When it comes to alternative investments, single family rentals are tough to beat. Compared with stocks, bonds, and cash, rental properties have generated an impressive and consistent amount of wealth for stakeholders over time.

During the last 15 years and even through the recession, single-family rentals continued to deliver excellent returns through appreciation and rental income. Since 2010 single-family rents have consistently increased by about 3% annually, and in Q3 2021 posted the fastest year-over-year increase in the past 16 years.

What’s creating this growth? According to a report from the Joint Center for Housing Studies of Harvard University, renting has become more common among the age groups and family types traditionally more likely to own their own home. This may be due to rising home prices, higher lending rates, and a preference for flexibility.

Also, a new generation of home dwellers is more inclined to rent than buy. According to Pew Research, the millennial generation — which accounts for roughly half of U.S. households with children — are more likely to rent than own a home compared to previous generations.

Before we go into the gritty details of why SFRs may be an ideal place to invest, let’s quickly define what a single-family rental is and how it differs from other property types.

What’s a single-family rental property?

Single-family homes are a unique real estate asset. Often found in suburban neighborhoods, they are detached structures, usually with a yard and garage.

Other property types include:

Multi-Family Homes: Structures like duplexes, triplexes, and other multi-family homes have units for several families under one roof. They obviously provide more rental income streams than SFRs but also require more property and tenant management.

Apartment Complexes: Typically buildings with more than five living spaces, apartment complexes are considered by most lenders as “commercial” properties and typically have a different financing process. The potential for growth is clear, but this type of investment requires more owner-involved management.

Commercial Properties: These retail and industrial properties can be detached businesses, warehouses, or shops in a mall or complex. They differ from SFRs in that they tend to have longer term leases (e.g. 2-3 years) and the tenant is a business — not an individual or family.

Compared to other property types, SFRs offer a number of advantages. They are easier to purchase and manage, and the tenants usually have more of a sense of ownership, encouraging them to stay longer and take better care of the property.

SFRs also make better business sense. Here are some key reasons why single-family rentals are a smart investment.

You can invest more capital than you actually have

Say you want to make a $250,000 investment but only have $50,000 cash to spend. This is entirely possible with SFRs through leveraging, a common investment practice where the buyer uses borrowed money to increase returns.

Through financing — whether a mortgage, VA loan, or private investor — your $50,000 down payment allows you to borrow the remaining $200,000 to purchase the home. Meanwhile, you’re collecting rent and the property is appreciating, boosting your $50,000 to five times the investing power.

As we’ve illustrated in a previous article, using “other people’s money” can be more lucrative than buying a home outright. For example, if you have $250,000 to invest, rather than buying one home for $250,000 you can buy five $250,000 homes.

How does this work? By using that capital sum to finance five $250,000 homes (putting $50,000 down for each of the five homes and borrowing the rest), you increase your investing share to $1,250,000 (5 x $250,000). Though you’ll have mortgage payments and expenses each month, you’ll still be netting rental income and earning five times the annual appreciation than if you’d just bought one home with your $250,000.

Basically, you’re using “other people’s money” to build your single-family real estate portfolio.

Leveraging works with other real estate property types, but managing and unloading a single-family rental tend to be easier.

SFRs are powerful income generators, yet they’re also one of the most secure investments you can find.

A less volatile investment than stocks

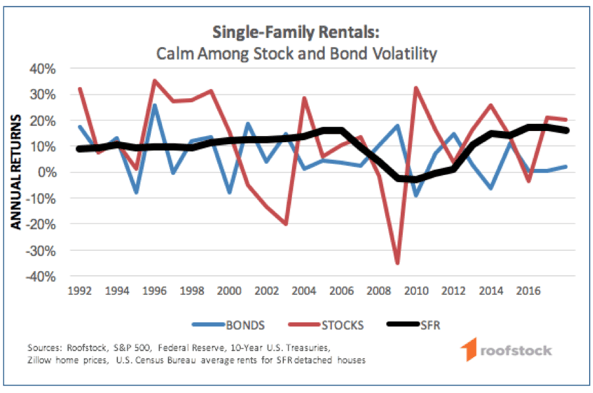

Average annual returns from single-family rentals were nearly identical to stocks and bonds over the past 25 years, but with far less volatility.

