The demand for single-family rental (SFR) property continues to increase, with a growing number of both private and institutional investors focused on the asset class.

Residential rental real estate is something that people can feel and touch, may provide recurring rental income and long-term appreciation, and can act as a hedge against stock market volatility and rapidly rising inflation.

Some of the best opportunities for investing in SFRs and small multifamily properties can be found in under-the-radar secondary and tertiary markets, with many investors using online platforms like Roofstock.com and NoradaRealEstate.com.

In this article, we’ll discuss how the two companies work, the key differences between them, and the pros and cons of each to help you decide which option is the best match for your unique investment goals and strategies.

Key takeaways

- Both Roofstock and Norada Real Estate Investments have single-family homes and small multifamily properties listed for sale online.

- Roofstock is the #1 marketplace for investing in SFR homes.

- The Roofstock Marketplace has hundreds of single-family and small multifamily properties listed for sale in over 70 markets.

- Norada Real Estate Investments has a more limited number of homes for sale in about 20 markets.

How Roofstock and Norada work

Investors can use both Roofstock and Norada Real Estate Investments to buy SFRs and small multifamily properties, although there’s a significant difference in options between the two companies.

Roofstock is the #1 marketplace for investing in SFR homes, with more than $4 billion in transactions completed in less than 6 years. The company operates an online investment property marketplace or listing service specifically for SFR real estate investors.

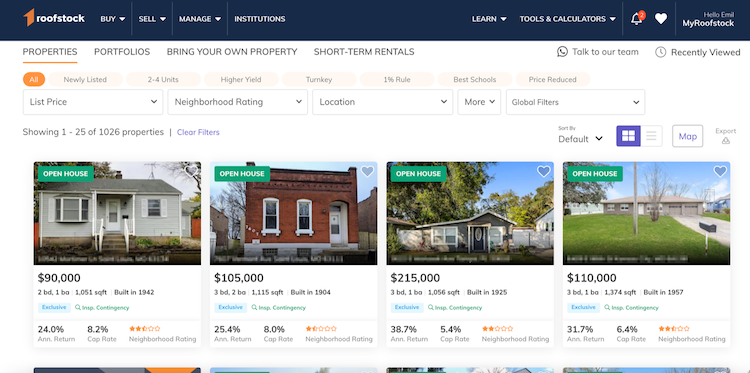

There are typically hundreds of SFRs and small multifamily properties listed for sale on the Roofstock Marketplace, in more than 70 markets across the U.S. Some of the homes are already rented to tenants, and investors can browse listings using search criteria such as higher yield, annual return, neighborhood and school ratings, listing price, and price reduced.

Norada Real Estate Investments offers a somewhat similar approach, but offerings are more limited. The company operates in 22 markets and currently has about 80 homes listed for sale on its website.

While Roofstock provides interactive tools investors can use to create their own pro forma financial analysis, Norada provides preprinted reports based on the company’s own financial projections. Investment real estate can be bought and sold entirely online using the Roofstock platform, whereas buyers must contact an investment counselor at Norada to ask questions or discuss investment goals before transacting.

Roofstock overview

Roofstock offers a number of ways to invest in SFR homes and small multifamily buildings, with many properties already rented to tenants.

Investors looking for direct ownership can browse long-term rentals on the Roofstock Marketplace and short-term and vacation rental homes on the Roofstock Short-Term Rental (STR) Marketplace.

The platform is designed so that an investor can complete the entire buying process online, from searching and analyzing rental property, negotiating an offer, performing due diligence, and closing escrow. Roofstock also works with a buyer’s agents if an investor prefers their own representation and also can recommend a certified real estate agent in the market where the property is located.

Roofstock provides a number of free tools a buyer can use to analyze potential investments and perform due diligence. The Roofstock Neighborhood Rating Checker can help investors research neighborhood-specific risks and benefits using key criteria, such as school district quality and employment rates.

Each home listed for sale on Roofstock also has an interactive tool for visualizing potential returns and cost estimates based on different scenarios, along with due diligence documents like property inspections (if available) and valuations, title reports, and current lease and tenant details if the home is already rented.

Once the transaction closes, buyers have the option of interviewing vetted property management companies who can take care of the day-to-day details of tenant management and property maintenance to make remote real estate investing a bit easier.

Other options for investing in real estate on Roofstock are:

- Roofstock One shares that track the economic performance of portfolios of fully managed properties, for accredited investors

- Portfolios of single-family and small multifamily rental properties

- Newly built houses from Lennar Homes

- Bring Your Own Property for a home being considered as an investment and use of Roofstock’s data science and proprietary technology to forecast a home’s return potential

Fee structure

The Roofstock fee structure is competitive and transparent. Sellers pay a sales commission of 3% of the property sales price or $2,500, whichever is greater. Buyers pay a fee equal to 0.5% of the purchase price or $500, whichever is greater, only after an offer is accepted.

