Dentists may have access to investment opportunities such as venture capital, hedge funds, and business opportunities. However, one investment vehicle that dentists sometimes overlook is income-producing residential real estate.

There’s a tremendous amount of capital being invested in the rental real estate sector by private individuals, institutional investors, and family offices.

This article will explain why dentists should consider investing in real estate, along with common real estate investing strategies that can help you secure your financial future.

Key takeaways

- Creating multiple income streams, increasing equity through appreciation, and tax benefits are some of the reasons why dentists invest in real estate.

- Income from real estate may also result in a lower tax burden because, in most cases, rental income is not subject to payroll taxes.

- Common real estate investing strategies include owning single-family rental (SFR) property, joining a real estate investing group (REIG), or buying shares of a real estate investment trust (REIT).

Why dentists invest in real estate

While every investor has different goals and objectives, here are 3 reasons for dentists to invest in real estate.

Create multiple recurring income streams

As Warren Buffet says, “Never depend on a single income. Make investments to create a second source.” While your dental practice might be your bread and butter, creating multiple income streams is a strategy used by many investors to pursue financial goals and build long-term wealth.

The potential for recurring income is one of the main reasons for investing in real estate. In most cases, rental income collected from a tenant covers property operating expenses and the mortgage payment (if the property is financed), with cash left over at the end of each period.

Although most tenants probably don’t think of it this way, as a real estate investor, you’re using money collected from a tenant to pay for the costs of owning and operating a rental property.

Increase net worth

Increasing net worth by reinvesting rental income and profiting from equity appreciation is another reason to invest in real estate.

According to this chart from the Federal Reserve, the median sales price of houses sold in the U.S. has increased by 239% over the past 20 years. Provided that a home is well maintained, you can profit from rising home prices over a long period of time while collecting monthly rental income to pay the bills.

While it’s true that other assets like growth stocks may increase in value over time, SFRs historically have offered more attractive risk-adjusted returns than the S&P 500 and bonds but with far less volatility. In fact, since 1971, SFR prices and stock prices have been almost perfectly uncorrelated. Real estate can also add diversification to your portfolio.

Lower tax burden

A thriving dental practice is definitely something to be proud of. But W-2 income from a dental practice is subject to withholdings, such as federal and state income tax, unemployment tax, and Social Security and Medicare.

On the other hand, the Internal Revenue Service (IRS) generally treats rental income as passive income that isn’t subject to withholding taxes. While income is still taxed, taxes are assessed based on the tax bracket that you are in. However, before paying taxes, owning rental property provides several tax benefits that can be used to lower the amount of taxable net income.

For example, you can deduct operating expenses, such as property management fees, repairs and maintenance, mortgage interest, property taxes, and landlord insurance. The IRS also allows investors to deduct reasonable owner expenses, such as traveling to and from a rental property, lodging while you’re in town visiting, and continuing education to learn about real estate.

Another tax benefit of owning investment property is claiming depreciation. Depreciation is a noncash deduction used to lower pretax income.

Residential investment property is depreciated over a period of 27.5 years. So, if an SFR was purchased for $150,000 (net of land value), the annual depreciation expense used to reduce pretax income would be $5,455. In some cases, a real estate investor may have little or no taxable net income from a rental property while still having positive cash flow, thanks to the power of depreciation.

Potential drawbacks to investing in real estate

As with any other investment, real estate has some drawbacks. While the learning curve for real estate investing isn’t nearly as steep as dentistry, a certain amount of time and knowledge is still required.

Property management

There are legal aspects, such as federal fair housing laws and local and state landlord-tenant laws. You also need to know how to set the right monthly rent price to keep occupancy levels high without undercharging, perform periodic property inspections, and make repairs to ensure the home is safe and habitable for the tenant.

While it’s important to understand basic responsibilities and tasks such as these, you don’t need to be an expert.

An investor can enjoy the benefits of investing in real estate without the traditional hassles of being a landlord by hiring a trusted property manager to take care of day-to-day responsibilities, such as repairs and maintenance, communicating with tenants, and complying with local, state, and federal laws.

Capital

Down payments to finance investment real estate are usually at least 20% of the property purchase price, plus closing costs and up to 6 months of operating expenses and mortgage payments held in a reserve account.

Real estate is also a depreciating asset that can lose value if it isn’t properly maintained. Over a period of time, an investor may need to make capital repairs, such as replacing a roof or heating, ventilation, and air conditioning (HVAC). To help ensure funds are available when and if they are necessary, many investors deposit a portion of the monthly rental income into a capital expense (CapEx) account.

Liability risks

Similar to running a dental practice, there is also a certain amount of liability risk that comes with owning rental property. Somebody could get injured on the property and decide to sue, or a tenant could claim that their rights were violated and take the landlord to court.

