Here’s a scenario: You just closed on an awesome investment property and you eagerly share the big news with your friends.

“What’s the ROI [return on investment]?” they ask.

“It’s amazing!” you say. “It’s …”

Then it hits you. You’re not sure how to answer the question, because there are a number of possible answers.

Are they talking about capitalization rate? Cash-on-cash return? Internal rate of return? Cash flow? Appreciation?

Every investor has their own understanding of what an "amazing" ROI is. In this article, we’ll look at defining your investment goals (namely, cash flow vs. appreciation) and run through the primary formulas for calculating rental property ROI.

Defining your investment goals

To calculate rental property ROI, you need to first define your investment priorities and goals. Ask yourself: Are you investing for cash flow or are you investing for appreciation?

I know, I know, the answer is both. But when you start to analyze properties, you’ll quickly find that it’s difficult to achieve both high cash flow and high appreciation. I’m not saying it’s impossible, but typically properties with great cash flow have a slower rate of appreciation, and vice versa — properties that have a faster rate of appreciation typically don’t have high cash flow.

Why?

Because rental rates don’t increase as fast as home values in rapidly appreciating markets. The ratios just don’t work out (from a cash flow perspective) at a certain purchase price.

For example, a Midwest property that sells for $250,000 and rents for $2,500 a month might generate strong cash flow but have a “slow” expected appreciation rate of ~1% annually. On the other end of the spectrum, a West Coast property that sells for $450,000 and rents for $2,500 a month may have a higher expected appreciation rate of ~3.5% annually — but higher monthly mortgage payments could mean you receive less (if any) cash flow.

Now, let’s jump into the specific metrics used to calculate rental property ROI and talk through a real-life example.

Metrics for calculating rental property ROI

1. Cash flow (aka, the key to financial independence)

“Cash is king.” Yep. That old adage is kind of true. Cash flow is the amount of cash you have left over each month from a rental property after paying all the operating expenses and setting aside money for any future repairs.

Cash flow = gross rental income - expenses

Here’s a real-life example of how to calculate the monthly cash flow from a property I own in Indianapolis (a Roofstock market).

>>Related: 10 Reasons I’ll buy more rental properties in Indianapolis

Monthly rental income: $1,000

Monthly operating expenses:

- Mortgage: $346

- Property taxes: $216

- Insurance: $46

- Property management: $90 (For me, this is 9% of my rental income. Note that fees vary between property management companies)

- Vacancy reserves: $50 (5% of my rental income, adjustable depending on risk tolerance)

- Repair reserves: $100 (10% of my rental income, adjustable depending on risk tolerance)

Total monthly expenses: $842

Cash flow: $152 ($1,000 - $842)

Tip: For a quick and easy cash flow estimate, check out Roofstock’s new rental property ROI calculator, Cloudhouse. Enter the address of any single-family rental home in the U.S. and get a complete forecast of potential return. Roofstock also provides cash flow estimates for every property listed on its marketplace.

2. Cash-on-cash return (aka, the sexy number investors love)

The cash-on-cash return is a good gauge of how well an investment property will perform. It expresses the ratio of annual cash flow to the amount of actual cash you invested upfront.

Cash-on-cash return = annual cash flow / initial cash out of pocket

Personally, I look for properties that produce at least 7% cash-on-cash return, as you can historically get about 7% by investing in long-term index funds. I want to beat index funds.

Looking at the same real-life property example as before, here’s how to calculate the cash-on-cash return:

Monthly cash flow: $152

Annual cash flow: $1,824 ($152 x 12 months)

Initial cash out of pocket: $22,400 (down payment + closing costs + rehab costs)

Cash-on-cash return = 8.14% ($1,824 / $22,400)