Feature summary

It’s easy to find and research a property on Roofstock. Each home listed for sale includes pictures and street views, floor plans, title reports, and current lease information and a rent roll if the home is already rented to a tenant.

Investors can search for rental property based on key criteria and financial metrics, including:

- Location

- List price

- Neighborhood rating

- Square footage

- Number of beds and baths

- Minimum year built

- Newly listed

- Price reduced

- Discount to valuation

- Cash only

- Higher yield

- Best schools

- Occupancy

- Monthly rent

- 2 to 4 units

- Annual appreciation

- Gross yield

- Cap rate

- 1% Rule

- Section 8

Pros

- Hundreds of listings of SFRs, STRs, and small multifamily properties at a wide range of asking prices

- Opportunity for immediate cash flow if a purchased property is already occupied by a tenant

- Ability to compare multiple properties to make an informed investment, with data such as Neighborhood Ratings and estimated market rent

- Low one-time transaction fees and optional referrals to investment property lenders, insurers, or property managers upon request

- A free account with the robust property management software Stessa, a Roofstock company, to track real estate investments

Cons

- Not the best choice for investors looking for deeply discounted homes, fix-and-flips, or value-added rental properties

Norada Real Estate Investments

Norada Real Estate Investments offers new and refurbished single-family homes on up to fourplex multi-units, including homes that are rented to tenants. The company operates in 22 markets across the country and has a total of 83 properties listed for sale on its website (as of February 2022), some of which are already sold or under contract.

Each home listed for sale on the Norada Real Estate Investments website includes information such as square footage and number of bedrooms and bathrooms, year built, neighborhood rating, rental income, rent/value ratio, cap rate, cash flow, and purchase price.

Investors can download a PDF property analysis including financial analysis, cash flow and equity charts, and neighborhood information. To receive more information or to make an offer, investors may use the Request Info tab to contact the company.

The company’s website also includes information for each of the 22 markets in which Norada Real Estate Investments operates, including market highlights, housing market trends, and economic trends.

Norada Real Estate Investments also offers accredited investors the option of purchasing short-term promissory notes with fixed rates of return from 12% to 17.5% per year through Norada Capital Management.

Fee structure

The website does not explain how the company’s fee structure works. Investors who are interested in taking the next step are advised to contact one of the investment counselors to ask questions or to discuss their investment goals.

Feature summary

Norada Real Estate Investments currently has over 80 homes listed for sale in 22 markets. The company believes it is a premier source for cash-flow investment property:

- Norada Real Estate Investments offers rent-ready single-family homes and multifamily properties with up to 4 units.

- Investors can shop for property on the company’s website, review basic neighborhood information and market trends, print a financial analysis, and request more information from the company if they are interested in buying.

- Norada Real Estate Investments also provides referrals to local property managers, recommendations for mortgage brokers and bankers, and offers a rent guarantee of up to 12 months for some properties.

- The company offers short-term promissory notes with fixed rates of return ranging from 12% to 17.5% per year for accredited investors.

Pros

- Buyers can search for cash-flow investment property listed for sale in 22 markets using the company’s website.

- Norada Real Estate Investments selects markets that the company believes make sense from an economic and investment perspective.

- The company can provide referrals to local property managers and mortgage lenders and brokers.

Cons

- Investors interested in purchasing a property must speak with an investment counselor at the company to learn more about how the sales process and fee structure works.

- A limited number of real estate markets and homes for sale are listed on the company’s website, some of which are under contract or have already been sold.

- It’s unclear whether the homes listed for sale are owned by Norada Real Estate Investments or a private seller.

- There are no interactive tools on the company’s website for investors to perform their own financial analysis and due diligence; instead, they must rely on the company’s data and projections.

Roofstock vs. Norada Real Estate Investments: How to decide?

Both Roofstock and Norada Real Estate Investments offer single-family rental and small multifamily properties for sale, although there is quite a difference between the two companies.

Roofstock gives investors a variety of options for investing in residential real estate, including long-term and short-term rentals, portfolios of rental property, fractional ownership of rental property, and brand-new single-family homes from Lennar Homes. There are hundreds of homes listed for sale on the Roofstock Marketplace in more than 70 cities in 24 states.

On the other hand, Norada Real Estate has a more limited inventory in 22 real estate markets. Investors can review the due diligence and pro forma financial projections for each property that the company has done, but must contact an investment counselor at the company to receive more information and to learn how the sales process and fee structure works.

Before investing in any type of rental property, investors may wish to conduct their own financial analysis and due diligence by:

- Researching sales comparables of nearby homes and ordering a property appraisal to verify that the property value is correct

- Running rent comparables to ensure that current tenant rents, or rents used on a pro forma analysis, are at market and not overstated or understated

- Making sure that property management and leasing expenses are included in the profit and loss statement

- Including contributions to a realistic capital expense (CapEx) reserve account based on property condition when calculating cash flow

- Analyzing property tax trends in the market and checking whether property taxes will increase if a home is converted from a primary residence to a rental property