To mitigate potential liability risk, a real estate investor can purchase a landlord insurance policy and hold real estate in a limited liability company (LLC). An LLC creates an additional layer of protection by separating investors' personal wealth from their business assets while avoiding double taxation by passing through income and losses directly to the shareholder.

Real estate investing strategies for dentists

There are many ways people invest in real estate, such as house hacking, real estate wholesaling, and fixing and flipping homes. However, many investors look for less active ways to invest in real estate to allow more time to focus on their day jobs.

While you’ll still need to spend time monitoring the performance of your investment, here are 4 common real estate investing strategies that can require minimal involvement.

REIT

A REIT is a public or private company that owns and operates real estate, such as SFRs, apartment buildings, commercial properties, and special-use buildings, like data centers and cold storage units.

Shares of public REITs are bought and sold on the major stock exchanges, the same way that other stocks are. Private REITs, such as Roofstock One, are unregistered securities available to accredited investors and have limited liquidity as they are not publicly traded.

REITs are legally required to pay out the majority of their net income each year to shareholders and can be a good source of recurring income provided that a REIT is profitable. However, owning a REIT does not offer the same benefits as directly owning real estate, such as tax deductions used to reduce personal pretax net income.

REIG

An REIG is similar to a private REIT, but on a smaller and more intimate scale. An investor can join an REIG to pool capital with other investors for various ventures, such as buying and renovating SFRs or building new homes from the ground up.

Some of the benefits of joining an REIG include investing capital in different projects to help minimize downside risk, sharing in any income and profit when the project is sold, and learning how the real estate business works from more experienced investors.

When vetting an REIG, it’s important to analyze how successful the group’s past investments were and ensure that the REIG’s investment strategy and appetite for risk match your own.

Crowdfund

A real estate crowdfund is another vehicle for group investing. Crowdfunds collect capital from a large pool of investors to develop, own, and operate different types of real estate, such as build-to-rent (BTR) subdivisions, apartment buildings, and industrial distribution centers.

While crowdfunds offer an investor the opportunity to participate in projects that would typically be out of reach, crowdfund investments may be subject to lock-up periods of several years. As with private REITs, some crowdfunding opportunities are restricted to accredited investors.

Rental property

Directly owning rental property may be a good option for investors seeking recurring rental income, equity appreciation over the long term, and the numerous tax deductions real estate investors use to reduce taxable net income.

An investor who wants to own rental property without being actively involved in the investment can hire a property manager to enjoy the benefits of owning rental property without being a landlord. A property manager handles day-to-day tasks such as leasing, rent collection, tenant management, and property maintenance. Hiring a property manager allows for smarter investing by buying in markets that offer the best returns.

Important real estate investing metrics for dentists to know

Returns from rental property can vary from one home to the next due to factors including demographics of the local marketplace, location, and neighborhood quality.

This simple spreadsheet by Roofstock provides an easy way to view the potential financial performance of a given property. You can use it to forecast the potential return of a property. Simply enter some information to view projected key return on investment (ROI) metrics, including cash flow, cash-on-cash return, net operating income, and cap rate.

Final thoughts

There are a number of reasons why dentists may be interested in investing in real estate, including earning recurring income, appreciation in property value, and tax benefits. As a rule of thumb, investing in real estate is a good match for a buy-and-hold investment strategy because it can't quickly be sold.

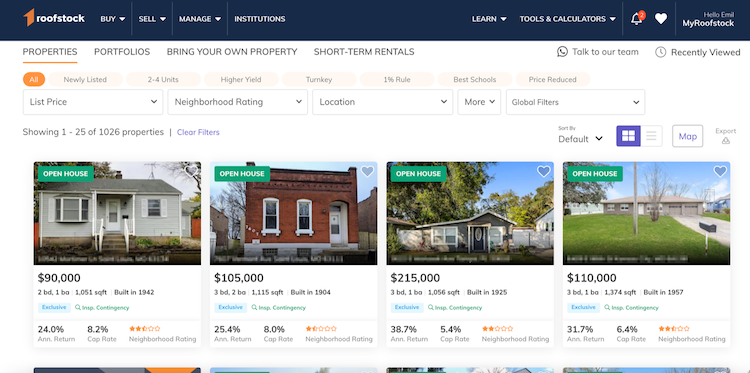

While finding investment real estate on traditional listing platforms like Zillow and the local multiple listing service (MLS) is possible, investors looking for SFR property may find Roofstock to be a better match.

Since 2016, Roofstock buyers and sellers have completed over $5 billion in transactions in over 70 real estate markets in the U.S. Rental property for sale on Roofstock already has much of the due diligence done. Frequently, homes on the Roofstock Marketplace are already occupied by a tenant, so you can start collecting rental income the day escrow closes.