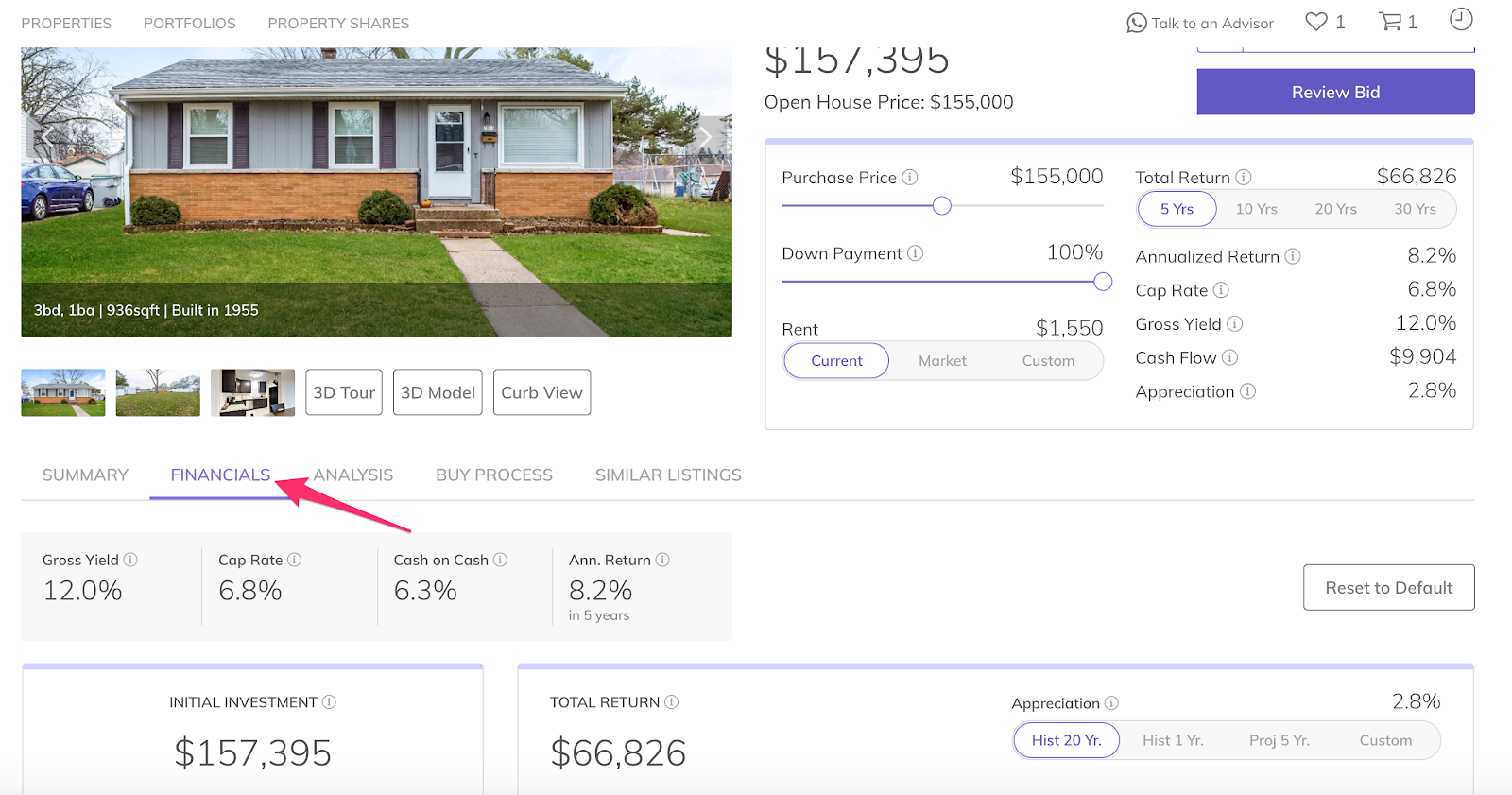

Tip: Roofstock provides a full financial snapshot for every property listed on its marketplace. To view estimated cash-on-cash return for any property, click on the “Financials” tab within the property details page.

3. Net operating income (aka, monthly income without factoring in a mortgage)

The net operating income, or NOI, is similar to cash flow in that it’s a measurement of rental income minus vacancy and operating expenses. The biggest difference between cash flow and NOI is that NOI does not factor in mortgage expenses.

NOI = (rental income + other income) - vacancy losses and operating expenses

Looking again at my real-life property example, here’s how to calculate NOI:

NOI = $1,000 (rental income) - $50 (vacancy reserves) - $452 (operating expenses) = $498

NOI is useful when comparing multiple properties because it gives you a great gauge of returns without involving the intricacies of various loan terms.

4. Cap rate (aka, ROI without factoring in a mortgage)

The capitalization rate, or cap rate, is the estimated rate of return on an investment property. It is similar to cash-on-cash return, but (1) does not factor in loan expenses, and (2) looks at the purchase price instead of the amount of cash you initially invested.

Cap rate = NOI x 12 months / purchase price

Cue my real-life example:

Purchase price: $85,000

$498 (NOI) x 12 months = $5,976

Cap rate: 7% ($5,976 / $85,000)

5. Appreciation (aka, bonus ROI for investors who buy and hold)

Ahhh...the icing on the cake! Appreciation quite literally means an increase in the monetary value of your property.

The justification for investing in a slowly appreciating market with great cash flow (like in the Midwest or South, where I generally invest) is that any appreciation you see is a bonus. Let me explain.

If you’re investing for cash flow, it doesn’t really matter what your property is worth (until you sell it) as long as your your mortgage is fixed and the rental rate stays consistent or increases. So even if your property value fluctuates from year to year, it’s not a big deal if the desired monthly cash flow stays on target.

This is not to say that appreciation should totally be ignored or discounted, but it goes back to that initial question I asked. Are you investing for cash flow or appreciation?

If long-term appreciation is the name of the game and you’re banking on a big payout 10, 20, or 30 years down the road, here are a few indicators of an up-and-coming real estate market:

- Population growth

- Job growth with higher wages

- Diverse economy

- Strong occupancy rates

- Infrastructure development

- Lifestyle amenities

6. Internal rate of return (aka, the all-encompassing gauge of ROI)

The internal rate of return, or IRR, measures the rate of return earned on an investment during a specific time frame. It includes cash flow and any profits from a property’s sale. Simply put, IRR represents a property’s net cash flow and expected appreciation divided by the target hold time.

While IRR is a helpful way to estimate your asset’s performance over the entire time that you plan to hold it, it’s not the first metric I look at when evaluating real estate because it relies heavily on forecasting years of cash flow and a projected sale price. Since none of us has a crystal ball, forecasting years in advance is difficult to do and not always the most reliable.

7. The intangibles (aka, a little trial and error)

One of the greatest ROIs you can get can't be calculated on an Excel spreadsheet or a calculator: It’s the experience you gain from taking action.

Your first investment property might not be a home run. It’s not going to make you a billionaire. It’s not going to provide you with a life of financial freedom. And that’s perfectly fine — because it’s just the first step. And the first step leads to your second step. You will learn an invaluable amount by taking action, taking risks, and learning on the fly. Education, preparation and research is important, but the key is to get started.