends the new economy with powerhouse Fortune 500 entities. All of those companies translate into a highly skilled and educated workforce with money to spend.

We’ve put together your guide to the St. Louis real estate market, including both the current investment scene and future potential over the next year.

>>Explore Roofstock's St. Louis properties here.

Population growth

The St. Louis region grew by only 1.2% over the past 10 years. Over the last few years, people priced out of bigger cities have been moving to St. Louis where prices are affordable and the quality of life is considered great.

Key Population Stats:

- St. Louis is home to over 300,000 people in the city and more than 2.8 million residents in the metropolitan area.

- Population of St. Louis declined by 0.12% last year and has grown by 1.2% over the past decade.

- St. Louis is the largest metropolitan area in Missouri and the seventh-largest metro area in the Great Lake Region.

- Major counties in metropolitan St. Louis include Franklin, Jefferson, Lincoln, and St. Louis counties in Missouri, along with Bond, Clinton, Madison, and Monroe in Illinois.

- Per capita income in St. Louis is $36,995 and median household income is $65,725.

Job market

Although the rate of employment in the state is slowing, job growth in St. Louis is still going up. The job market in St. Louis grew by nearly 0.02% last year, according to Data USA. The U.S. Bureau of Labor Statistics (BLS) reports that (as of April 2022) unemployment in the St. Louis MSA is down to just 2.9% with most employment sectors on the rebound.

Key Employment Stats:

- GDP of the St. Louis, MO-IL MSA is nearly $171.5 billion, according to the Federal Reserve Bank of St. Louis, and has grown by nearly 23% over the last 10 years.

- Employment growth in St. Louis is 0.02% year-over-year with the metro area home to over 1.4 million employees.

- Median household incomes in St. Louis grew by nearly 6% year-over-year while median property values increased by over 2% over the past 12 months.

- Unemployment rate in St. Louis is 2.9% (as of April 2022) with the construction, manufacturing, leisure and hospitality, and professional and business services sectors showing the fastest signs of new growth (BLS).

- Major industry sectors in St. Louis include aerospace, food processing, chemicals, electrical equipment manufacturing, bio-technology, and printing and publishing.

- Largest employers in St. Louis include BJC HealthCare, Mercy, Washington University in St. Louis, Boeing Defense, and SSM Health.

- St. Louis is home to three national research universities: University of Missouri-St. Louis, Washington University in St. Louis, and Saint Louis University.

- Nearly 93% of the residents of St. Louis are high school graduates or higher, while almost 36% hold a bachelor’s degree or advanced degree.

- Transportation infrastructure of St. Louis includes four interstate highways, metro light rail and subway, freight rail service, two airports, and the Port of St. Louis.

Real estate market

Now might be a good time to buy a home in St. Louis with some “normalcy,” according to report from KSDK TV. As one local real estate expert notes, a property that may have had 30 offers last year might have 6 today. While activity is slowing down somewhat, buyers should still be prepared to act quickly.

Key Market Stats:

- Zillow Home Value Index (ZHVI) for St. Louis is $173,968 through May 2022.

- Home values in St. Louis increased by 12.1% over the last year.

- Over the last five years home values in St. Louis increased by nearly 60%.

- Median sales price of a single-family home in St. Louis is $275,000 based on the most recent housing report from St. Louis Realtors (May 2022).

- Median sales price of a single-family home in St. Louis has increased by 3.8% year-over-year.

- Average days on market until sale is 19 days vs. 23 days last year.

- Pending sales of single-family homes in St. Louis are down about 10% compared to last year.

- Months supply of inventory is only 1.2 months, a decrease of 7.7% year-over-year.

- Home sellers in St. Louis continue to benefit from tight market conditions with attractive mortgage rates and a low supply of inventory.

Strong renters’ market

St. Louis is one of the best 100 cities for renters, according to recent research from WalletHub. The report analyzes the same key criteria real estate investors use, including activity in the rental market, job and population growth, and the preference of households to rent rather than own. In fact, more than half of the household units in St. Louis are occupied by renters.

Key Market Stats:

- Median rent in St. Louis is $1,397 per month for a 3-bedroom home, based on the most recent research from Zumper (June 2022).

- Rents in St. Louis have decreased by 6% year-over-year.

- Renter-occupied households in St. Louis account for 54% of the total occupied housing units in the metropolitan area.

- Most affordable neighborhoods in St. Louis for renters include Holly Hills, Mark Twain-I-70 Industrial, and Walnut Park East where rents are $865 per month or less.

- Most expensive neighborhoods in St. Louis for renters include Downtown St. Louis, Wydown Skinker, and Tower Grove East where average rent goes for $2,123 to $2,823 per month.

Historic price changes & housing affordability

Two key data sets experienced real estate investors use to predict the potential demand for rental property in St. Louis are the historic price changes and the affordability of housing in the metropolitan area.

