It’s never too early to begin investing in real estate, even if you only have a few hundred dollars to start with. From direct ownership to JV partnerships, REITs, crowdfunds, and more, there are lots of ways to get started in real estate investing today.

In this article, we’ll explain why real estate can be a great investment for those seeking passive income, how to use other people’s money (OPM) to maximize your returns, and why the answer to the question “How much money do you need to invest in real estate?” is literally much less money than you might think!

How leverage turns a little money into a lot

Leverage allows real estate investors to use a small amount of money to receive a much bigger return. In real estate investing, this concept goes by a variety of names, including financing and other people’s money.

When you think about it, real estate is the only asset where you can make a minimum down payment, finance the remaining purchase price, and own and control an asset that generates monthly cash flow and appreciates in value over the long term.

Cash-on-cash return

In order to understand the power of leverage, it’s important to know how cash-on-cash return works. Cash-on-cash is a percentage that compares the amount of money you invest in an asset to the amount of money you receive:

- Cash-on-cash return = Annual net cash flow / Total cash investment

Generally speaking, the higher the cash-on-cash return is the more profitable the investment is, because you are receiving more net cash flow compared to the amount of cash invested.

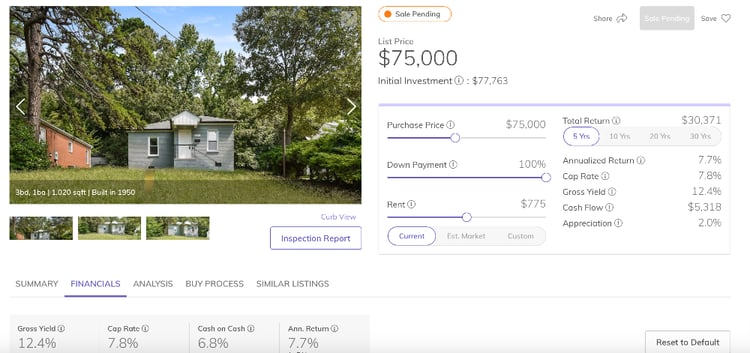

Now, here’s an example of how cash-on-cash return works in the real world of real estate investing. On Roofstock you find a rental property priced at $75,000 that ticks all of the boxes and matches your long-term investment strategy that focuses on cash flow.

You can pay all cash for the house, or use the power of leverage by making a conservative 25% down and financing the rest. Here’s how the cash-on-cash returns would look using both scenarios after the first year of ownership:

- Option #1: $5,318 Net Cash Flow / $75,000 All Cash Purchase = 7.09% Cash-on-Cash Return

- Option #2: $2,096 Net Cash Flow / $18,750 Down Payment = 11.18% Cash-on-Cash Return

As you can see from the above example, your cash-on-cash return is almost double (11.18% vs. 7.09%) when you use a conservative amount of leverage compared to buying a rental property for all cash.

So as we’ve seen so far, it’s very doable to buy your first rental property that generates solid cash flow for less than $20,000. However, another benefit of using conservative leverage is that you can diversify your investment portfolio by purchasing several properties instead of just one.

Leverage combined with diversification can significantly increase your total net cash flow.

For example, if you have $60,000 in investment capital to work with you could pay all cash for one property, use $18,750 to finance one property, or use your $60,000 to invest in three rental houses and still have cash left over:

- One property, $60,000 all cash generates $5,318 net cash flow

- One property, $18,750 down payment generates $2,096 net cash flow

- Three properties, $56,250 total down payments generate $6,288 total net cash flows

These cash-on-cash calculations use net cash flow, which is the difference between the annual rental income received and the money spent on each year on items such as property maintenance and mortgage payments.

The great thing about owning rental property is that the rent from the tenant pays for your mortgage and everything else:

- Property tax

- Property management

- Leasing fees

- HOA fees

- Insurance

- Repairs and maintenance

- CapEx (capital expenditures reserve)

- Mortgage

In other words, by using leverage to invest in real estate, you can:

- Control a large income-producing asset for very little cash

- Use the rent from the tenant to pay for the cost of owning and operating the property

- Have net cash flow left over as profit at the end of each month

However, not every house makes a good rental property. When investing in real estate, it’s important to find property that’s average and affordable.

Why average affordable houses can make great real estate investments

Many new investors mistakenly believe that the more expensive, bigger, and unique a property is, the better it is. The fact is that is not necessarily true. Here’s why:

Cash flow can be stronger.

People can often make the mistake of buying rental properties in the same place and with the same quality that they want to personally live in. Places with high-end finishes in the best school districts that are 30 minutes or less from your own home normally don’t always make for the most profitable rental properties.

That’s because average (and affordable) can be better when you buy real estate:

- Average houses generally are affected less during routine downward market cycles and economic recessions

- Affordable average homes make it easy to diversify your investments by owning several rentals in different parts of the country

- Buying property around the median price point for your real estate market ensures you’ll be able to rent to a wider variety of tenants because your fair market rent will be average for the market

- Cash flow is usually stronger and more predictable, while vacancy rates are lower when you invest in average affordable homes

To be fair, one dilemma many investors face is that home prices and the cost of living are high in the market where they live. That’s an obstacle that is very easy to overcome.

Online resources such as the Roofstock marketplace simplify the process of investing long-distance in markets where homes are affordable and yields are double-digit.

At any one time, Roofstock has hundreds of single-family homes available for sale – some even turnkey with a tenant already in place – with asking prices of less than $100,000.

Other options for investing in real estate

In addition, using leverage to directly own rental property, there are several other good options for investing in real estate even if you only have a few hundred dollars to start with:

Real estate investment trusts (REITs)

REITs are publicly-traded companies on the major stock exchanges that invest in income-producing real estate including residential rental property, commercial real estate, and health care properties. For example, Equity Residential is a large residential REIT that currently trades at $56.65 per share (as of August 27th, 2020).

Pros:

- Broad exposure to different types of real estate assets

- Highly liquid with shares very easy to trade

- REITs pay dividends (although less than the cash-on-cash returns by using leverage)

Cons:

- Low dividend yields

- No control over specific properties the REIT buys and sells

- Share prices affected by stock market volatility

Crowdfunding

Crowdfunds are real estate syndications where a large number of investors contribute capital to invest in commercial assets such as shopping centers, new home developments, and apartment buildings. Two examples of crowdfunding companies are Fundrise and RealtyMogul.

Pros:

- Access to large real estate deals out of the reach of most investors

- Yields usually higher than a REIT

- Deal quality and risk depends on the sponsor

Cons:

- Limited control over how your money is actually used

- Crowdfund may freeze redemptions during times of economic distress

- Best deals often limited to high net worth accredited investors

Joint venture partnerships (JVs)

JVs are formed by like-minded real estate investors to own and operate a specific property. Normally, one investor is designed as the general partner to handle the day-to-day activities of the investment, and the remaining investors are passive partners.

Pros:

- You know who the other investors are

- Bigger share of potential profits

- Good hands-on learning opportunity for new real estate investors

Cons:

- Risk may be higher because there are fewer investors involved

- Personality conflicts can occur if partners aren’t properly vetted

- Inexperienced general partner can lead to negative returns and loss of investment capital

Wrapping up

Instead of asking how much money do you need to invest in real estate, perhaps the better question is, “How much money do you want to invest in real estate?”

For people with just a few hundred dollars to invest, options such as REITs or crowdfunding may be a good option. If you have a little more money to invest in real estate, using conservative leverage is the perfect way to use a small down payment to directly own and control a rental property to generate consistent net cash flow for yourself while using the tenant’s rent to pay all of your bills and still earn a profit for yourself.