What’s one of the most important factors when it comes to real estate investing?

FINDING A DEAL.

Everything starts with a deal. You need to source it, analyze it, and quickly figure out if it’s worth pursuing. The quicker you analyze it, the quicker you can make a move on it, or pivot to the next opportunity to find passive income.

Luckily, there’s an abundance of free resources out there to utilize when analyzing real estate for investment purposes. I’ve listed my top 10 tools and organized them into two categories:

- Comprehensive tools: which give an overall picture of the numbers behind a deal

- Niche tools: which provide specific information on factors that go into analyzing a property.

Alright, let’s do it. Let’s analyze!

Comprehensive Tools

These tools provide a detailed financial overview of a deal. Once you run a property through these analysis tools, you should be able to determine if you want to move forward with the property or let it go and move on to the next one.

You’ll have to note, that depending on the tool you use, you may need to understand how to estimate and research data on these factors:

- Mortgage

- Closing costs

- After repair value (ARV)

- Property Taxes

- Insurance

- Property Management Fees

- Vacancy

- Current and future repairs

- Homeowners Association (HOA) Dues

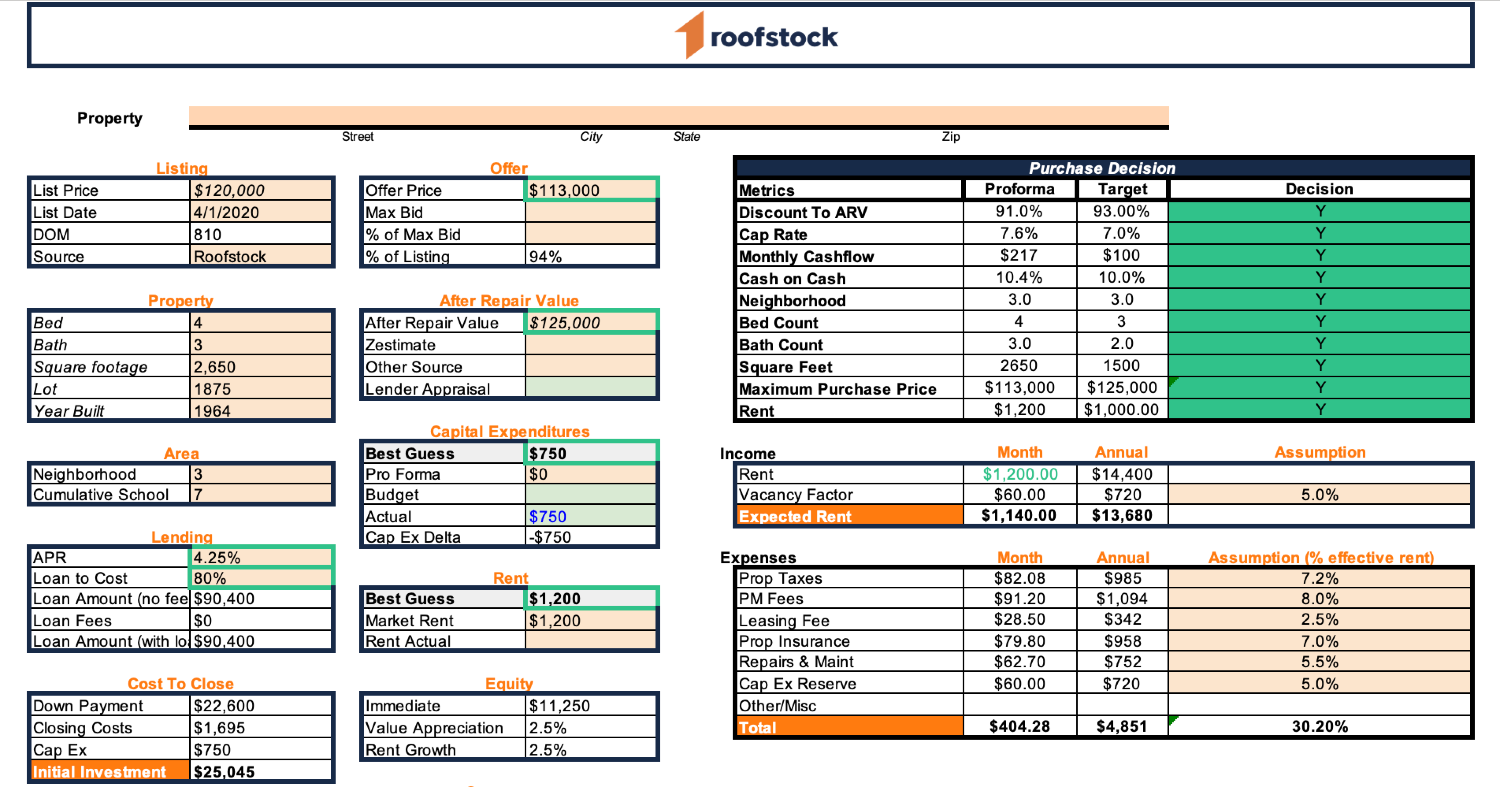

1. Roofstock's property analyzer spreadsheet

This simple spreadsheet by Roofstock provides an easy way to view the potential financial performance of a given property. You can use it to forecast the potential return of a property. Simply enter some information to view projected key return on investment (ROI) metrics, including cash flow, cash-on-cash return, net operating income, and cap rate.

Check it out here: https://learn.roofstock.com/blog/rental-property-analysis-spreadsheet

2. Deal Check

DealCheck is a great tool to help you analyze the ROI of an investment property on your computer, phone or tablet. It’s been around for a while and that’s one of its advantages, because they’ve been tweaking, updating, and advancing their tools for a long time, and they now have a very powerful and robust platform.

DealCheck covers all of the necessary and basic deal analysis, but in addition, it also helps by providing recent sales and rental comps. They have a cool tool for determining your highest offer price and you can create and share property reports. These reports come in hand if you need a PDF or hard-copy analysis to present to a lender, investor, or spouse when evaluating a deal. I’m a big fan.