For example, between 1992 and 2017, S&P 500 stocks posted average annual returns of more than 35% in some years, but also plummeted by the same percentage or more during their worst years. By contrast, single-family rents produced more reliable returns of 17.5% in their best year, while declining by only 2.5% in their worst year.

There’s also much less of a roller coaster ride with single-family rental property. During this 25 year period, the stock market has 6 down years versus 2 years for the single-family rental sector.

Here are a few reasons why single-family rental properties may be more secure investments compared to traditional stocks and bonds:

- Tangible Assets: As the saying goes, land will always go up in value because they’re not making any more of it. When you purchase SFRs you’re acquiring the land in addition to the structure built on it. No market is foolproof, but real estate gives you something tangible to inhabit, rent, or sell for profit.

- Less Volatility: Stocks can surge in the course of a few hours; they can also plummet in the same timeframe. Housing markets, though not completely immune to fluctuations, are less affected by national economic dynamics and have proven to be dependable.

- Steady Income: Single-family rentals not only appreciate in value but provide a monthly income stream through rent. In August 2021, single-family rents increased at their fastest year-over-year increase in over 16 years.

- Inflation-Resistant: Inflation is inevitable in the U.S. economy; however, the median sales price of houses is increasing at a faster rate than inflation. This allows property investors to stay one step ahead of inflation numbers.

It’s nice knowing that your money is in a relatively safe place, earning income, and appreciating in value. It’s also nice when the income requires very little effort on your behalf.

Potential source of additional income

Though a single-family rental requires some obvious maintenance, cleaning, and upkeep, rental agreements usually require renters to mow and reasonably maintain the home. With a dependable tenant who loves living in your property, you may be able to generate steady, reliable income.

There are other sources of real estate investing — like, Real Estate Investment Trusts (REITs) and crowdfunding — but these options don’t always generate the same cash flow as outright ownership of a single-family rental.

To help make rental home ownership even more stress-free, real estate investors with a portfolio of homes sometimes enlist the services of a property manager. This individual or company can take care of basics like repairs, rent collection, and tenant communication.

Property managers are an essential tool for the remote real estate owner — another key option for SFR investing.

Investing without borders

Thanks to technology, single-family real estate investors are not limited to purchasing the homes only in their area. With a dedicated property manager in place, real estate investors earn reliable rental income without even seeing their properties in person.

Why would someone want to buy outside their local marketplace? Here are a few possible reasons:

- Accessibility: Markets like coastal California, New York City, and Washington, D.C. are out of reach for the casual or first-time property owner. If you reside in an expensive market, remote real estate investing expands your options to include more affordable communities.

- Return on Investment: Markets vary across the country. Through long-distance acquisitions, investors living in volatile areas have access to steadier markets with potentially higher ROI.

- Diversification: Remote real estate investing provides a little protection from local market ups and downs by allowing buyers to own multiple properties across a wide range of markets.

Long-distance landlords usually assemble local teams to help facilitate these out-of-state deals. For example, they could form relationships with local agents, inspectors, and property managers to purchase and maintain their single-family rentals.

Another way to build a remote portfolio is through tools like Roofstock. Our service allows anyone to search through a database of turnkey rental properties for sale. Users can filter results by price, location, size, etc. and set up alerts for newly posted properties.

We also provide comprehensive due diligence data like tenant history, inspection reports, neighborhood ratings, and interactive tools for estimating costs and earnings. You’ll have all the numbers in front of you to make a smart purchase.

The next step is as easy as Amazon.com: simply check out and close. You start earning rent as soon as you close on the home and, if you wish, we can recommend a local, preferred property manager to give you a little peace of mind.

It sounds easy and it really is. If you prefer more human contact in the process, our dedicated customer service team is available to help you find, research, and close on homes.

Curious about investing in out of state single-family rentals? Check out this simple diagram on how our process works, then check out our Deep Dive into SFRs.