Each month Freddie Mac publishes a house price index report (FMHPI) that updates the short- and long-term trends of home prices in all major markets in the U.S.

The most recent FMHPI from Freddie for the St. Louis, MO – IL MSA reveals:

- April 2017 HPI: 139.4

- April 2022 HPI: 202.6

- 5-year change in house prices: 45.3%

- One-year change in house prices: 12.3%

- Monthly change in home prices: 1.4%

Experienced real estate investors in St. Louis also research housing affordability to help forecast the current and future demand for rental real estate. Affordability compares the amount of annual income needed to purchase a median-priced home in St. Louis.

Business forecast and personal finance publication Kiplinger publishes a housing affordability report for the top 100 metropolitan areas in the U.S. The firm ranks affordability on a scale of 1 to 10, with 1 representing the most affordable markets and 10 the least affordable.

Kiplinger’s analysis of housing affordability in St. Louis reports:

- Since the last real estate cycle market peak in May 2006, home prices in St. Louis have declined by 3.3%.

- Since the last real estate cycle market bottom in March 2012, home prices in St. Louis have increased by 58.1%.

- St. Louis has an affordability index of 3 out of 10, but even though housing affordability in the market is mid-range more than half of the households in St. Louis still prefer to rent rather than own.

Quality of life

St. Louis is a city with good salaries, a high quality of life, and a low cost of living. As The Ascent by Motley Fool reports, there’s a “low cost of living large in St. Louis.”

Key Quality of Life Stats:

- Cost of living in St. Louis is lower than other Midwestern cities such as Chicago, Milwaukee, and Columbus.

- Forbes ranked St. Louis as one of the best places for business and careers last year, noting that high-tech employment in the metro area grew by 2.2%.

- Niche.com gives St. Louis high ratings for outdoor activities, cost of living, and nightlife.

- Some of the best neighborhoods in St. Louis to live include Hi-Pointe, Shaw, Debaliviere Place, Kings Oak, and Skinker-Debaliviere.

- St. Louis is one of the best places to live and to retire in the country, based on the most recent research by U.S. News & World Report.

- St. Louis is known as a bio-tech and business center and is home to almost 40 colleges and universities.

- Major attractions in St. Louis include The Gateway Arch, numerous museums such as the St. Louis Art Museum and the Missouri History Museum, and the world-famous St. Louis Symphony Orchestra.

- Pro sports teams in the St. Louis area include the MLB St. Louis Cardinals and the St. Louis Blues ice hockey team.

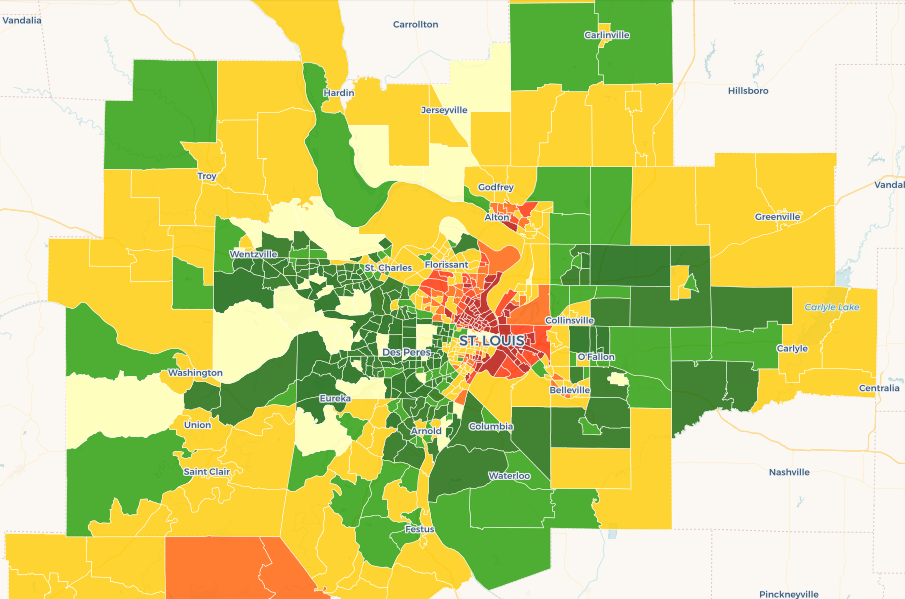

Check the map

Where to begin your search? Roofstock created a heat map of St. Louis based on our Neighborhood Rating, a dynamic algorithm that enables you to make informed investment decisions by measuring school district quality, home values, employment rates, income levels and other vital investment criteria.

DARK GREEN: 4-5 star neighborhood

LIGHT GREEN: 3.5-4 star neighborhood

YELLOW: 2.5-3 star neighborhood

ORANGE: 2 star neighborhood

RED: 1 star neighborhood

Ready to invest in the St. Louis housing market? If you haven't already done so, create your free Roofstock account and set up alerts. We'll notify you when we have a St. Louis investment property that matches your search criteria.