In addition to being able to store photos and notes for a property right on their platform, they have a sleek app, so you can always have your investment analysis in your pocket and on the go.

Check it out here: https://dealcheck.io/

3. Roofstock rental property analysis spreadsheet

If you want something a little more simple, but that still packs a powerful punch, check out the free rental property analysis spreadsheet that Roofstock offers. It’s essentially an Excel spreadsheet where you can easily plug in numbers to determine investment potential.

What I love most about this spreadsheet is the Purchase Decision indicators, which display a snapshot showing if the deal lives up to the specific data-driven metrics you choose. For example, you can plug in a minimum cap rate, minimum cash on cash return, minimum monthly cash flow, along with many other metrics, and once you complete the spreadsheet it will conveniently display if the deal matches those standards or not.

In addition to the snazzy Purchase Indicators, you can analyze lending terms and costs, the cost to close, and equity, along with a ton of other valuable metrics.

Check it out here: https://learn.roofstock.com/blog/rental-property-analysis-spreadsheet

4. BiggerPockets rental analysis tools

Over the years, BiggerPockets has introduced a number of free online analysis tools and diversified them into categories such as Rental Property, Fix and Flip, BRRRR, Rehab Estimator, and much more.

These are some of the original calculators I used when just starting out on my investing career, but please note that you only can use them a few times for free. For unlimited use, you will have to sign up for their paid membership.

Similar to DealCheck and the Roofstock analysis spreadsheet, you plug in basic information regarding the property such as purchase price, loan details, income, and expenses. After that, it produces a clean looking report for your review. Plus, you can also save it as a PDF and print it out if a hard copy is needed.

Check it out here: https://www.biggerpockets.com/investment-calculators

5. RentZend

This is a newer calculator that I was only recently introduced to. After inputting your property address it populates a number of important data points needed to assess an investment. One aspect I like about this analysis tool is they have a very simple “Tax Benefits” section which displays the annual depreciation and loan interest you can utilize for tax purposes.

The one downside I’ve found, however, is that it pulls data from Zillow, which can often be inaccurate. For example, I analyzed one of my properties in Indianapolis and it calculated property taxes to be $1,000 when they are actually closer to $2,600. Luckily, you can easily edit all of the metrics needed to analyze, so as long as you know the accurate income and expense numbers on the subject property you’ll be good!

Check it out here: https://www.rentzend.com/tools/rental-analysis

Niche Tools

These tools take things a step further into the more micro analysis of property fundamentals. Not only do you need the overall big picture analysis that the previously listed tools provide, but you need to also have your numbers and data buttoned up in more niche categories such as estimating rent, mortgage payments, crime levels, flood zones, and property values.

Here are my top five niche tools that I use on the regular!

1. Rentometer - for estimating rent

This is one of the best tools out there to verify and confirm rental ranges for the property you’re analyzing. After you input the subject property’s address, Rentometer will pull information on comparable properties in the same neighborhood. It’ll display the average rent, median rent, data on specific percentiles, and show you a cool gauge of where your rent lands in comparison to the neighborhood. Many of the comprehensive tools listed earlier will estimate rental income for you, but it’s important to check income from multiple sources so you’re confident.

Check it out here: https://www.rentometer.com/

2. Bankrate - for estimating mortgage payments

Your go-to resource to check mortgage rates and payments should be your lender, but if you need a quick resource to verify the numbers, Bankrate.com is my recommended platform. Input home price, down payment percentage, and interest rate and you’ll be able to then verify monthly mortgage expenses which will be critical to your overall investment analysis.

They’ll even give you the full amortization schedule, so you can see just how much interest you’ll be paying the first few years.

Check it out here: https://www.bankrate.com/calculators/mortgages/mortgage-calculator.aspx

3. Trulia - for verifying crime levels

I’ve always found Trulia’s crime map to be very helpful and accurate when it comes to determining the safety and environment of a neighborhood. Plug in the address of the property you are analyzing, then scroll down to their crime map and you’ll see a color-coded map with nearby crime activity.

On their crime map, the darker blue areas are higher crime and lighter blue areas have less criminal activity. You can even click on specific reported crimes to review the police activity that took place. I am personally very wary of neighborhoods that show major crimes like shootings, homicides, or lots of drug activity.

4. FEMA - for reviewing flood zones

Newer real estate investors may not understand the importance or need to review flood zones. However, if a property you purchase ends up being in a flood zone, generally your insurance costs will be higher. This can be a major curveball and added expense if you are caught off guard.

Preserve your cash flow, and take the quick two minutes to search flood zones by using this platform: https://msc.fema.gov/portal/search

5. Roofstock - for Neighborhood Ratings

Location, location, location. It’s cliche and you hear it all the time, but the importance of location is critical in the world of real estate investing. Understanding location and neighborhood quality is the backbone of analyzing a property and determining investing potential.

That’s why I recommend Roofstock’s Neighborhood Rating tool which helps you discover insights for both buyers and sellers. Their system is one of a kind and is the first single-family rental rating index for US neighborhoods.

All you have to do is input your property address and it displays a summarized assessment of the neighborhood profile and its risks and rewards. Using a 1 to 5 star rating system, you can quickly determine if it's a property and neighborhood you want to invest in.

It also pulls data on median home value, median income, employment, school ratings, and the percentage of owner-occupied homes. Give this tool a shot when looking for a nice snapshot and analysis of neighborhoods!

Final Thoughts

There you have it - the top 10 recommended free tools and platforms to analyze your next investment property!

While we’re on the topic of analysis, I encourage you to read this post on the nuts and bolts of calculating Return on Investment (ROI). I'll show you the exact formulas and equations needed to calculate ROI on an investment property.

It’s also important to know that although these tools will provide you with a quick and easy way to understand the financials of a property, you must realize there’s much more that goes into a property than just the numbers on paper. Market, neighborhood, and the team you work with are among other factors that dictate the success of a real estate investment. Luckily, Roofstock can help you with all of those factors!

Now, before I conclude this post, I have a challenge for you: start analyzing five properties per day. Just do it! Get the hang of analyzing and you’ll be on your way to finding your next deal! Repetition makes you stronger.